The budget does not inspire confidence

Recently, our prime minister stressed that our priorities were to curb inflation and maintain stability. Similarly, Planning Minister Mr Mannan noted that sustaining our progress was the key challenge. These are eminently sensible views given that Bangladesh's economy has been facing severe challenges for over a year, such as record-high external deficits, foreign exchange shortages, sharply declining reserves, a 25 percent currency depreciation, and an inflation rate approaching nine percent.

The key task now is to restore confidence. The recent downgrade by Moody's of the credit ratings of Bangladesh's economy and some private banks is not the only indicator that confidence is declining. In the first nine months of the outgoing fiscal year, the financial accounts in the balance of payments – short-term loans, trade credits, and banking operations – swung from a surplus of nearly $12 billion last year to a deficit of $2 billion; another deficit of more than $2.5 billion was still being accounted for. Thus, while exchange rate depreciation and tight control of LCs and forex helped decrease our current account deficit to less than $4 billion, Bangladesh Bank reserves still fell by $8 billion. In that process, imports fell by 13 percent in the first nine months, which makes our estimated 6.03 percent GDP growth this year incongruous. A third indicator of shaky confidence is the low growth of remittances, by less than five percent, in a year of a nearly record-breaking number of workers going abroad.

Unfortunately, the proposed FY 2023-24 budget seems to not heed the PM's words. It complacently suggests that macroeconomic challenges are behind us – which is inaccurate.

The global economy is slowing down; the latest forecasts are that US imports will decline in 2023 and 2024, while our other major markets, the EU and Japan, will also see slower growth. The IMF programme negotiated earlier this year helped shore up reserves and provide assurance, but its implementation is unclear. Key targets of net external reserves and primary fiscal balance may be met, perhaps with some creative accounting; or they may not be met, in which case our troubles will deepen.

In either event, and for several reasons, the proposed FY 2023-24 budget creates more uncertainty than confidence.

First, consider aggregate balances. The headline numbers are unrealistically ambitious and risky under current conditions: the budget of 15 percent of GDP is one-third deficit-financed. Further, the deficit is significantly higher than long-term trends. In the first 10 years of the Awami League's current rule, actual budget deficits averaged 3.5 percent of GDP. In the last five years, these deficits increased to about five percent. The resulting high level of government borrowing has caused liquidity shortages and crowded out private activity. The proposed FY 2023-24 budget continues the crowding out by envisaging a growth of 75 percent in domestic financing compared to two years ago.

This year, however, FY 2022-23's deficit financing has taken an alarming turn. End-April data suggest that more than 90 percent of the domestic bank borrowing has been from the central bank; that is, by printing money, increasing high-powered money, and creating significant inflationary pressures that will spill well into next year. It should be noted that, inflation, already running at 8.5 percent this year, increased to nine percent in April 2023 – much higher than the target.

The significant risk here is that inflationary pressures will lead to further depreciation pressures in an inflation-depreciation cycle: inflation causing depreciation causing inflation. Increasing interest rates is essential to breaking such a cycle, but interest rates are now in the nine percent to six percent policy straitjacket.

The second factor to note are our highly inadequate revenues that cripplingly constrain the economy. If we compare ourselves to countries whose per capita incomes were the same as ours, their revenue collection rate was double ours. Over the last 10 years, our revenue-to-GDP share has decreased from nearly 11 percent to an estimated eight percent only in FY 2022-23. However, the proposed FY 2023-24 budget sets highly unrealistic revenue targets of more than a 30 percent increase, unmatched by any policy measures to achieve them.

Many opinion pieces, including by yours truly, have extensively discussed tax policy and administration measures to raise revenues. The challenges are profound. For one, the complex multiple-rated VAT dysfunctionally resembles an excise tax. Revenue sources must be transferred from trade taxes to trade-neutral VAT and income taxes, as that is the only way to gain trade competitiveness and create good jobs. Introducing effective property taxes will be progressive and empower urban and local governments. And so will expanding the tax base to include more of the five million people with TINs, and eliminating tax expenditures or loopholes that aid the wealthy.

One budget proposal, the Tk 2000 per head minimum tax on those availing government services may, perhaps at a lower rate, have some merit, including promoting good governance. But politically, it is likely a non-starter in an election year and would be administratively demanding.

Administrative measures, such as separating policy from collection and the collector from the taxpayer, are urgently needed. Automation will be crucial, but not a silver bullet. We will need to introduce fundamental institutional reforms to make the revenue board more accountable and resourced enough to increase tax collection by several percentage points in a business-friendly way.

Unfortunately, the proposed FY 2023-24 budget seems to not heed the PM's words. It complacently suggests that macroeconomic challenges are behind us – which is inaccurate.

Concerning expenditure, Bangladesh had a good story to tell of prioritising expenditure allocations for human development and rural infrastructure that helped growth to be more inclusive. Over the past 10 years, ADP expenditures have quadrupled in real terms. However, in recent years, expenditure allocation and financial management have suffered in planning and practice as interest payments and subsidies have exploded to a quarter of all expenditures. The FY 2022-23 experience is particularly instructive. Because revenue collection was weak and subsidies had to increase due to below-cost pricing, critical spending in the social sectors, recurrent costs for capital budgets, and repairs and maintenance were all considerably lower than budgeted, with several being negative in real terms.

Two weaknesses stand out in the proposed FY 2024 budget. Repairs and maintenance have less than two percent of the budget. My estimates of the maintenance requirements of our capital stock suggest that the repair and maintenance budget needs to increase by three to five times, as neglecting repairs and maintenance will have deadly consequences. Leaks in old gas pipes have caused fatal explosions in many areas countrywide. A survey of 1,687 km of Dhaka's 7,000-km pipelines, conducted by Titas Gas last year, discovered 985 leaks that need sealing. Similarly, despite having 23 gigawatts of installed capacity, the power supply cannot cross 16 GW of demand because of inadequate budgets for fuel, grid lines, and maintenance of power stations.

Finally, we have shot ourselves in the foot by under-budgeting economic management. The internal revenue division's budget is about 0.5 percent of all expenditures, but provides two-thirds of the funding. On average, every taka spent there earns about Tk 150 or more in revenue. While the marginal impact would be less, greater allocation and organisational reforms of the NBR would have high returns in needed revenues.

Although the Annual Development Plan expenditure has quadrupled impressively in real terms over the past decade, we know little about the returns and quality we are getting. The budget for the IMED – our "independent" monitoring agency – is tiny at Tk 184 crores, or 0.07 percent of the size of the ADP. And, absurdly, the budget for the IMED has been falling in recent years, when it actually needs to increase by 10 times to approach good practice norms.

The budget must fund a thorough, transparent review of the ADP allocation and its implementation processes to ensure value for money. There is likely a good case for stalling or mothballing many projects. Similarly, there should be funding for reviewing and streamlining subsidies to eliminate regressive expenses that support the private consumption of the well-off. Another review should be of tax expenditures. All these measures will dig up much-needed resources.

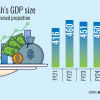

Managing Bangladesh's large economy, the 35th largest in the world as per IMF statistics, and achieving our growth aspirations urgently needs good quality and timely data. Unfortunately, this is another area in which we massively underinvest. We have spent less than 0.01 percent of our GDP on this, whereas the norm is spending five times or more of this proportion. That should be another burning budget priority.

Dr Ahmad Ahsan is director at the Policy Research Institute of Bangladesh, a former World Bank economist, and a Dhaka University faculty member. Views expressed here are his own.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments