Dollar shortage bites pharma industry

The pharmaceuticals industry, which has made life-saving drugs available at lower costs, is facing troubles in opening letters of credit (LCs) to import much-needed raw materials and capital machinery owing to the US dollar crunch.

Bangladesh Bank data showed local drug-makers opened LCs for the imports of raw materials worth $465.43 million in the first six months of the current financial year, down 22.41 per cent from a year earlier. It was $599.85 million in the corresponding period in 2021-22.

Likewise, the LC opening for capital machinery used in the pharmaceuticals sector declined 35.15 per cent to $65.15 million between July and December.

Under the circumstances, the industry is worried about whether it would be able to deliver products to international buyers within agreed deadlines, failure to which may dent the image of the sector.

"The pharma industry is going through a challenging time as the prices of raw materials have risen, and sometimes, banks are delaying opening LCs," said Md Zahangir Alam, chief financial officer of Square Pharmaceuticals.

"But if pharma companies can't bring in enough raw materials, production would be hampered."

Bangladesh needs to import $1.3 billion worth of raw materials for the pharmaceuticals sector a year since local firms can at best meet 10 to 15 per cent of the annual demand for inputs.

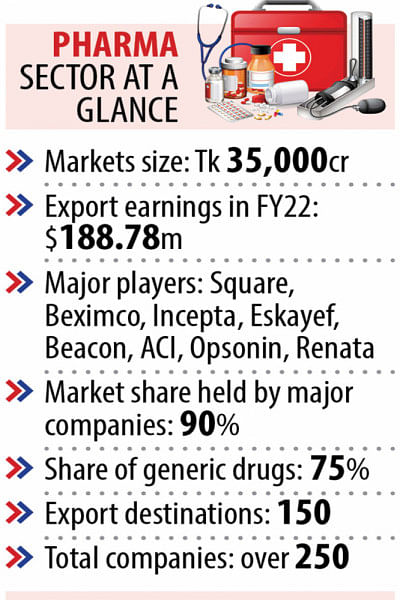

The sector meets 98 per cent of the local demand and also ships products to around 150 countries, including several developed nations.

The finance cost to open LCs may go up as banks sometimes forward LC applications to their offshore branches to pave the way for the settlement of the import bills in US dollars, Zahangir said.

Bangladesh is facing a serious dollar shortage as escalated imports have driven down the foreign currency reserves and thus, the value of the local currency against the US dollar. So, businesses can't go ahead with required imports to feed the economy owing to banks' inability to supply the American greenback needed.

The central bank has restricted non-essential imports to save US dollars. Amid the tightening of purchases from external sources, overall LC opening in Bangladesh slumped 14 per cent year-on-year in July-December. Settlement declined 9 per cent.

"Amidst the sharp strengthening of the dollar, entrepreneurs are not getting adequate dollars to open LCs," said M Mohibuz Zaman, chief operating officer of ACI Pharmaceuticals.

"Banks are taking more time to provide approvals to the opening of LCs. This is prolonging the lead time."

SM Shafiuzzaman, secretary-general of the Bangladesh Association of Pharmaceutical Industries, a platform of about 250 local drug-makers, says manufacturers can't import ingredients on time.

"This is hampering the production of life-saving drugs. In some cases, importers can't have their raw materials released from the port on time as banks can't settle LCs."

"We can't open LCs even after providing a 100 per cent margin against the imports of raw materials and capital machinery."

Shafiuzzaman does not see an immediate solution to the crisis facing the industry.

"The government should give priorities to allow opening LCs for the pharmaceuticals sector considering its importance. The health sector will suffer a lot if the situation does not improve soon."

Monjurul Alam, director for global business development at Beacon Pharmaceuticals, said although the sector is suffering while opening LCs for the time being, it might perform well in 2023 as the number of export destinations could increase.

According to him, the industry is struggling to continue business amidst the ongoing dollar crisis and the latest gas and power price hikes.

On June 18, the government raised the retail price of gas between 14.5 per cent and 178.9 per cent for industries, power plants and commercial establishments to lessen its unsustainable subsidy burden amid a narrow fiscal space.

It came less than a week after the tariff for electricity was revised upwards by 5 per cent.

The hike in gas and electricity prices would emerge as a major burden for the sector when it comes to maintaining competitiveness in the global market, Mohibuz said.

"If the situation persists, the sector will suffer a lot and struggle to survive."

Monjurul acknowledges that the industry has been facing a lot of troubles due to the falling raw material imports amid the restrictions on the opening of LCs.

"There is no way to avoid the rising cost of production due to the increase in the dollar price."

The taka has lost its value by about 25 per cent against the US dollar since Russia's war in Ukraine began in February last year.

Prof Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, called for a careful examination to know the problems the businesses are facing.

He said the Bangladesh Bank was providing support by injecting dollars from its reserves to ensure the import of essentials.

"Health and well-being are as essential as food and energy. So, it demands closer scrutiny to ensure that supply, availability and prices are not affected."

Square Pharma's Zahangir urged the central bank to open a window to ensure LC opening for drug-makers.

"The gas prices are going up. So, the cost of production would be higher for drug makers."

Though the costs of production have risen, manufacturers can't pass on the entire cost to consumers.

The price adjustment is only possible after taking approval from the Directorate General of Health Services, said Zahangir.

Pharma exports witnessed a downward trend recently due to the global economic crisis. Shipment dropped 12.06 per cent to $92.78 million between July and December, data from the Export Promotion Bureau showed.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments