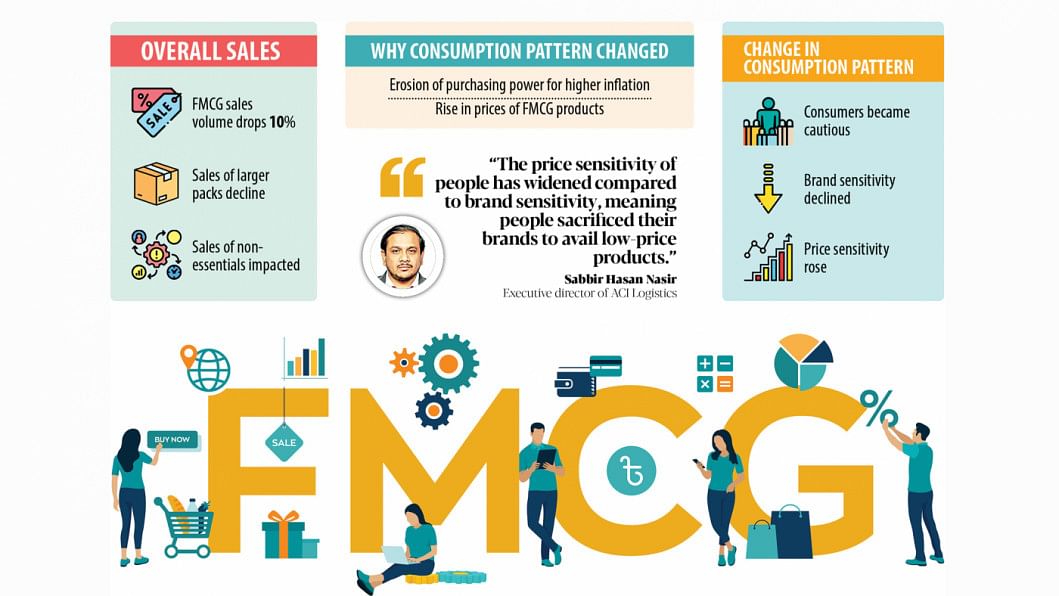

FMCG sales drop as inflation eats into consumption

In the face of a soaring cost of living, many low and middle-income people in Bangladesh have either ditched branded products or switched to smaller packs, causing consumer goods producers and marketers to record a slowdown in sales in 2022.

Senior executives of a number of fast-moving consumer goods (FMCG) companies told The Daily Star that the sales volume of non-essential products either fell or posted a very minimal growth last year compared to 2021.

FMCGs, also known as consumer packaged goods, are products that sell quickly at relatively lower costs. And the top officials say people have become more sensitive to the prices while sensitivity to the brands fell, meaning they are giving up their preferred brands in order to access low-priced alternatives.

This is because their purchasing power has eroded as inflation has persistently remained at an elevated level since March while incomes have stagnated.

"In general, consumers are in a tight corner due to the higher prices of goods. So, they are buying less," said Syed Alamgir, managing director and CEO at Akij Venture Group.

"The sales volume of FMCG companies dropped by around 10 per cent on average in the last one year. Most of the sales drop have taken place in rural areas."

Owing to escalated raw material costs in the global markets and the higher US dollar price, FMCG products have become dearer. Companies have hiked the prices of consumer products by 20 per cent to 80 per cent, according to industry insiders.

"2022 was a challenging year for almost all the segments of FMCGs," said Kamruzzaman Kamal, director for marketing at Pran-RFL Group.

"Due to the cost escalation, the market saw a slight drop in demand since consumers have tightened their belts."

Sabbir Hasan Nasir, executive director of ACI Logistics that operates the country's largest retail chain brand Shwapno, says they had thought that the sales growth of FMCG products would bounce back after the impacts of Covid-19 petered out. However, it varied from product to product.

"The sales growth in essential products has remained in good shape while the growth in personal care products declined or turned negative."

"The price sensitivity of people widened compared to the brand sensitivity, meaning people sacrificed their brands in order to avail low-priced products."

He blamed higher inflation for the change in consumer behaviour.

Inflation hit a 10-year high of 9.52 per cent in August 2022, according to data from the Bangladesh Bureau of Statistics. It fell to 8.71 per cent in December.

Md Quamrul Hasan, business director of ACI Consumer Brand, said the massive depreciation of the local currency against the US dollar raised the raw material prices for most of FMCG products in 2022.

The taka has lost its value by about 25 per cent against the American greenback since Russia's invasion of Ukraine in February.

"Other operating costs also pushed up the prices of FMCG products in Bangladesh. There are some products that have almost gone out of the reach of many consumers. In case of some products, people are consuming less," Quamrul said.

He pointed out that as the prices of FMCGs rose, the sales value was higher and the growth was also positive. "But the sales volume declined in many segments for most companies."

On average, the sales volume of non-essential products of FMCG companies fell by around 10 per cent, he added.

Jesmin Zaman, head of marketing of Square Toiletries Ltd, says in some cases, consumers have moved from larger packs to medium-sized or smaller packs.

Regional and small players that produce FMCG products for a certain region had been in the most challenging situation when it comes to importing raw materials. As such, their sales were impacted to a large extent and major players benefitted from the situation, she said.

The companies that have to rely on imports to sell their products in Bangladesh have been affected more than those that manufacture products locally, said Md Sahabuddin, company secretary of Marico Bangladesh, a multinational company.

He, however, thinks that the FMCG is a large market, so a higher inflation might not hurt it severely.

Pran's Kamal says his company had tried not to hike prices initially and instead went for downsizing the products so that the prices could be kept unchanged.

"Only when it was not possible, we increased the prices, and most of the companies also did the same."

Shamima Akhter, director for corporate affairs at Unilever Bangladesh, says: "2022 had been one of the most tumultuous years we experienced as the country navigated unprecedented commodity cost escalation, supply lines gridlocks, currency depreciation, and heavy flash floods in the north."

"But despite all the headwinds, we stayed resolute in our ethos of 'what is good for Bangladesh is good for Unilever' as we continued to serve our consumers with their much-needed essential products."

The second half of 2022 was especially challenging as the inflationary environment impacted the consumption, leading to a volume decline and leading toward higher production costs, Shamima said.

"We have focused on driving productivity efficiencies hard to generate savings that offset some of the cost increases. At the same time, we are invested more in product quality and brand support to ensure that they offer superior performance and great value."

Md Shafiqul Islam, a private sector employee who lives in the capital's Shewrapara, says the prices of all products have risen in the past one year.

"So, I have had no other option but to slash expenses since my salaries have not gone up in line with the hike in the cost of living. So, I have cut the consumption of some products that are relatively less important."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments