Shares of loss-making firms rise abnormally

Five listed companies that have an accumulated loss of at least Tk 500 crore each saw their share price rise sharply in the past three months, whereas the stocks of the top profit-makers fell.

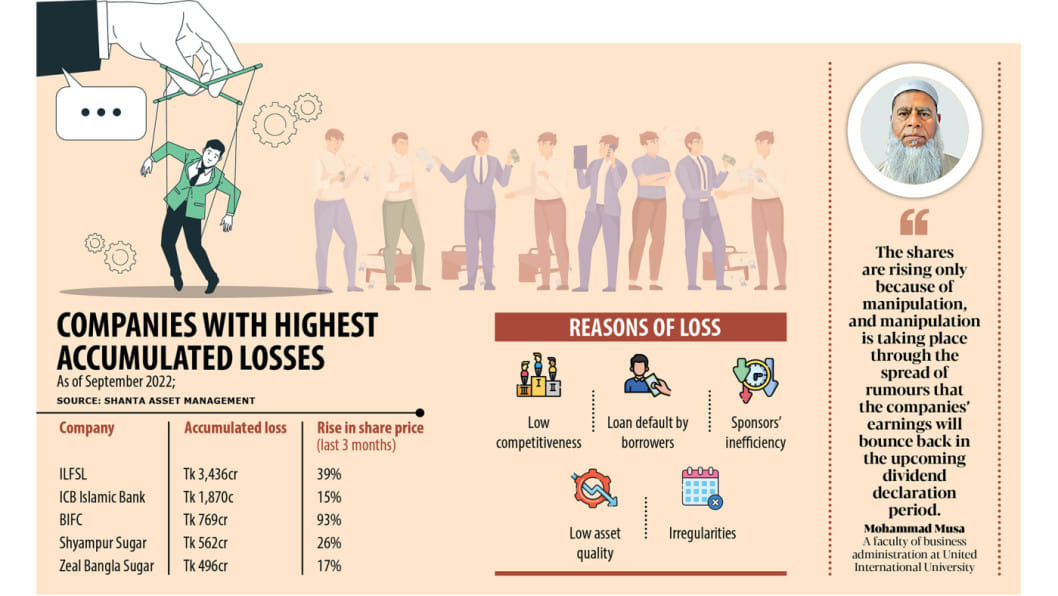

Among the highest loss-incurring firms, International Leasing and Financial Services Ltd (ILFSL) topped with Tk 3,436 crore.

The accumulated loss of ICB Islamic Bank, Bangladesh Industrial Finance Company Limited (BIFC) Shyampur Sugar Mills, and Zeal Bangla Sugar Mills was Tk 1,870 crore, Tk 769 crore, Tk 562 crore, and Tk 496 crore respectively, data compiled by Shanta Asset Management showed.

ILFSL shares rose by 39 per cent in the three months to September 20, while shares of ICB Islamic Bank rocketed 15 per cent, BIFC was up 93 per cent, Shyampur Sugar Mills went up 26 per cent, and Zeal Bangla Sugar Mills advanced by 17 per cent, according to the Dhaka Stock Exchange (DSE).

Analysts attribute the mismatch to manipulation and say such a trend would drive the real investors out of the stock market in the long run.

"These shares are rising only because of manipulation," said Mohammad Musa, a professor of the business administration department at the United International University.

"Manipulation is taking place through spreading of rumours that the earnings of the companies' will bounce back in the upcoming dividend declaration period."

When the prices of certain issues go up and general investors buy them, the manipulators go for the sell-off and take a quick profit, said Musa, who has several publications on the stock market in Bangladesh.

"However, financially strong and stable companies are not rising keeping in pace with weak firms as our investors are also chasing the securities that are part of the manipulation."

During the three-month period, the shares of the profit-making companies fell.

Walton Hi-Tech Industries has reserves and surplus funds of Tk 9,042 crore and it has been making profits every year. However, its stocks dropped 4.4 per cent in the past three months.

Stocks of Square Pharmaceuticals, which is sitting on a reserve of Tk 7,999 crore, fell 4 per cent.

Grameenphone, United Power, and British American Tobacco Company are also logging huge profits and have more than Tk 2,500 crore in reserves.

But the shares of Grameenphone, United Power, and British American Tobacco were each down 7 per cent, 6.37 per cent, and 5.50 per cent.

When the share of sound companies fell, it has a huge impact on the confidence level of investors and they don't want to stick to such a market situation, said Prof Musa.

"Such a situation prompted real investors to shift their funds to other securities and other assets such as land."

The companies that perform well and make significant profits year after year are mostly blue-chip firms where foreign investors have a huge stake, said Mohammad Emran Hasan, chief executive officer of Shanta Asset Management.

"Foreign investors have been selling for months. Now, they are selling due to the depreciation of the local currency against the US dollar."

Hasan says the loss-making companies are rising due to manipulation. "These companies have a lower paid-up capital, so they are easy to manipulate."

Manipulators also speculate that these companies would turn around in a bid to draw unsuspecting investors. Since the share price of the companies is comparatively lower, they take a chance. The buy pressure sends the stocks higher.

Apart from the top five loss-making companies, eight had accumulated losses of more than Tk 100 crore, DSE data showed. They included five non-bank financial institutions (NBFIs) and three textile manufacturers.

Most of the NBFIs lack good governance and have poor asset quality, so they are in the red. In recent years, they have seen funds embezzlement by their directors and sponsors. As a result, their financial health has worsened.

"The textile sector also faces governance challenges. Some of them are incurring losses although many are doing good business," Hasan said.

Of the top unprofitable companies, two are state-run: Shyampur Sugar Mills and Zeal Bangla Sugar Mills.

A top official of Bangladesh Sugar and Food Industries Corporation, which runs the two mills, said the two companies have been incurring losses for years as they have failed to compete with the private sector.

"We are astonished to see such a share price hike of Shyampur Sugar Mills and Zeal Bangla Sugar Mills. I don't know why investors are buying the stocks."

Mohammad Rezaul Karim, a spokesperson of the Bangladesh Securities and Exchange Commission, said the regulator is focusing on raising awareness among investors so that they invest based on analysis and research.

"If they are aware, they will not invest in junk stocks or in the companies that do not pay dividends and are closed."

The BSEC has beefed up monitoring to unearth whether there is any manipulative trade, insider trading or any breach of securities rules, said Karim.

"We have strengthened the monitoring with the help of several government agencies."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments