Agent banking: the largest alternate delivery channel for banking the unbanked

Bangladesh Bank introduced agent banking in 2013 to promote financial inclusion through alternate banking channels. Agent banking extends regular banking services to the last mile citizens across the country as a convenient and cost-effective delivery channel.

In 2017, the central bank published a comprehensive prudential guideline for agent banking operation covering the various components of agent selection and activation process, AML/CFT requirements along with customer protection and business continuity towards an impactful implementation of agent banking in Bangladesh.

Agent banking moved from strength to strength over the past five years in Bangladesh

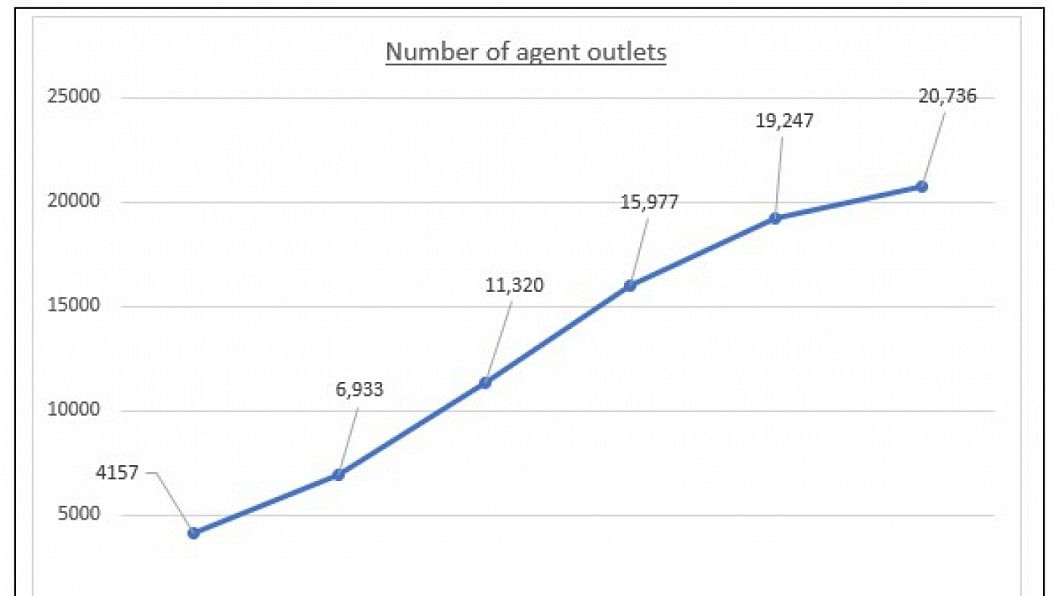

Agent banking grew to all extents over the past five years. As of December 2022, 31 banks out of 61 have been offering agent banking services through 20,736 agent outlets throughout the country. The number of agent outlets rose more than five-fold over the past five years.

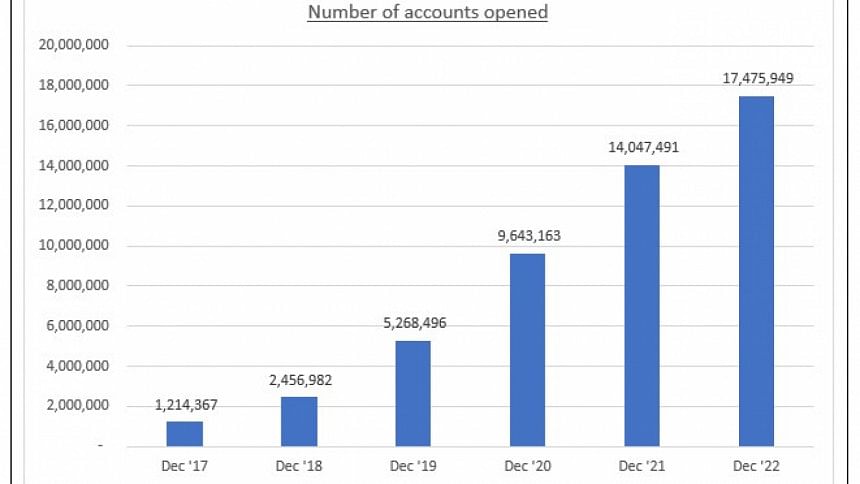

As of December 2022, the number of accounts registered in agent banking reached 17.47 million.

As per the agent banking report by Bangladesh Bank in December 2022, the amount of deposits collected through agent banking stood at Tk 30,157.9 crore, a lion's share (76.83%) of this deposit, has been collected in the rural geography.

The report also revealed that deposit in male customers' accounts is significantly higher than that of female customers.

Dutch-Bangla and Bank Asia topped the list in the acquisition of both agent outlets and customers.

Whereas in deposit collection Islami Bank was the leader with 36% of the total deposit and followed by Dutch-Bangla Bank with 16%.

Agent banking network grew faster than micro-finance institutes' (MFIs) branch network

Before the advent of agent banking, only microfinance institutions, and Grameen Bank were considered as the key actors and influencers for financial inclusion in rural Bangladesh.

Microfinance got traction in the late 70s and early 80s when some NGOs and Grameen Bank started their demand-driven operations along with social development activities.

As on June 2022, around 739 active MFIs have reached 38.26 million clients through 23,543 branches. Grameen Bank as a specialised financial institution is currently serving 9.93 million clients through its 2,568 branches across the country.

For MFIs, it took more than 40 years to build a branch network of 20,000 whereas banks build a similar size of agent banking outlet network in just 10 years.

MFI branches extend micro-credit and some compulsory savings as financial services.

However, banking agents provide savings, credit, payments, and transfers to rural customers.

Agent banking is a popular delivery channel for inward foreign remittance disbursement

Inward remittance disbursement as an ancillary service of agent banking, experienced phenomenal growth over the past few years. Agent banking report of December 2022 by the central bank revealed that the volume of inward remittances through agent banking rose to Tk 114,917.4 crore with an increase of 7.77% over Q3 2022.

More than 90% of this total remittance volume was disbursed to the rural vicinity.

Agents are bringing higher efficiency in remittance disbursement by reducing cost, time, and traveling distance for the inward remittance beneficiaries.

Agent banking outlets are gradually becoming centres of excellence for receiving inward foreign remittances.

Remittance beneficiaries are now likely to receive doorstep remittance services within the shortest possible time with zero cash-out fee.

Islami Bank, Dutch-Bangla, and Bank Asia are the top three banks that account for 85% of the total market share for inward remittance through agent banking channels with Islami Bank currently holding 52.09% of the total inward remittance.

Lending through agent banking is to be the lifeline of our rural micro-entrepreneurs

One of the key objectives of agent banking in Bangladesh is to provide credit to rural people.

In 2018, a country focus research on 'Addressing Market Demand through Agent Banking' by MSC (MicroSave Consulting) commissioned by BFP-B and Bangladesh Bank recommended bringing focus on lending through agent networks. The research revealed the advance-to-deposit ratio (ADR) was (10% in agent banking.

Against this backdrop, the central bank constantly advised the banks to increase their lending through the agent banking channel. As a result, a number of banks started lending through agent banking.

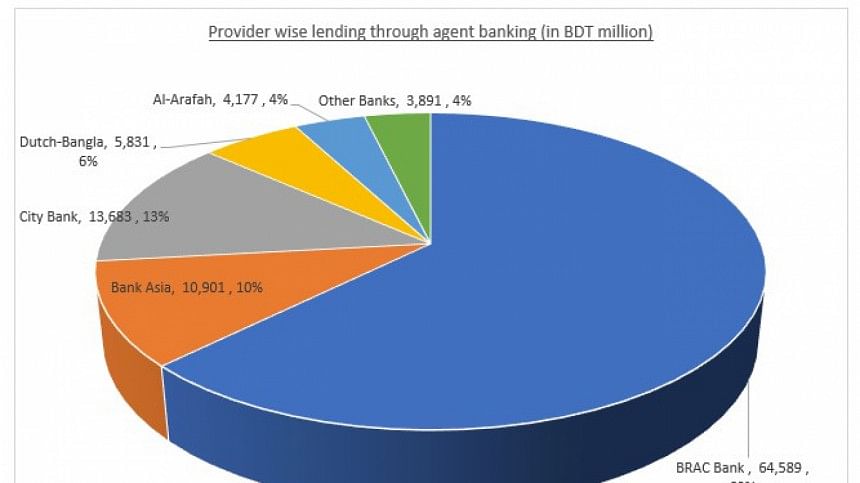

Currently 19 banks out of 31 are disbursing loans in agent banking. The volume of lending reached to Tk 10,307.2 crore in December 2022.

It witnessed an average yearly growth of 161% over the past five years.

Brac Bank Limited is at the peak of the industry for lending in agent banking. This late-entrant agent banking player alone holds 63% (Tk 6,458.95 crore) of the total loans disbursed through agent banking.

However, through the agent banking channel, only Tk 1,375.2 crore worth of credit has been disbursed to female customers.

This accounts for less than 15% of the total credit disbursed through agent banking across the country.

One reason to explain this could be the fewer number of women micro-entrepreneurs in the country. The 2018 UNCDF landscape assessment of retail micro-merchants in Bangladesh found that women-owned microenterprises comprise a meagre 5% of the total microenterprises.

Around 34.18% is the current Advance-to-deposit ratio (ADR) which indicates that agent banking players are still falling behind the expected outcome of ADR in comparison to the conventional banking ADR 78.92% in December 2022.

Agent banking is bridging the gender gap in financial inclusion

Financial inclusion of women has accelerated through the introduction of agent banking in Bangladesh.

The number of female agents in banking accounts stood at 3.7 million in December 2017. It reached 8.4 million in December 2022.

The quarterly report by the central bank shows that the number of female accounts represents 48.26% of the total accounts (17.47 million) in agent banking.

This steady encouraging growth of female accounts in agent banking indicates the well acceptance and popularity of agent banking services among women.

However, lack of financial awareness, low asset holding and income, low financial literacy, social and religious misconception are still the key barriers to financial inclusion for women.

Thanks to the Bangladesh Bank for its initiative to set up a dedicated women entrepreneur development unit (WEDU). WEDU is to deal with business-friendly services to women entrepreneurs, complaint management, promotional activities related to women's entrepreneurship development, and also monitoring and evaluation of the women-focused initiatives of banks and non-bank financial institutions.

Cost-effectiveness, higher transaction limit, biometric security, inward remittance and loan facility are the key catalysts for users' preference of agent banking over other digital financial services in Bangladesh.

Banks should keep all these aspects in mind while designing any new product and making any new offer in agent banking.

On a recent trip to my village home beside the river Padma, I had an opportunity to sit with a bunch of village people from different professions, ages, income levels, and gender.

More than 50% of them don't have a bank account. But when I asked them to name a bank in which they will open their accounts if it is possible. They mentioned 2-3 names who are prominent in agent banking.

They remember the name of those banks that are running agent outlets in the nearest marketplace.

It seems agent banking operation is creating a customer perception to become a future bank of choice.

Such evidence of agent banking acquaintance gives a message to reach the rural unbanked people by providing suitable financial services. Finally, agent banking has been making some meaningful impacts to better shape the national financial inclusion landscape since its inception. It has significant contribution to financing rural women, microentrepreneurs, and inward remittance beneficiaries towards an economic reinforcement in rural Bangladesh.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments