Low performing stocks surge in bearish market

Investor Abu Sayeed was eagerly buying stocks of Orion Infusion sitting inside a brokerage house in Dhaka last Thursday. The share of the company had almost tripled in the past three months.

"A big manipulator is buying the stock, so I am also buying it," he candidly explained his actions to The Daily Star.

On whether he knew that the company had repeatedly informed investors of having no undisclosed information that could have led to the abnormal rise of its stock price, he said, "So what?"

Not only Sayeed but many other investors were buying such stocks which already witnessed the doubling of their prices, with the belief that the securities would continue to rise through the backing of manipulators.

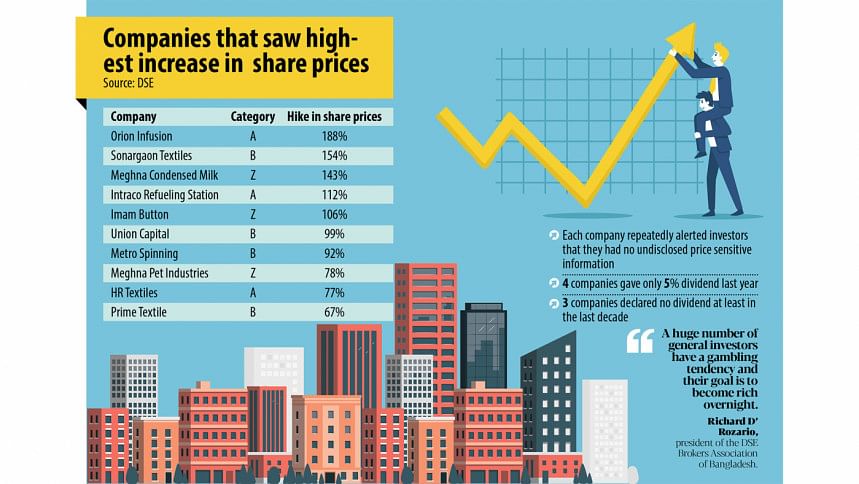

Over the past three months, Orion Infusion stocks had almost tripled while four others, including two junk stocks, more than doubled despite repeated warnings from the companies that they had no undisclosed information that could have influenced the rise.

On the contrary, the hike in the prices of raw materials led by the appreciation of the US dollar, pent-up demand and supply disruption alongside a rise in fuel prices locally may bring their profits down.

Another contradictory fact was that the stocks have soared at a time when the benchmark index of the bourses remains bearish.

Therefore, stock market analysts are suspecting that manipulation was the reason behind such an "abnormal price" surge.

Stocks of Orion Infusion skyrocketed to Tk 220 from Tk 76 during the last three months till August 25, according to Dhaka Stock Exchange (DSE) data.

The company warned investors twice that it had no undisclosed information that could have raised the stocks abnormally.

This is not the first time that manipulators pushed up the prices of some low capital-based or junk stocks through serial trading and then spread rumours among general investors only to dump them afterwards, said a top official of a merchant bank preferring anonymity.

However, the Bangladesh Securities and Exchange Commission (BSEC) does not catch them at an early stage, he said, adding that a similar abnormal rising trend was seen in some other stocks a few months back.

Later, the regulator found it to be manipulation, he said.

"Now, there is no economic reason behind the rise of the stock price but manipulation. The regulator has enough scope to stop the manipulation at an early stage. However, it does not stop it."

Sonargaon Textiles, a B category company, soared 154 per cent to Tk 72 from Tk 28 in the last three months. As the company provided only a 3 per cent dividend in 2019, it was downgraded from the A category.

In the same period of time, a junk stock named Meghna Condensed Milk Industries, which failed to provide any dividend in the last two decades, surged 142 per cent to Tk 42.

"When stock prices of such companies start to rise abnormally, the BSEC should look into whether there is any manipulation," said Richard D' Rozario, president of the DSE Brokers Association of Bangladesh (DBA).

The monitoring and manipulation should stop at the initial stage so that general investors do not become victimised, he said, adding, "For these stocks to soar at such a pace is absolutely for manipulation."

About Sayeed's tendency to make such purchases, the DBA president said a huge number of general investors bear a "gambling" tendency in the stock market as their goal was to become rich overnight.

So, they rushed after manipulators and purchased stocks prone to gambling even at a high price whereas many stocks with good performance records remain at a low price, he said.

It is also true that stocks with good performance records are scarce in the stock market, for which their numbers should be raised, he added.

Stocks of Intraco Refueling Stations rose 112 per cent to Tk 42 while another junk stock named Imam Button Industries climbed 106 per cent to Tk 126, DSE data showed.

The refuelling company also had not disclosed any good news in the last three months. Moreover, a sponsor director had sold around 43 lakh shares seeing such a high jump in prices.

Imam Button Industries failed to provide any dividend after 2010 but its stock price rocketed unusually. The company repeatedly announced that it has no undisclosed data.

A top official of the BSEC, preferring not to be named, said the surveillance team of the regulator was keeping an eye on trading every day.

"It is true that these stocks rose abnormally, so I will talk to the surveillance team. I hope the team is also concerned and if any wrongdoing took place, it will take steps," he said.

"But general investors need to be careful about their own investments because if they buy stocks based on rumours, none can stop them."

Of the 10 stocks that witnessed the highest increases, Union Capital soared 99 per cent, Metro Spinning surged 92 per cent, Meghna Pet Industries rocketed 79 per cent, HR Textile Mills climbed 78 per cent, and Prime Textile Spinning Mills jumped 67 per cent.

Among them, only one company provided a dividend of at least 10 per cent while three provided less than 5 per cent and one consistently failed to provide any.

The DSEX, the benchmark index of the DSE, rose 1 per cent, or 69 points, in the last three months.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments