Another year of missed opportunities against corruption

Another year of missed opportunities ends with hardly any specific progress to effectively prevent and control corruption, which continues to cause endless harm to the state and to our society.

High-level pledges against corruption continued to be reiterated in 2022, as in the past several years. Soon after taking over, on January 2, the Chief Justice of Bangladesh compared corruption with cancer, and called for zero tolerance for it. Later, at a seminar on National Mourning Day, he stressed on resisting and rejecting corruption as a means to ensuring justice. And on Constitution Day, he reminded us that corruption adversely affects democracy, weakens the foundation of the state, antagonises the people and causes rage among them.

This anti-corruption narrative from the highest echelon of justice not only echoed the prime minister's frequently reiterated commitment towards zero tolerance against corruption and of sparing no one (including those in her own party), but also represented the responsiveness of the judiciary to ever-growing public suffering and frustration as a result of deepening and widening corruption.

On August 17, the PM, at a meeting with secretaries of the government, called for tough action against anyone involved. Echoing her, at a seminar on International Anti-Corruption Day, the president also called for exemplary punishment for the corrupt, irrespective of their political identity.

Meanwhile, Bangladesh continued to be ranked poorly by nearly every credible governance- and corruption-related international indices, like those on WJP's Rule of Law, Regulatory Quality Indicator, Government Effectiveness, Political Stability, Voice and Accountability, Press Freedom, Political Rights, Civil Liberties, Corruption Control, Bribery Risk Matrix and the Corruption Perception Index (CPI). According to the latest CPI, in fact, Bangladesh scored only 26 out of 100, way below the global average of 43. We remained the second worst performer in South Asia after Afghanistan.

Institutional ineffectiveness is among the main reasons for our failure to improve our performance in the aforementioned indices. The Anti-Corruption Commission (ACC) continued to face challenges of trust and credibility on whether it can even-handedly deliver its core mandate of effectively controlling corruption beyond the small fries, and hold to account bigger fish. The ACC's credibility took on another negative dimension around the controversial dismissal of one of its investigation officers, whose annual performance assessment was consistently high-grade. It happened against the backdrop of his courageous investigation against some key syndicates of grand corruption in Chattogram and Cox's Bazar. It caused a large section of ACC staff to resort to unprecedented acts of protest for their rights, including job security. The incident also reinforced concerns about the ACC's seriousness of purpose, governance challenges, and organisational effectiveness.

Though hard to concretely measure, the cost of corruption in Bangladesh is staggeringly high, amounting to at least two to three percent of GDP, as informed by the then finance minister in 2015. Corruption, grand or petty, is also discriminatory and a major impediment to inclusive development. This was a key finding of the National Household Survey on Corruption released by Transparency International Bangladesh on August 31, 2022. Nearly 71 percent of the respondents of the survey experienced corruption, and 72.1 percent of victims had to pay bribes to access public services.

The burden of bribery, in terms of proportion of annual income, is seven times higher on lower-income households compared to their higher-income peers. The rate of victimisation of corruption among rural households was significantly higher, at 46.5 percent, than the rate for those in urban areas at 36.6 percent.

The discriminatory nature of corruption is further manifested in the victimisation of households headed by persons with disabilities, as 80.3 percent of such households were victims of corruption, compared to the national average of 70.6 percent.

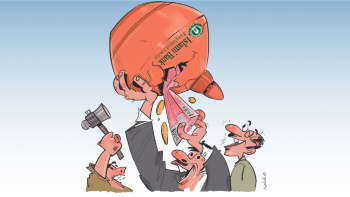

The year 2022 brought corruption's distributive injustices into sharper focus while also exposing corruption-induced macroeconomic fragility, especially in the banking and financial sectors, which have been pushed to the brink of collapse by a triangular trap of loan forgery, tax evasion, and money laundering.

The massive embezzlement involving Islami Bank, together with several others, pointed to the mountain of dirty games of collusive fraud that has been allowed to become part of the bank loan culture.

Hardly any of the kingpins of these scandals, who most often use fake and anonymous entities as their key enablers, have been brought to account. The beneficial owners – who own, control, and profit from such secretive companies and shadowy bank accounts – secure loans to never repay, but mainly to launder. Instead of being subjected to justice, beneficiaries of this dirty game have secured lobbying power for themselves to the extent of policy capture to extort even more concessions.

The year also saw unprecedented privileges granted to money launderers when the national budget for FY 2022-23 made a provision to "bring back" illicitly accumulated wealth and overseas income without any question. This was a self-defeating, immoral, discriminatory, unconstitutional, and corruption-conducive enticement, and an example of ridiculing the high profile pledges of zero tolerance against corruption.

The amount of annual illicit outflow of money from Bangladesh, even by the most conservative estimate, is at least three times higher than the USD 4.5 billion of IMF loan that the government negotiated to be receivable in 42 months, which is not only repayable with interest but also compromises our policy autonomy. Ironically, it is well within the reach of the government to make such loans redundant if it had the political will and institutional capacity to even moderately prevent money laundering.

The institutions authorised to control crime and repatriate stolen assets (by enforcing relevant laws and taking advantage of available avenues of international cooperation) have been evasive at best. Their energy appears to be invested more on disputing the reported data on money laundering and critics thereof.

On October 26, 2022, the High Court rebuked the ACC for failing to take concrete actions against money laundering and recover laundered money.The first official recognition of the massive problem of trade-based money laundering appeared when, at a media briefing on November 15, Bangladesh Bank (BB) officials disclosed that a special audit had detected illicit financial transfers out of the country through 20 to 200 percent misinvoicing by importers and exporters. Half a month later, the BB governor mentioned nearly a hundred such unnamed cases of misinvoicing in the month of July 2022 alone.

It clearly took the central bank the unprecedented foreign exchange crisis (driven by the Covid pandemic) and the Ukraine war to wake up. Nothing is known, though, of any actions to be taken to prevent and control this long-nourished practice of invoice manipulation in import and export businesses to illegally transfer massive amounts of foreign currency abroad and evade taxes – a phenomenon which is neither unknown to relevant authorities nor takes place without the collusion of sections of relevant officials.

Unlike well over 120 countries, including some of our neighbours, Bangladesh remains evasive about adopting the Common Reporting Standard (CRS) for automatic exchange of information on banking transactions, which could facilitate live tracking within and across borders. By adopting CRS we could have taken our starving revenue system and anti-money laundering efforts to a more effective level.

Similarly, there appears to be no interest from authorities to ensure beneficial ownership transparency, which could be a powerful tool to salvage the banking sector from the brink of collapse. Will the government have the political courage to undertake such badly needed reforms, in a context where the policy regime continues to be possessed by beneficiaries and protectors of loan defaulting, tax evasion, and money laundering?

Dr Iftekharuzzaman is executive director of Transparency International Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments