De Dollarisation in a multipolar world - what is Bangladesh’s strategy?

In recent times we have seen geo politics accelerating two major shifts, firstly, moving away from dollar as global currency reserve and secondly, focusing on bi lateral currency swaps for trade. Let's expand these two issues in greater depth to understand its impact on Bangladesh in the long run.

Foundation of Petrodollar is at risk

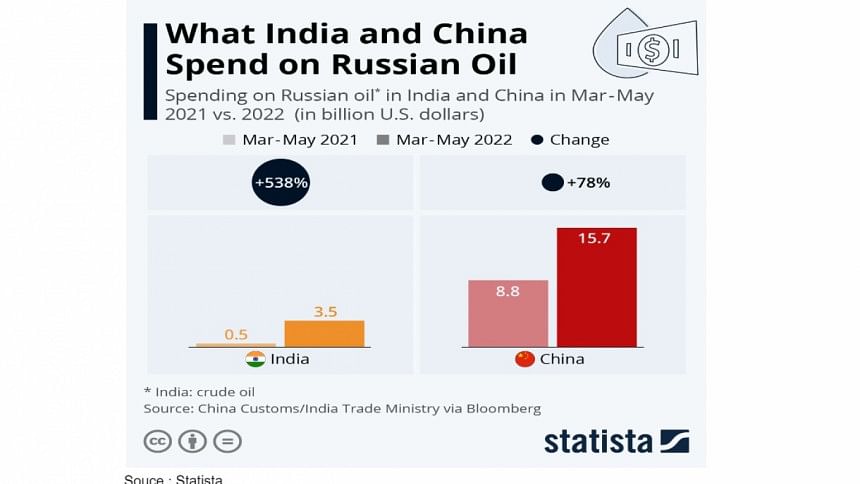

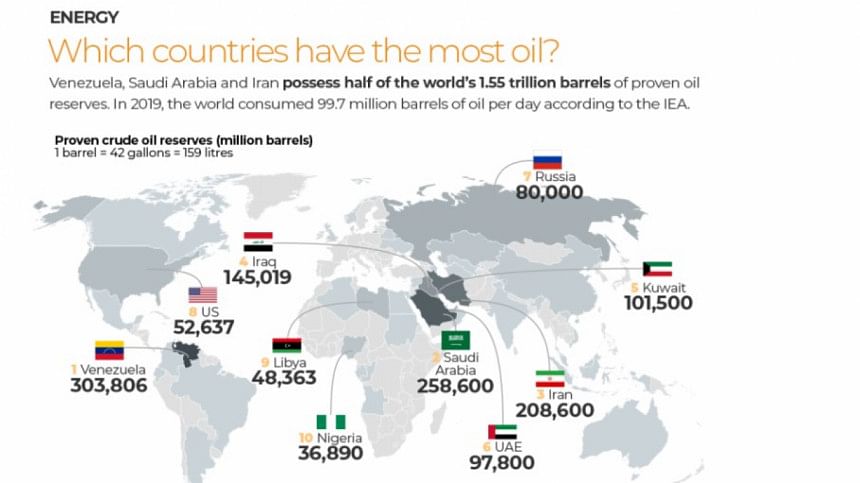

Importance of the petrodollar is showing some cracks as Saudi Arabia has shown an appetite to hedge and diversify its security by normalizing relations with neighboring countries. On top of that, China buys 25 per cent of Saudi Oil exports and recently agreed to settle some portion of oil trade in Yuan to diversify from the dollar.

The latter move was unthinkable a few years back but at this moment, it appears to chip away at the foundation of the petrodollar very slowly. I expect oil trading in different currencies to only increase when more countries like Russia and India start trading in Ruble/ Rupee to avoid trading in dollars.

Dollar is used as sanction tool

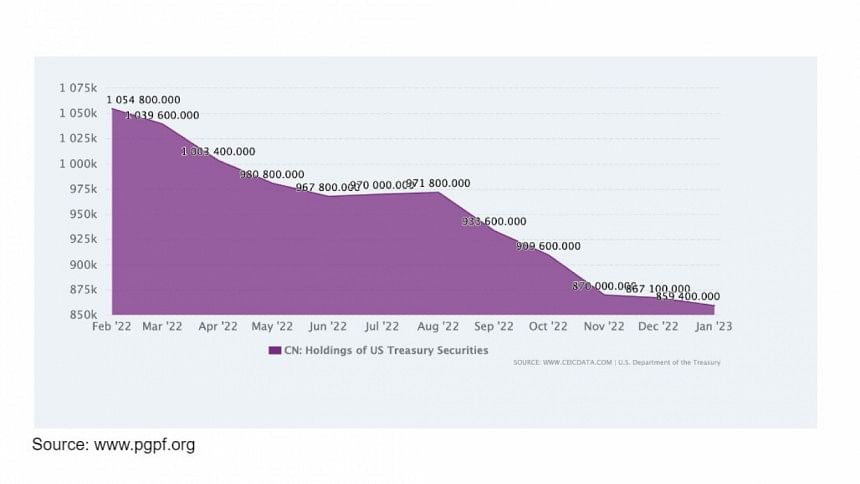

Weaponisation of the dollar is the biggest threat to itself for continuing to be a global currency reserve. For example, $600 billion Russian reserves were frozen in a matter of days. More countries who are wary about US hegemony are slowly but surely moving away from the US dollar reserve.

As the West continues to use sanctions as a tool to manage foreign policy, the expectation of these foreign debts to be paid in dollars is surely not based on reality. So weaponisation of the US dollar is not sustainable in the long run as it only compels foreign governments to find alternative assets.

For example, China has been dumping US treasuries from one trillion holding to 859 billion to all time low as its priority is to find alternate assets beyond the reach of the US govt.

Gold reserve holding by government is increasing

Before the reign of fiat currency, US currency was tied to the gold standard but was decoupled in 1971. Ever since then, the US government has been using monetary policy to control their currency and manage its economy.

On the other hand, fiscal policy is managed with a political lens. As a result, common sense diminishes and we end up holding assets that are just paper. So in recent times we observed that various govt. increasingly holding gold as part of reserve as a safe-haven asset.

Currency swap between trading blocs

Bilateral trade between governments and accepting each other's currency is gaining as the new norm to reduce US dollar dependency. For example, 18 countries have agreed to trade in Indian rupee.

These countries include Germany, Kenya, Sri Lanka, Singapore, UK, Malaysia etc. Similarly Brazil signed an agreement last month with China to trade in Yuan. So far China has signed agreements with 41 countries for Yuan for clearing bilateral trade.

This practice is emerging in regional trade blocs which have proximity and integrated trading relationships.

BRICS is expanding, Saudi Arabia and Iran have formally asked to join the group along with countries like Argentina. In 2020, China and 14 other countries agreed to set up the world's largest trading bloc RCEP.

The hotly discussed China's Belt and Road Initiative (BRI) which was adopted in 2013, so far has 149 countries formally affiliated with it.

However, BRI is singled out as a debt trap by Western government and China has adjusted to increase scrutiny while funding the infrastructure projects so the viability is ensured. Brazil, which is the fifth largest country by population and a BRIC member, reached an agreement with China in March to trade in yuan for bilateral trade instead of US dollar.

As these newer trading blocs mature, we can expect partner countries using baskets of currencies to trade among themselves to circumvent the US dollar.

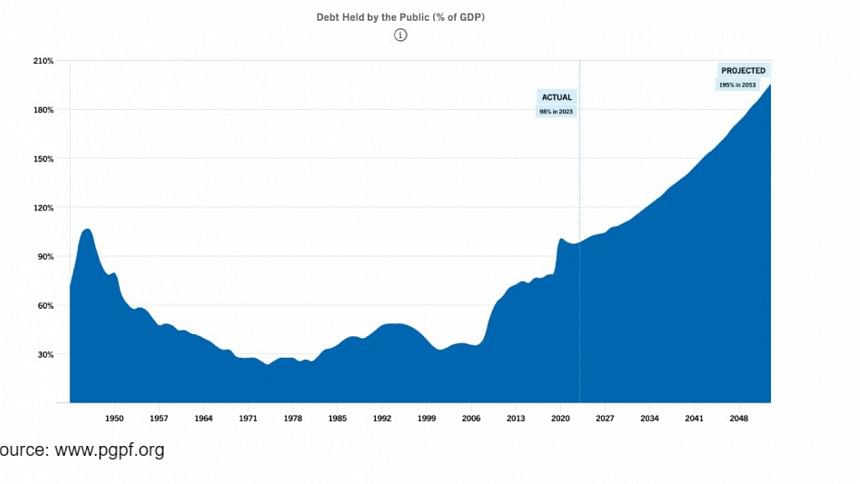

United States government debt: percentage of GDP

US debt is at an all-time high as its debt accounted for 123.4 per cent of the country's nominal GDP in Dec 2022.

Most countries trading with the United States, see that internal US debt is not sustainable in the long term.

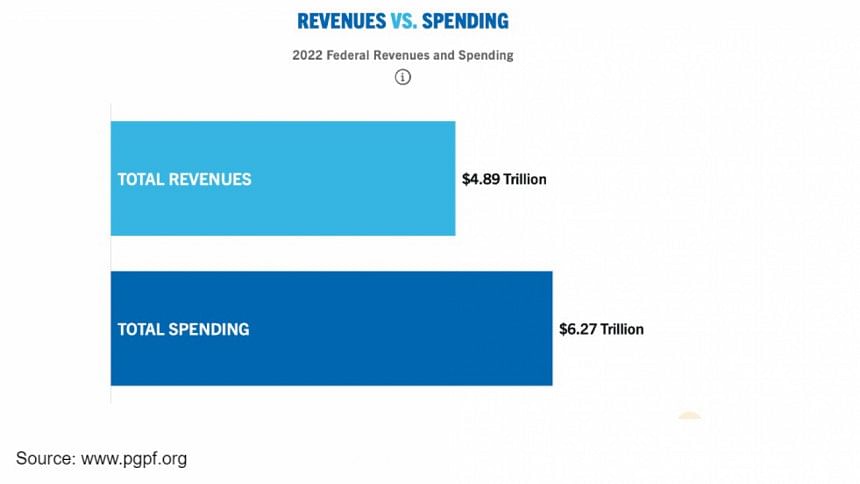

The US borrows $2-3 trillion to sustain its economy every year and everyday the US spends $1.3 billion dollars in interest. In this current borrowing trend, the dollar will surely be in crisis in the near future and the world anticipates it.

Global banking is in crisis

The US banking industry which serves as the backbone for global trade is showing increasing risk. The financial crisis in 2008 showed clear weakness which was caused by liberation of policy control.

The financial market still shows dire need for reforms but it is hard to put guard rails as the US lobbyists are against it. As the US can print money being the global currency reserve with impunity, it printed approximately $3.3 trillion in 2020 alone.

Moreover, in 2022, the US government is increasing the interest rates to tame inflation resulted in a massive asset-liability mismatch in the banking sector and caused several bank runs and bank failures in billions of dollars.

The biggest impact of the US interest rate hike was seen in emerging markets whose foreign debts are usually in dollars.

Earlier sanctions on Iran and Venezuela and subsequent sanctions on Russian oil resulted in higher energy prices that caused global inflation which then in turn devalued various currencies (Taka depreciated by 20 per cent in the last 1 year).

This was further aggravated with increase in commodity prices as the global food supply chain was restricted by sanctions. Extreme inflation wreaked havoc in those countries with weak macroeconomic conditions.

In addition, higher cost of capital increased their country's risk profile, for example, Sri Lanka and Pakistan. So now every country is wary about the failure of mega banks in their own country from the contagion effect of the Credit Suisse bank.

If countries do not have assets to backstop financial crises then they are clearly doomed, for example Lebanon, Argentina, Sri Lanka. This is a perfect example of how domestic monetary policy in the US is creating massive havoc around the world.

Though higher US interest rates played a role in causing stress in emerging economies, a greater role of unplanned expenditures within these countries is to be blamed for the current state of economic affairs.

All these shifts mentioned above indicate a world moving from a unipolar system to a multi-polar system. This will ultimately mean that the world is moving from the US dollar to most likely a basket of global currencies where I see Chinese RMB and Indian Rupee playing a significant role in our regional trade, at least in Asia.

What does it mean for Bangladesh ?

We have two major risks, internal ones which consist of fiscal policy and the governance in the financial sector. External shocks which stem from shifts in trading blocs and decoupling of economies to adjust to geopolitics. In order to mitigate these two risks, I recommend the followings:

Internal shocks are firmly rooted in the current governance of our financial sector which has shown delayed but much needed reforms. We should be joining the regional trade blocks like ASEAN and focus on bilateral currency swap for trading to reduce our dollar shocks. As we are a net importer of crude oil for our energy needs, we must diversify to other sources of energy like nuclear and green energy. We also have to shift investment from energy production to energy distribution as there is an imbalance. To supplement that, we must start investing in hydrocarbons both inland and in the deep sea. Our national debt is used to finance mega projects which should get increased scrutiny from the government.

However, Bangladesh with its population base needs to focus on domestic demand driven economy and double down on connectivity to move goods and people at a far faster velocity which means continuing to invest in infrastructure development. Our biggest risk is key export dependency on garments which urgently needs to be diversified to under developed and under funded sectors like talent export in the blue and white collar category. We also run the risk of food security so it has to focus on mechanized and smart agriculture supply chains with better access to finance. Bangladesh needs to invest in a blue economy which should be supported by a forward force like our navy as politics in the Malacca straits near the Indian Ocean may spill over in our maritime borders.

External shocks are the result of the decoupling of globalization. Bangladesh is being squeezed between regional big powers like China, India, Russia, Japan and to great extent the collective West. We really have to have a robust and engaging foreign policy as navigating between the powers will get increasingly difficult as we are forced to take a side. There is significant headwind in militarisation of Asian countries as the combined West starts to create alliances in the region to thwart China's economic and military rise.

So going forward, we will have to learn to punch above our weight like Singapore while engaging with regional and global players. Our statecraft needs a review, and we can take note from Dr Jaishankar, Foreign Minister of India who really overhauled India's engagement with the broader world. Lastly, we should delay our graduation to developing countries by a decade as we may end up in a middle income trap as the world is moving fast towards uncertainty. We need to keep our borrowing cost low and preserve the trade concessions as LDC as long as possible during this time. The last recommendation may sound controversial but we are passing through the most difficult time after the Second World War, so it calls for desperate measures.

The writer is a serial entrepreneur, TEDX speaker and a partner at a local VC firm, with over 23 years of experience in heading teams across diverse industries in Asia.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments