Why the FY23-24 budget will not curb the rate of inflation

The finance minister announced the budget earlier this month and has been taking a lot of heat on a number of issues – the resource shortfall, the new tax proposals, and its impact on inflation, to name a few. The proposed budget for 2023-24 has a total outlay of Tk 7.62 trillion (a 15 percent jump) with development expenditures at Tk 2.59 trillion and non-development expenditures at Tk 4.11 trillion. The budget has been promoted as a "Smart Budget" with the upcoming elections in mind. A Ministry of Finance announcement proclaimed that the "Smart Bangladesh" concept is based on four main pillars which are smart citizens, smart government, smart society and smart economy. "The budget for the next fiscal year (FY24) will be the first budget towards building 'Smart Bangladesh'," added the release.

I do not envy the FM because his job is tough even under normal circumstances, and these times are anything but. There is heightened global uncertainty if we take a cursory look at the political environment, food and oil prices, and the total economic growth projections. One does not have to be Pollyanna to state that the budget estimates are but our best hope that things will turn out to be better than last year, and offer some respite for the hapless poor.

For my readers who are wondering who Pollyanna is, allow me a slight detour. "Pollyanna" is the name of the eleven-year-old orphan girl, the heroine in the novel by that name, and has become a byword for someone who, like the title character, has an unfailingly optimistic outlook. A nation, and I mean Bangladesh, facing gloomy days ahead can also collectively use the Pollyanna method to cope with the real difficulties and sorrows that, along with luck and joy, shape every life.

The FM is definitely a Pollyanna: he sounded like one when he declared, "The budget will be for the poor. There is no special pressure this time. The social safety net is increasing in a big way this time." But on close reading of the budget, we find that the budget is plagued by insufficient domestic resource mobilisation, an uphill battle to increase the tax/GDP ratio, an out-of-control inflation hammering the poor and the middle class, and the IMF breathing down the government's neck.

The government is fully aware of the headwinds it faces as it tries to push the GDP growth rate to 7.5 percent, as opposed to last year's actualised rate which was 5.3 percent according to an Asian Development Bank (ADB) report and 6.03 percent according to Bangladesh Bureau of Statistics (BBS).

Some sources apprehend that the proposed budget "continues the crowding out by envisaging a growth of 75 percent in domestic financing compared to two years ago." It is needless to mention, this might keep up the pressure on prices.

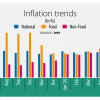

The finance ministry has provided some supporting documents to back up the FM's goals. We learned that the budgetary allocation aims to tame inflation alongside the higher GDP growth trajectory. While the inflation rate broadcast by BBS is currently in the neighbourhood of 10 percent, independent calculations by South Asian Network on Economic Modeling (SANEM) and Centre for Policy Dialogue (CPD) put the effective rate at 15 percent.

Of major concern is the cost of living, particularly for the common person. The budget aims to bring down the inflation rate to 6.5 percent. Unfortunately, the budget will do nothing to ease the hardship and the budgetary crunch felt by the common man. "If a product's price rises 10 percent in the international market, it increases 30 percent in the local market. We have shown it item by item in CPD's analysis," said the Executive Director of CPD at a post-budget review session.

The FM of Bangladesh is in a unique position among his fellow global finance ministers. The budget is presented to the parliament and gets automatic approval, because of the sheer size of the ruling party's majority. Debate on the budget or political wrangling among different political parties or different wings of Awami League do not present any headaches or cause for worries. While it might be a little frivolous, it would not be too much to characterise the process as a "show" or even say that the parliament is rubber stamping the budget. "The budget is expected to be passed in parliament on June 26, a bit earlier than the usual tradition because of the holidays of Eid Ul Azha," reassures the media!

Bangladesh's budget spending has tended to fall short of the target. According to Fitch Ratings, the gap between budgeted spending and actual spending has oscillated between 20 percent and 30 percent of the projected spending target if we consider the last five years' statistics. Obviously two of the major determinants of the expected shortfall is the GDP growth rate and the revenue projections. "The Bangladesh government's projection that the budget deficit will remain broadly stable in the year to June 2024 (FY24) could be vulnerable if growth undershoots the authorities' relatively optimistic target," says Fitch Ratings. The same could be said about spending. "Bangladesh's fiscal outcomes have often diverged significantly from budget forecasts, with persistent underspending against targets," it notes.

As I mentioned above, deficit financing has been a sore point in Bangladesh's negotiations with the IMF. However, there is nothing wrong with budget deficits, since all other countries including the USA always has a deficit and just overcame a gruelling duel over the control of budget deficits and debt servicing.

But one also notes that of late, our deficit is significantly higher than long-term trends. The resulting high level of government borrowing has caused liquidity shortages and crowded out private activity. Some sources apprehend that the proposed budget "continues the crowding out by envisaging a growth of 75 percent in domestic financing compared to two years ago." It is needless to mention, this might keep up the pressure on prices.

On a positive note, the budget document is presenting some initiatives to offer support for the vulnerable population, to renew the pledge to bring down inflation further, and to raise the tax to GDP ratio from 9 to 13 percent to reduce deficits. This ambition may present some problems. In the first 10 years of the Awami League's current rule, actual budget deficits averaged 3.5 percent of GDP, but in the last five years, it increased to about 5 percent. While deficit financing is expected to hold steady in the 5 percent of GDP rate range next year, the government has declared its intention to bring it down.

Dr Abdullah Shibli is an economist and works for Change Healthcare, Inc., an information technology company. He also serves as senior research fellow at the US-based International Sustainable Development Institute (ISDI).

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments