Listed firms build huge reserve of Tk 153,000cr

Listed companies in Bangladesh have built up reserves of Tk 153,000 crore collectively from their respective earnings for use in expansion and to weather out rainy days, when they would otherwise be forced to raise fresh funds from investors or borrow from lenders.

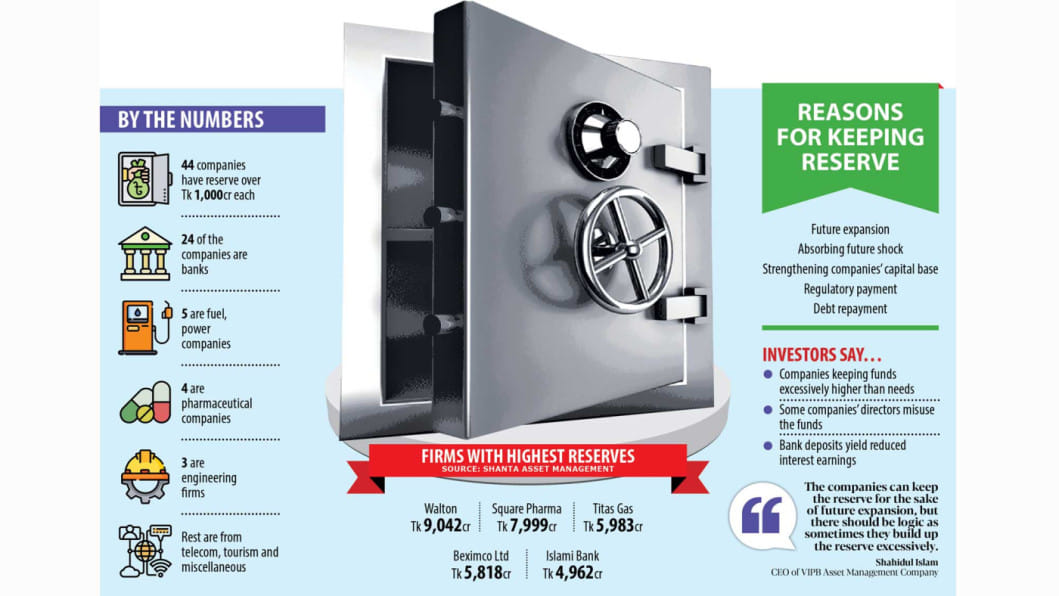

Of the 298 listed companies that have kept reserves, 44 set aside more than Tk 1,000 crore each from their profit while 28 have a reserve of Tk 500 crore each, according to their published financial data compiled by Shanta Asset Management Company.

Local electronics giant Walton Hi-Tech Industries holds the highest reserve of Tk 9,042 crore followed by Square Pharmaceuticals with Tk 7,999 crore and the Titas Gas Transmission and Distribution Company with Tk 5,983 crore.

A reserve and surplus fund is a liquid asset that is normally set aside from the company's profit to meet any future costs, including expansion projects, and financial obligations such as debt repayments.

Analysts say that maintaining reserves is a good practice worldwide as companies can use these funds to tackle any unforeseen shocks as well.

Companies in Bangladesh have similar intentions for their reserves but some investors are sceptical in this regard as some firms are not expanding even though they have held a good amount of reserve for several years.

In addition, the real income from reserve funds kept in banks or invested in other securities is low at times when inflation is high.

AB Mirza Azizul Islam, former finance adviser to a caretaker government, said general investors want an immediate cash dividend and so, they do not like the idea of retained earnings.

On the other hand, companies always think about the future, so they want to keep a portion of their profit for use in case of emergency or expansion, he said .

"But if investors have any qualms about the reserve, they can talk about it in during the annual general meeting," he said.

"All the companies should not be blamed for the actions of a few that have been accumulating reserves year after year without expanding," added Islam, also a former chairman of the Bangladesh Securities and Exchange Commission.

Echoing the same, Shahidul Islam, chief executive of VIPB Asset Management Company, which manages Tk 280 crore worth of mutual funds, said there should always be a logical reason to keep reserves.

Some companies are keeping huge sums of money as reserves each year even if their capital expenditure and rate of expansion is low.

"So, their dividend activities are totally puzzling," he added.

Besides, some companies with good performance records and good profit growth are making investments but the size of their reserves is much too high considering their needs, he said.

"I asked for an explanation in this regard from a company's directors during their annual general meeting last year but they did not give an answer," Islam said.

Of the 44 companies with a reserve of more than Tk 1,000 crore each, 24 are banks and non-bank financial institutions, five are fuel and power companies, four are pharmaceutical companies, three are engineering companies and the rest are from other sectors.

Anis A Khan, a veteran banker who is a former managing director of Mutual Trust Bank, said banks have to have high amounts of capital to increase their lending. Moreover, they need to have a large reserve against default loans, he said.

"So, banks are always hungry for raising capital," he added.

As banks cannot lend more than a certain percentage of their capital to a single borrower, it tries to increase its capital so that the lending limit increases as well, he said.

Having high amounts of capital also helps increase the trade finance limit with foreign banks, he said.

"More capital means more potential and that is why keeping higher retained earnings is good for banks' investors," Khan said.

Sajib Hossain, a stock investor, said some profitmaking companies were keeping huge amounts of retained earnings in reserve in banks year after year.

Such funds are not yielding any dividend at all as the real interest rate is almost zero now. The real interest rate is an interest rate that has been adjusted to remove the effects of inflation.

"On the other hand, many companies keep much higher funds compared to their needs for expansion," Hossain added.

He went on to say that more importantly, there are many companies that have been holding back funds for years without making any major investment in growth.

"They are depriving their investors," he said, adding that if the companies do not need the fund, then it should be distributed as dividend instead of being kept on hand or in banks.

Square Pharmaceuticals is a growing company that invests in itself every year to meet the growing demand of its products, according to Muhammad Zahangir Alam, chief financial officer of the drug maker.

"So, it needs a lot of money in reserve," he told The Daily Star.

He then said the funds are kept for expansion, which will give better returns to investors in the coming future.

In reply to a query, Alam said the way Square Pharmaceuticals saves funds is not similar to other companies as the company is still growing.

Profits of Square Pharmaceuticals grew 22 per cent to Tk 1,275 crore while its net revenue rose around 16 per cent to Tk 5,073 crore in the first nine months of fiscal 2021-22.

"If any company thinks that it has better potential that can be tapped by investing in infrastructure, then they can keep the funds. Otherwise, a reserve is not necessary and it can be disbursed among investors," he said.

Square Pharmaceuticals recently invested around Tk 500 crore in Square Life Science, a subsidiary of the company, as well as a huge sum in its manufacturing plant in Kenya.

"This will benefit investors," he added.

Beximco has a reserve of Tk 5,815 crore while Beximco Pharmaceuticals has Tk 2,271 crore, the data shows.

The fund was kept as retained earnings for future expansion as per the companies act, said Mohammad Asad Ullah, company secretary of Beximco.

However, he declined to comment further on the matter.

A stockbroker, preferring anonymity, said not all listed companies are not misusing their reserve funds.

Asked how the money may be misused, he said some directors manage their loans by depositing the huge fund in a bank instead of using it for expansion.

Meanwhile, some of them are increasing their reserves or paid-up capital by giving only stock dividend instead of paying cash dividend to their shareholders, the stockbroker added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments