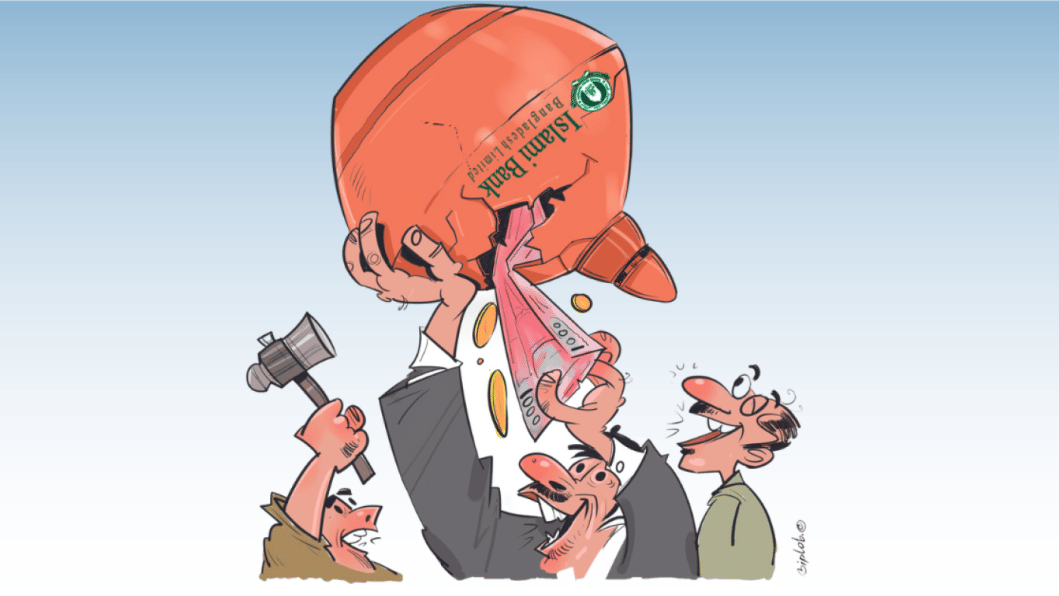

The rise and fall of Islami Bank

Established in 1983 as a first-generation private bank, the Islami Bank Bangladesh Ltd (IBBL) began its journey with the slogan "Pioneer of Welfare-Oriented Banking." The bank opened the doors of financial services to export-oriented industries and poverty alleviation projects. The UK-based economic magazine The Banker listed Islami Bank as one of the top 1,000 banks in the world for nine consecutive years since 2012 – the only Bangladeshi bank to have achieved that.

Foreign investors provided 70 percent of the bank's capital when it was established, but after a change of ownership in 2017, foreign shares fell to 32 percent, as reported by Prothom Alo in 2017. Among its 11 Middle East-based investors were the Islamic Development Bank (IDB), Kuwait Finance House, Dubai Islamic Bank, Al-Rajhi Group, etc. A client of JP Morgan also owned IBBL shares.

The change of IBBL ownership started in 2013 with the aim to free the bank from Jamaat-e-Islami's influence. The change was tacitly supported by pro-government elites, intellectuals, and the media. After a step-by-step change in ownership and management over several months, former bureaucrat Arastoo Khan, one of the directors of the bank and a representative of Armada Spinning Mills, a concern of the business giant S Alam Group, was appointed as the chairman during a board meeting on January 5, 2017. Several other independent directors joined the board as well, mainly coming from different companies of S Alam Group. The bank got a new vice-chairman and managing director in the same board meeting, in what was seen by the government as a "peaceful" changeover.

Foreigners started leaving the bank soon after the plan for a changeover became known. In a letter to the then Finance Minister AMA Muhith in January 2017, IDB President Bandar MH Hajjar said that, despite investors from Saudi Arabia and Kuwait, and IDB holding 52 percent shares in the bank, they were cornered by the decision to change the bank's ownership, according to a Prothom Alo report. A client of JP Morgan also reduced its 4.16 percent stake to 1.68 percent. Although the foreign owners had a clear influence on the bank's policy decisions, they gradually withdrew as the original bank owners became "cornered."

According to its website, Islami Bank has 394 branches and 228 sub-branches. There are 33,686 shareholders listed in Dhaka and Chittagong stock exchanges (as of December 2021). The bank has 16.2 million depositing customers, and 1.8 million borrowers. At the end of 2021, the bank's deposits stood at around Tk 139,000 crore, which was Tk 5,000 crore more than Sonali Bank, three times that of Pubali Bank, and the second highest deposit in the private sector. The bank was also at the top of remittance collection. In 2021, it received nearly Tk 50,518 crore in remittance sent by the expatriates, while goods worth around Tk 64,530 crore were imported and goods worth about Tk 30,178 crore were exported through the bank.

Regardless, after the change of ownership, the bank fell into a major financial crisis due to mismanagement and internal conflicts. The chairman appointed by the S Alam Group resigned, and the bank curtailed its lending activities due to lack of funds.

In 2022, the bank fell into a second crisis. The Business Standard reported that in October, the bank disbursed a Tk-900-crore loan to a man only a month after he set up his trading company and within 10 days of applying for the loan. There are other such instances of incredibly fast loan approval and disbursement. No collateral or credit report was required in any of the cases. Upon investigation, discrepancies were found in the information provided by debtors, such as fake addresses, contact numbers, etc.

The IBBL disbursed Tk 5,000-6,000 crore on average every year over the last six years, but between December 2021 and September 2022, it disbursed more than Tk 25,000 crore of loans, according to The Business Standard. The latest audit by the Bangladesh Bank show that the S Alam Group, which controls Islami Bank, alone took out Tk 30,000 crore of loans from the bank.

The Bangladesh Bank assigned an observer to the bank in 2010 to monitor lending activities, but withdrew said observer in 2020 without providing a reason. The central bank was silent despite knowing about the huge irregularities.

There is an allegation that the companies that took out loans for import financing from the bank spent only a small portion of the funds. If that is the case, then where did the rest of the loans go?

Abnormal amounts of loans to unusual customers, approved in unusually short periods of time, and irregular waivers for collateral mean that the bank has been hijacked – either by the owner or by privileged businessmen. There are rumours in the market that a highly politically powerful business group is going to take over the ownership of the bank from S Alam Group. Such abnormal lending activities fan the flames of such rumours. Does this signal another "peaceful" transition?

Politically-motivated occupiers don't understand that bank deposits belong to its ordinary customers and not any special political entities. Taking advantage of the regulatory body's silence, politically influential businessmen are directly or indirectly looting money from Islami Bank through loans. The question is: what will happen to the one and a half crore depositors of the bank?

A commercial bank's deposit and lending operations are supposed to operate within regulations set by the central bank. Commercial banks take deposits and earn money through lending, i.e. investing. They need to reserve some securities in fixed and temporary funds, capital deposits and daily deposits. According to the International Monetary Fund's (IMF) Basel-3 guidelines, most of the banks in Bangladesh don't have mandatory capital reserves.

Nowadays, banks use the fractional reserve system to generate multiple lending cycles against a single deposit; in this way, new wealth is created, but the loan needs to be properly invested. The fractional reserve system trusts in the dependence of return on investment on bank loans. On the assumption that the loan given has been converted into investment assets, new loans are made again, by keeping a small portion as reserves. This cycle functions on the basis of the trust that the loan will be properly returned from that investment asset.

The fractional reserve system works where bank loans are converted into real investments, meaning that repayment of instalments is maintained and monitored. The creation of new money does not lead to inflation. But it is not working in Bangladesh, because the loan money is being laundered instead of being invested! The balance between the deposit and the credit cycle is disturbed by money laundering and loan defaulting. In other words, there are no regulatory obligations to convert debt into investment in Bangladesh, so applying the fractional reserve system here is risky.

If defaulting, looting and laundering of a bank's loans continue, as is happening in Bangladesh, the bank should, in theory, go bankrupt, unless it is artificially kept alive – that is, it's bailed out with public money. In the past, the Oriental Bank and The Farmers Bank were saved this way. Is the Islami Bank also heading in the same direction? If a quarter of the IBBL deposits of Tk 139,000 crore goes into default, there is no option but a bailout. Can the government, which is going through a financial crisis itself, afford such a burden?

Faiz Ahmad Taiyeb writes on sustainable development and has authored Fourth Industrial Revolution and Bangladesh and 50 Years of Bangladesh Economy.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments