Import bills stay at higher levels

Import bills rose 63 per cent year-on-year to $7.66 billion in July but it declined from a month ago, signalling the easing of international payment pressure thanks to the recent Bangladesh Bank efforts to cool down the volatile foreign exchange market.

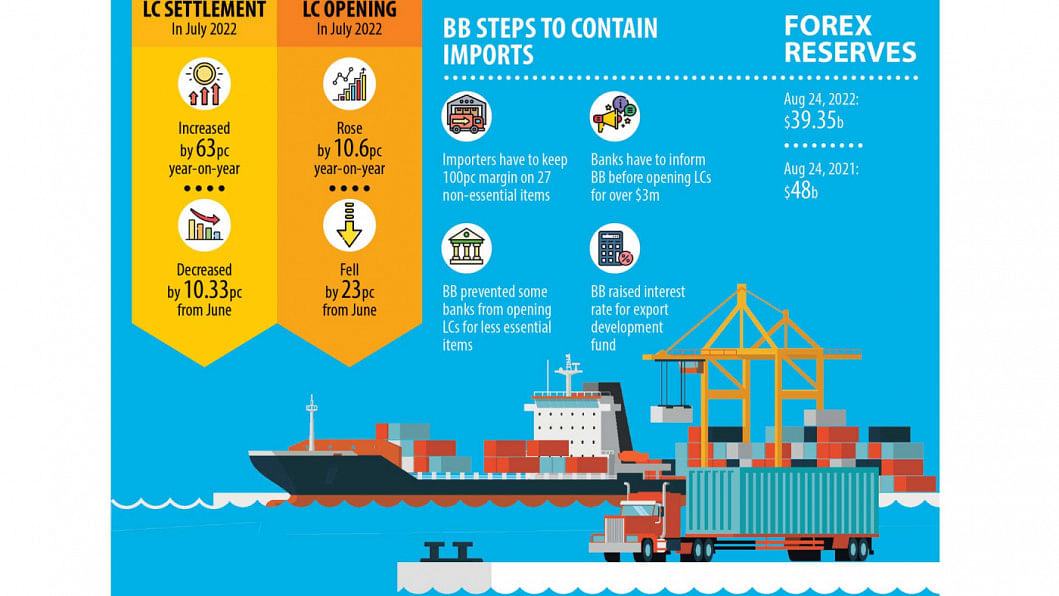

The settlement of LCs, also known as import payments, decreased 10.3 per cent from June's $8.54 billion, data from the central bank showed.

In July, lenders had to settle a good number of letters of credit (LCs) opened earlier, keeping the overall import payments at a much higher level, say bankers.

Emranul Huq, managing director of Dhaka Bank, says import payments might decline after three to four months thanks to the initiatives taken by the BB.

Opening of LCs decreased substantially between July and August, giving a breathing space to both BB and the government to tackle the ongoing macroeconomic pressure, he said.

"We are discouraging businesses from opening LCs to ease the ongoing foreign exchange pressure."

Before July, Dhaka Bank usually opened LCs worth $2.5 million on average per month. But it opened LCs worth $1.26 million last month and the trend has continued so far in August.

Banks collectively opened LCs to the tune of $5.69 billion in the first month of the current fiscal year, up 10.61 per cent year-on-year but a decrease of 22.91 per cent from a month ago, data from the BB showed.

The BB has been struggling to curb the import payments for the last couple of months amid escalated global commodity prices for the Ukraine war, and rocketing demand to feed the economy rebounding from the coronavirus pandemic, which sent the country's trade deficit to an all-time high of $33.24 billion last fiscal year.

The import payments stood at $82.49 billion in FY22, up 36 per cent from a year ago, comfortably exceeding export and remittance receipts, thus creating volatility in the entire macroeconomic sector and the foreign exchange market and pushing inflation to a record high.

The situation forced the BB to ask banks to take up to 100 per cent advance payments from businesses for the opening of LCs to import luxury and non-essential items.

The BB also asked banks to inform it about the opening of LCs whose value is $3 million and above so that the import of non-essential items can be checked.

A central bank official said that the BB had recently prevented some importers from opening LCs for less essential items.

In addition, the BB raised the interest rate on the loans disbursed from the Export Development Fund.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, describes the current falling trend of import payments as a welcoming development.

"But we will have to observe the import trend of August to evaluate the ongoing situation."

According to Rahman, the country would reap benefits from the declining commodity prices in the global market.

Internationally, energy prices fell 1.3 per cent in July, as a 10 per cent decline in crude oil was balanced by a 50 per cent gain in European natural gas prices, the World Bank reported.

Food prices declined 8.5 per cent, led by grains, which gave up 8.3 per cent. Fertilizer prices eased by 3.7 per cent.

Metal prices plunged 13.4 per cent, with iron ore dropping 17 per cent, World Bank data showed.

Thanks to the falling imports, the pressure in the foreign exchange market has eased to some extent in recent days, Rahman said.

Importers are now purchasing the US dollar for Tk 103 to Tk 104 from banks in contrast to Tk 112 just a few weeks earlier.

In the interbank market, where banks buy and sell the American greenback from each other, the dollar traded at Tk 95 yesterday, up 11.56 per cent year-on-year.

There is a strong possibility that the price of the dollar would fall further, said a commercial banker.

Selim Raihan, executive director of the South Asian Network on Economic Modeling, said Bangladesh had faced an abnormal growth of imports in the past fiscal year.

He thinks the economy will take two more months to begin benefiting from the BB moves aimed at containing imports.

"The central bank may consider withdrawing the ongoing restrictions on the imports once the foreign exchange reserves start returning to its previous healthy position," said Raihan, a professor of economics at the University of Dhaka.

The reserves stood at $39.45 billion on August 24 in contrast to $48 billion a year earlier.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments