Robust remittance, exports to ease pressure on external sector

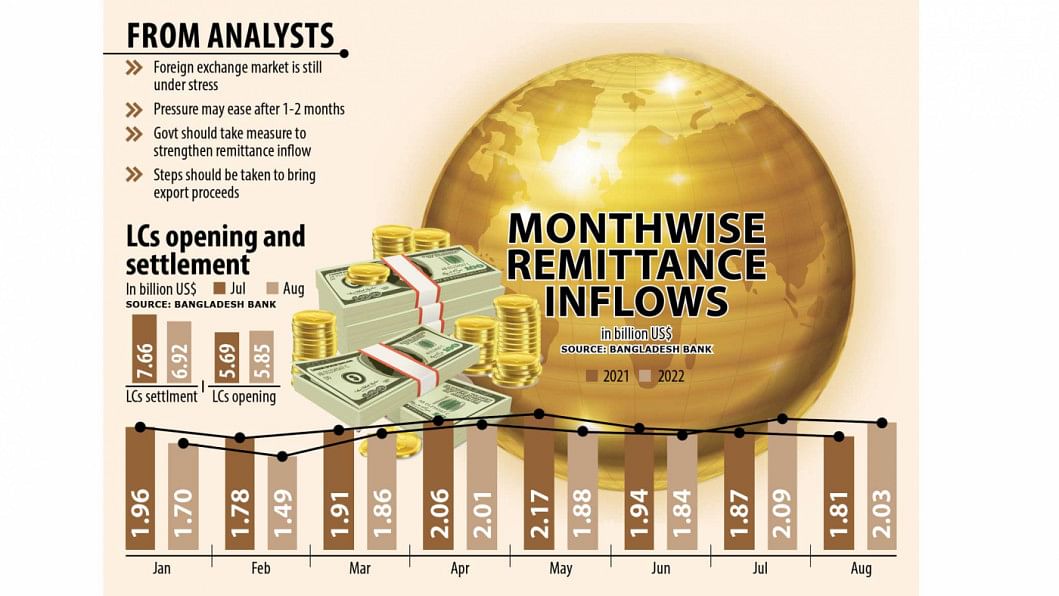

Migrant workers and Bangladeshis living abroad sent more than $2 billion in each of the first two months of the current fiscal year, a promising sign for the economy.

It came at a time when import payments have slowed and exports maintained a healthy growth, signalling that the pressure on Bangladesh's external sector may ease after two or three months.

In August, remittances stood at $2.03 billion, up 12.6 per cent year-on-year although the inflow was 3 per cent lower than the receipts of July, data from Bangladesh Bank showed.

Import payments, as calculated through the settlement of letters of credit (LCs), were $6.92 billion in August, down 9.6 per cent from a month ago, although the amount was still 14.2 per cent higher from the same period a year ago.

The central bank has allowed businesses to settle import payments after a certain period in order to tackle the business slowdown derived from the coronavirus pandemic.

Yet analysts read the numbers positively and say the foreign exchange market is still facing pressure, but the stress will peter out if the ongoing trend of imports and remittances continues in the next couple of months.

"The outflow of the dollar may decrease soon, which will have a positive impact on the external sector after one or two months," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

The demand for US dollars is still high due to a mismatch between the outflow and inflow of the greenback.

Banks are now purchasing dollars in the form of remittances from foreign exchange houses quoting Tk 114 for each greenback compared to Tk 107-Tk 108 just two weeks earlier.

Importers are purchasing each dollar for Tk 107-Tk 108 from banks. This has given an indication of the extent of the ongoing stress faced by the foreign exchange market.

"Import payments decreased to some extent in recent months, but businesses are now clearing their deferral payments of LCs that had been opened earlier," Mahbubur said.

The opening of LCs slightly increased to $5.85 billion in August in contrast to $5.69 billion a month earlier.

Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, thinks that falling imports and rising remittances would reduce pressure on the foreign exchange reserves.

The reserves stood at $39.05 billion on Wednesday, down from $48 billion a year ago.

"The policy measures that have been taken by the central bank should continue until the volatility comes under control," Mustafizur said.

The economist asked the BB to take measures so that banks repatriate the export proceeds in the quickest possible time. The government should also think of how to give a boost to export earnings further.

Export earnings grew more than 38 per cent year-on-year to $4.67 billion in August, data from the Export Promotion Bureau showed yesterday.

Emranul Huq, managing director of Dhaka Bank, describes the falling import bills as a good sign.

It came as the price of major commodities is declining in the global market.

"The foreign exchange market is still facing pressure, but it might ease in the next couple of months riding on the central bank measures," said Huq.

The BB has recently asked to impose a 100 per cent margin on opening the LCs for non-essential items, meaning that importers have to pay full import payments in advance.

"The fate of the local foreign exchange market is depending on global development," Huq said.

The forex market started to deteriorate substantially soon after the war between Russia and Ukraine erupted.

AB Mirza Azizul Islam, a former finance adviser to a caretaker government, says that there is still uncertainty in the economy.

"The reserves are still sliding due to higher imports."

The reserves may fall further next week when the central bank is set to settle the payments for the Asian Clearing Union (ACU), an arrangement for clearing trade bills among the participating central banks of Bangladesh, Bhutan, India, Iran, the Maldives, Myanmar, Nepal, Pakistan, and Sri Lanka.

"Under such a situation, both the government and the central bank should give efforts to enhance remittances and exports," Islam said.

Salehuddin Ahmed, a former BB governor, blamed money laundering for the falling reserve level.

"Strict actions should be taken to stop money laundering."

He also criticised the Bangladesh Financial Intelligence Unit for failing to take adequate measures against money launderers.

"The situation would not have worsened had the BFIU taken measures against the swindlers," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments