How foreign banks keep NPL in check while locals struggle

At a time when almost all of the local banks in Bangladesh are grappling with higher non-performing loans (NPLs), most foreign lenders have been able to keep the default rate in check.

Due diligence, independence of the credit department and corporate governance have been behind their stellar success for their lower bad loan ratio.

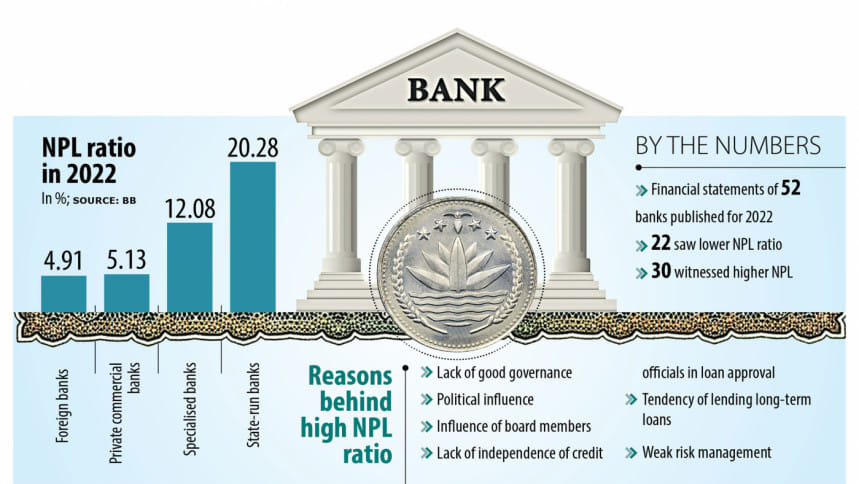

The average NPL ratio of nine foreign banks was 4.91 per cent in 2022, according to the Bangladesh Bank data.

For the state-run banks, the average NPL ratio was 20.28 per cent and for the specialised banks, it was 12.8 per cent. The NPL averaged 5.13 per cent for the private commercial banks.

"The foreign banks are good at managing risks for which they have an excellent policy framework, supported by robust processes managed by an effective organisation structure," said Muhammad A (Rumee) Ali, a former deputy governor of the central bank.

"In short, the answer lies in good governance," said the former chief executive officer of Standard Chartered Bangladesh and former chairman of Brac Bank.

Anis A Khan, a former chairman of the Association of Bankers, Bangladesh Limited, a platform for the CEOs of lenders, echoed Ali, saying corporate governance is the main differentiator.

Khan has experience working at Standard Chartered and Grindlays Bank for 21 years at home and abroad.

He said state-run banks are influenced politically while private banks are influenced by board members.

He said officials of foreign banks enjoy full independence when it comes to approving loans.

"At local banks, the board approves loans and this system is flawed. The board should not be involved in the process in any way."

The former managing director of IDLC Finance and Mutual Trust Bank said at multinational banks, credit officials always keep their eyes on borrowers' business and monitor them.

"Some local banks are following good corporate governance and their NPL ratio is much lower than others."

In 2022, nine banks had an NPL ratio that was lower than 3 per cent. They are Standard Chartered, HSBC, Citibank, Bank Al-Falah, Woori Bank, State Bank of India, Commercial Bank of Ceylon, Eastern Bank, and Pubali Bank.

New banks were not taken into account.

Shah Md Ahsan Habib, a professor at the Bangladesh Institute of Bank Management, says foreign banks' main focus is financing international trade, which involves mainly working capital where the chance of loans becoming classified is low.

Still, local banks see higher NPL in trade finance because of their risk management practices that deviate from standard norms, he said.

"Foreign banks strictly focus on risk management that ultimately pays them dividends by the way of a lower NPL ratio."

Multinational banks' NPL ratio ranges from 0.35 per cent to 2.63 per cent, except for two Pakistani banks: National Bank of Pakistan and Habib Bank.

Habib Bank's NPL ratio was 9.24 per cent.

National Bank of Pakistan struggled with an NPL ratio of 97 per cent.

State-run banks witnessed the highest NPL ratio in the banking sector in Bangladesh, ranging from 14 per cent to 36 per cent.

Prof Habib points out that sometimes, state-run banks carry out some non-profitable activities considering the national interest. For example, the banks provided loans to SMEs during the coronavirus pandemic.

Since the state-owned lenders work as both commercial and specialised banks, their NPL is often higher, he said.

ICB Islamic Bank had the second-highest NPL ratio of 84 per cent in 2022, followed by BASIC Bank's 57 per cent and Bangladesh Development Bank's 36.3 per cent.

Currently, Bangladesh's banking sector has the second-highest NPL ratio in South Asia, with Sri Lanka topping the list.

NPLs include substandard, doubtful and bad loans or default loans.

In 2022, defaulted loans in Bangladesh increased 16.8 per cent year-on-year to Tk 1,20,656 crore, according to central bank data. The ratio accounted for 8.16 per cent of the outstanding loans, up from 7.93 per cent a year ago.

Among the 52 banks whose financial reports for the year have been published, 22 saw a lower NPL ratio last year compared to 2021, while the rest witnessed a higher NPL ratio.

The NPL ratio is also higher among the new-generation banks. For instance, Meghna Bank's NPL ratio was 6.73 per cent while it was 5.18 per cent for South-Bangla Agricultural Bank, 4.48 per cent for Global Islami Bank and 3.53 per cent for Union Bank.

The NPL ratio was 2.78 per cent at Midland Bank and 1.7 per cent at Modhumoti Bank.

Among the first-generation banks, the ratio was 2.62 per cent for Pubali Bank and 3.9 per cent for City Bank.

Muhammad A (Rumee) Ali thinks NPLs will maintain their growth path simply because of the deeply flawed governance structure in the financial sector of Bangladesh.

Anis A Khan recommends raising the skills of local bankers so that they are well-equipped to deal with bad loans. Bankers at foreign lenders have to complete several courses to level up their skills.

Prof Habib said the government has brought about some changes to the Bank Company Act, giving the definition of willful defaulters for the first time.

"If the provisions of the law are implemented properly, the NPL in the banking sector may decline."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments