After energy, LC opening crisis now cripples businesses

At the beginning of 2022, businesses were upbeat and many of them thought that the worst stemming from the losses induced by the coronavirus pandemic was finally over. That was short-lived.

The assumption changed as another crisis began to unfold following Russia's invasion of Ukraine in February 2022. And Bangladesh, a net importing country, soon found itself on the receiving end.

Its deficit in transactions with the rest of the world widen in the face of skyrocketing import payments for higher energy and commodity prices amid the conflict.

The trouble did not end there.

In the middle of 2022 came power and gas crisis, forcing the countrymen to suffer power cuts and factories to run below capacity.

Amid the worsening energy and power crisis, the winter emerges as a saviour as electricity demand fell. Still, load-shedding remains while factories are yet to receive an adequate supply of gas amid insufficient local production and the pause in buying liquefied natural gas from international spot markets.

Faced with an increased cost of production after the government hiked petroleum, gas and electricity prices and higher import costs, businesses were forced to increase their prices of goods and services.

A US dollar shortage added fuel to the fire.

Now, businesses in Bangladesh are finding it difficult to open letters of credit (LCs) owing to banks' inability to provide the American greenback needed to finance imports and the central bank's restriction on non-essential imports. The stress seems to be intensifying with each passing day.

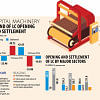

LC opening slumped 14 per cent year-on-year in July-December of the current financial year of 2022-23. Settlement declined 9 per cent.

The LC opening for intermediate goods such as clinker and limestone, the key ingredient for the cement industry, dipped 33 per cent to $2.58 billion during the period, data from the Bangladesh Bank showed.

The settlement of LCs for intermediate goods imports declined too. In the case of industrial raw materials, the situation is the same: LC opening for raw materials for industries dipped 27 per cent to $12 billion in July-December.

All these have caused a slowdown in sales and stoked fears among the business community that their regular business cycle is going to break.

"We have been facing a problem regarding LC opening for the last two months. It is breaking our supply chain and the production for domestic and export-oriented markets is being hampered," said Eleash Mridha, managing director of Pran Group, the largest agro-processor and exporter in Bangladesh.

He said banks were entertaining LCs for small-value imports. "But if the import does not improve, the situation will be tougher in the coming months," he said.

In Bangladesh, overall consumption has declined as disposable income dropped for the higher inflation and also for the winter, leading to a slowdown in the sales of consumer goods.

A top official at Shah Cement Industries Ltd said the market did not witness the shortage of the key building material although LC opening for intermediate goods fell.

"This is because demand has declined."

Capital machinery imports are on the downturn as well.

LC opening for capital machinery, which shows entrepreneurs' expansion or new ventures, nosedived 65 per cent to $1.27 billion in the six months to December.

The import of machinery for miscellaneous industries dropped substantially too, according to central bank data.

"Industrialists are going slow when it comes to taking new projects as they are worried about the cost of dollars. Fresh investment seems to have slowed," said the official of Shah Cement.

Shahid Hossain, who runs a factory that makes media paper for packaging, said he had been trying to open LCs to bring some spare parts valued around $16,000.

He applied to banks nearly two weeks ago. He has received no positive response so far.

Hossain, also the managing director of SB Distribution, an importer of deodorant, stationaries and cosmetics, said his company used to open $200,000 of LCs every month until June.

Imports fell later, he said, adding that the market did not see any shortage as demand dropped between 30 and 40 per cent owing to increased prices.

Hossain said his firm could manage with the existing stock of goods for the time being.

"But the stock will not last forever. It will be really tough to do business if we can't import products. We are really worried," said Hossain, fearing that the decline might force him to lay off at a certain point.

Md Saiful Islam, president of the Metropolitan Chamber of Commerce and Industry (MCCI), said import substitute industries are suffering.

He cited Bangladesh Bank's monetary policy statement and said the central bank claimed that it is not restricting the import of raw materials.

"The reality is imports have declined as banks don't have adequate dollars. I am quite concerned about the fall in the imports of industrial raw material imports and capital machinery."

"The fall in imports is disrupting the continuity in business. Continuity has to be there."

The MCCI chief warned if the import-substituting factories could not manufacture goods, production would suffer and the import of finished products would be required.

"The cumulative effect will be higher inflation," he said.

Md Fazlul Hoque, one of the top knitwear manufacturers and exporters, said exporters don't face problems in the opening of LCs to import raw materials as they can earn dollars as export proceeds.

M Masrur Reaz, chairman of the Policy Exchange Bangladesh, pointed out that load-shedding has been on while the gas supply is far from becoming smooth.

With this, the problem of falling opening of LCs for industrial raw materials, intermediate goods, and capital machinery has been added to the recent hike in gas prices.

"So, it is a double blow for businesses. The overall business has certainly slowed."

Economic challenges in Bangladesh continue to persist despite some important steps from the government.

"In some cases, it has amplified," he said.

"The industrial situation has worsened while there is no sign of stability in the balance of payments. The only encouraging development is prices are on the downward trend globally although prices are still high."

The former economist of the International Finance Corporation thinks an up to 178 per cent increase in the prices of gas will fuel the cost of production.

"It is an additional blow for exporters as the demand is feared to slow down for recession worries in the west. Many factories will have to run at break-even after the spike."

"Job cuts are likely. So, employment will be under threat."

Khondaker Golam Moazzem, research director of the Centre for Policy Dialogue, thinks part of the business slowdown was expected for the steps taken by the central bank that aimed at discouraging the import of non-essentials.

"However, desired imports can't be done," he said, pointing to the problems in payments for essential commodities.

Moazzem suggested the BB open a central monitoring cell to track dollar requirements and inflow and decide accordingly.

"Otherwise, the problem will intensify," he said.

Md Mezbaul Haque, the spokesperson of the central bank, said: "The slowdown was expected. So, we have revised down economic growth forecasts."

The central bank took measures to reduce demand for the dollar.

"There is uncertainty over when the war in Ukraine would end while Covid-19 is returning in some countries. So, we have become conservative. But we are providing support to essential imports," he said.

"We don't see anything abnormal but we are tracking data. We are cautious."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments