Govt’s higher borrowing from BB stokes inflation risk

The government has kept borrowing from the Bangladesh Bank as commercial banks can't come up with much-needed funds owing to the liquidity crunch.

But if the government consistently borrows from the central bank, it may fuel inflation, which has remained at an elevated level for the past one year.

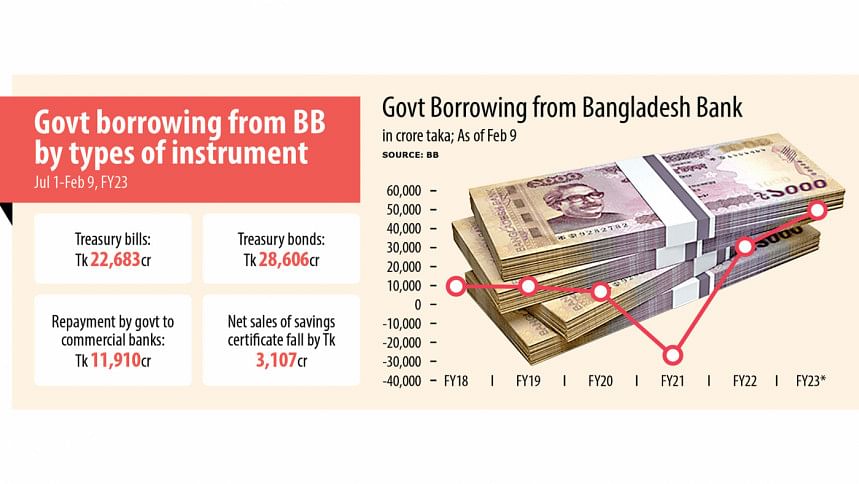

Between July 1 and February 9 this fiscal year, the government borrowed Tk 52,129 crore from the central bank, according to BB data. It borrowed Tk 31,403 crore in the entire fiscal year of 2021-22.

"Borrowing from the central bank usually means an injection of new money into the market. This usually put an adverse impact on inflation," said Zahid Hussain, a former lead economist of the World Bank's Dhaka office.

In other words, this means, the volume of notes and coins out in circulation is increasing. And such a form of money can multiply by as much as five times as only a fraction of deposits is backed by actual cash and is available for withdrawal.

So, the Tk 52,129 crore borrowed by the government may end up being Tk 260,645 crore eventually.

The extra money in the hands of people means it will create demand for goods, which may push up the price level.

According to data from the Bangladesh Bureau of Statistics, inflation stood at 8.57 per cent in January, down from 8.71 per cent in December

January's inflation figure was the lowest since August when consumer prices surged to a 10-year high of 9.52 per cent.

In order to help banks open letters of credit (LCs), the central bank injected around $9.50 billion into the economy between July 1 and February 9. A record $7.62 billion was supplied during the entire financial year of 2021-22.

Commercial banks bought the dollars in exchange for the local currency, which has reduced the liquidity base in the banking system. If the government had borrowed money from commercial banks, the liquidity situation would have worsened further.

The government has set a bank borrowing target of Tk 106,334 crore for 2022-23.

Of the money that the government has taken from the BB in the last seven months, Tk 11,910 crore was used to repay commercial banks. So, the government's net borrowing from the banking system stood at Tk 40,210 crore as of February 9.

Besides, the interest rates on treasury bills and bonds would have surged if the government had taken funds from commercial banks, Hussain said.

The interest rate on the 20-year treasury bond shot up to 8.89 per cent in January in contrast to 7.67 per cent the year before.

And Hussain says it would not be possible for the central bank to keep the interest rates of T-bonds below 9 per cent if the government prefers to borrow from commercial banks.

"Under such a situation, there will be a mismatch between the interest rate ceiling of 9 per cent on loans and the yield of the government securities."

Banks are following the interest rate ceiling since April 2020 in line with a central bank's instruction.

The ongoing weak revenue mobilisation is partly responsible for the government's heavy borrowing from the banking system.

The tax collection growth slowed drastically in the first half of the current fiscal year due to falling customs tariffs and direct taxes amid declining imports and reduced profits of firms.

The National Board of Revenue clocked an 11 per cent year-on-year growth in tax receipts in the July-December period, down from 17 per cent a year earlier.

Foreign financing has declined in recent months and it came at a time when the government failed to cut its expenditure in line with the target, forcing it to take funds from the central bank heavily, Hussain said.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, says that government borrowing from the central bank can be considered positive for commercial banks since the latter is experiencing liquidity stress.

"If the government borrows from commercial banks, they will be in trouble."

Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue, said although lower borrowing from commercial banks is good for them, it may stoke inflation.

The drastic fall in net investment in savings certificates in the first half of the financial year has also compelled the government to turn to the BB for funds.

Net investment in the savings tools was a negative Tk 3,107 crore between July and December in contrast to Tk 9,590 crore during the same period a year before.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments