Taxing air travel could fund climate victims

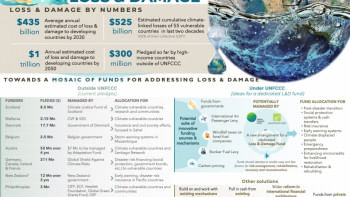

Last year, the 27th Conference of the Parties (COP27) for climate change agreed to establish a loss and damage (L&D) finance facility to support the recovery from loss and damage caused by the increasing impacts of climate change. The decision to establish an L&D fund can be regarded as just a political win; it is not a climate win yet.

COP27 established a 24-member Transitional Committee to develop a framework to operationalise the L&D facility, to be adopted at COP28 in Dubai this year. The framework is expected to include the approaches, modalities and sources to capitalise this finance facility.

A number of funding proposals have been made by different parties and agencies of the United Nations Framework Convention on Climate Change (UNFCCC), including the G20 Ministers and the UN Secretary-General's Advisory Group on Climate Financing, over the last 15 years. They included new and innovative avenues such as financial transaction tax, air passenger levy, levy on military expenditures, etc. This is because public financing from developed countries will never be sufficient for this purpose. Funding mechanisms that are independent of public treasuries of the developed countries can substantially complement the mobilisation of L&D funds.

The COP27 decision also indicates exploring innovative financing options. However, the current international environment is not very conducive for minimum public financing because of the global pandemic fallout as well as the ongoing war in Ukraine. The procrastination of politicking to mobilise the long-pledged USD 100 billion support is a case in point.

The LDCs also made a proposal at COP14 back in 2008 for a modest international air passenger adaptation levy (IAPAL). The Alliance of Small Island States (AOSIS) also proposed a multi-window facility focusing on insurance and rehabilitation schemes. But neither of these suggestions were accepted by the UNFCCC negotiators. There was some opposition from some developing countries, including the SIDS, that a levy on air travel would likely impact the tourism industry negatively, which is the main source of external revenues for many of those countries.

It may be mentioned that the foundational principle for addressing climate impacts remains Article 3.1 of the UNFCCC: the common but differentiated responsibility based on respective capabilities (CBDR+RC). This principle implicitly implies the polluter-pays-principle (PPP), which should be the cardinal basis of mobilising money to address climate change impacts. The climate regime is based on the neoliberal market-based economic system. However, the most fundamental of solutions under this very system lies in internalising the emission externalities that cause climate change. This is being applied by many countries, both developed and developing, in the form of carbon pricing – either through imposing a tax or emissions trading. The number of these schemes at present is well over 70 globally.

While these instruments are applied nationally, there are still no schemes at the international level to tax the externalities. The reason is, unlike solid waste, air pollution does not stay put within national borders. Now that there is an agreement on an L&D facility, interests are renewed at the policy and academic levels to look for new, extra-budgetary sources of funding. The suggested list includes, among others, a tax on fossil fuel companies, carbon pricing at global level, financial transaction tax, climate damage tax, levies on maritime and air transportation, solidarity payment, taxing billionaires, etc. Among all these, levies on maritime and air travels are being discussed very actively.

In this context, the proposal for international air passenger levy could be revisited. Air travel has changed a lot since the proposal was tabled in 2008, including the factors that determine the volume of air travel. Flying now includes a whole gamut of factors, such as historic heritage and entertainment facilities at destinations, volume of business travel, cost of accommodation at destinations, food costs, internal transport facilities, security-related issues and other charges imposed on travellers. So, demand for flying is not affected just by a little hike in ticket pricing.

In the last 15 years, average income across the world has risen significantly, including in developing countries. This and the enhanced demand for tourism are likely to cancel out the possible negative impact on the demand due to a little price hike. Also, the earlier opposition by the LDCs and SIDS against this levy may not hold now, in view of a sense of solidarity among the UNFCCC parties to mobilise fundings for an L&D facility.

So, we renew the proposal to revive the IAPAL in this changing context of global political-economic environment and the rising sense of climate emergency. The earlier proposal quantified the total revenue generation of around USD 10 billion, based on the levies of USD 4 and USD 40 on economy class and business/first class, respectively. The proposal warrants substantial research to look into the latest developments in air travel and the potential of mobilising new money for the L&D facility from this particular sector. Different scenarios may be developed under different levels of levies.

With this perspective, the International Centre for Climate Change and Development (ICCCAD) has undertaken a study on reviving the IAPAL proposal as a source of capitalising the loss and damage financing facility, the findings of which will be shared with a wide range of stakeholders well ahead of COP28.

Dr Saleemul Huq is director of the International Centre for Climate Change and Development (ICCCAD) at Independent University, Bangladesh (IUB).

Dr Mizan R Khan is deputy director of ICCCAD.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments