Inflation jumps to 7-month high in March

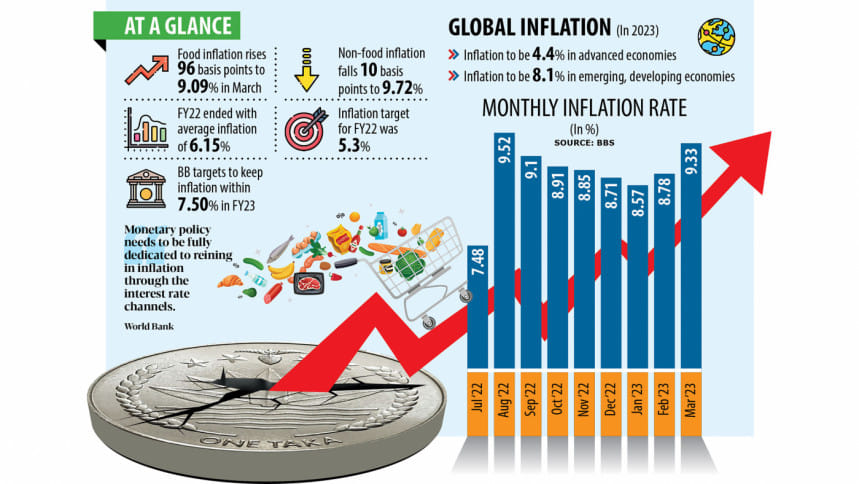

Inflation in Bangladesh jumped to a seven-month high of 9.33 per cent in March as food prices rose and the adjustment of oil, gas, and electricity prices took hold, highlighting the pains low-income households are going through.

The Consumer Price Index (CPI) rose 55 basis points from the 8.78 per cent reported in February.

This means the spike in the CPI was just behind the 10-year high of 9.52 per cent seen in August last year, led by higher commodity prices in the global markets and the resulting increase in the prices of petroleum, gas, and electricity at home.

Planning Minister MA Mannan shared the inflation figures yesterday after the meeting of the Executive Committee of the National Economic Council in the capital.

The government released the data on a day the World Bank and the Asian Development Bank also published their projection about consumer prices. According to the two multilateral lenders, the CPI would average 8.6 per cent and 8.7 per cent respectively at the end of the financial year ending in June.

Mannan said the inflation rate increased by 55 basis points and the wage rate has gone up by seven basis points.

"The rise in the wage rate might give some relief to the people."

Food inflation rose 96 basis points to 9.09 per cent in March as demand rose owing to Ramadan.

Non-food inflation, however, fell 10 basis points to 9.72 per cent, according to a document from the planning ministry.

In its Bangladesh Development Update released in Dhaka yesterday, the World Bank said pent-up demand increased aggregate demand, and a rise in the price of imported goods and subsequent energy and transport price increases exacerbated the inflationary pressure on other items such as pharmaceuticals, clothing, furniture, and house rent.

A series of adjustments to retail electricity tariffs increased prices by 15.7 per cent from January to March. Similarly, the price of piped gas surged by 150 per cent for large industries, 154.7 per cent for medium industries and 178.3 per cent for small and cottage industries in February.

Higher inflation puts poverty gains at risk.

To assess the effect of inflation on the livelihoods of the poorer households in Bangladesh, the South Asian Network on Economic Modeling (Sanem), a private research organisation, carried out a survey on 1,600 families in eight divisions from March 9 to 18.

It found out that the food habit of 90 per cent of the families has changed.

Some 73 per cent of the families had been concerned about not having enough food in their homes between September 2022 to February 2023. And the number of families who had no food at least for a day increased during the period, according to the survey.

Selim Raihan, executive director of the Sanem, said it was obvious that inflation would go up since the price of goods spiralled in February and March.

"In our survey, we found that the income of the households remained unchanged from September to February but the food expenditure increased drastically."

The economist warned that the higher inflation for such a lengthy period would push many into acute food insecurity.

Inflation in Bangladesh has been at an elevated level since July last year.

Prof Raihan pointed out flaws in market monitoring.

"Companies have increased the prices of oil, eggs, sugar, and rice disproportionately. But we haven't seen any effective measure when it comes to market monitoring."

On various occasions, many local economists have raised questions about the inflation numbers released by the Bangladesh Bureau of Statistics, saying the real rate would be much higher than the official figures.

When pointed to it, the planning minister said: "We reported an inflation figure that is higher than that of the ADB. Had we manipulated the data, we would not have reported higher figures."

"In fact, I said earlier that inflation would go up in March and it accelerated to 9.33 per cent. Fortunately, it did not touch 10 per cent."

The WB said enhancing monetary policy would enable inflation targeting and support financial stability in Bangladesh.

"Monetary policy needs to be fully dedicated to reining in inflation through the interest rate channels."

The BB has raised policy rates by multiple times in recent months to combat higher consumer prices. But the World Bank said the continued use of a lending interest rate cap introduced in April 2020 has impaired the effectiveness of policy rates.

The WB thinks the introduction of a benchmark lending rate or reference rate for commercial banks could provide a transition path from rate caps toward market-determined rates.

"This policy could see a shift from reserve money-based monetary policy transmission towards a policy rate-based transmission mechanism. The reference rate could be anchored on the treasury rates of government securities or interbank rates."

The BB is working to put in place a benchmark lending rate but that is not expected to come into effect before July.

Prof Raihan said Bangladesh has failed to use the interest rate, a decisive tool to combat inflation.

The interest rates were increased in many countries as part of their efforts to tame inflation. But the Bangladesh Bank said a market-determined lending rate will be introduced in July.

"Then it will be a late response," he said.

Ghulam Rahman, president of the Consumer Association of Bangladesh, said essentials are costlier now than in the past.

He said there are some global reasons for the price increase but there are local factors as well.

"Some illogical decisions and the reluctance to take actions are contributing to the rising inflation."

Prof Shamsul Alam, state minister for planning, feared that inflation might increase further due to the recent price hike of oil in the international market.

Prof Raihan said only 28 per cent of people benefit from the social protection programmes such as the sales of subsidised food items by the Trading Corporation of Bangladesh and the Open Market Sales operation of the food ministry.

"But the amount is very small. It is insufficient for poor people. So, ensuring food security should be the government's highest priority."

Average inflation stood at 6.15 per cent in the last financial year of 2021-22, well above the central bank's target of 5.30 per cent.

The BB has targeted to keep the average inflation within 7.50 per cent in FY23.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments