Slow export, fall in remittance to put pressure on economy

The slowing growth of exports and slump in remittances is not good news. It is rather concerning as the latest data of the two major indicators shows that the pressure on the economy is likely to increase unless there is any rebound in inflows in the coming months.

Economists said the export growth, which stood at 3.8 percent in August, is positive given the current global economic turmoil.

However, the volume of export proceeds is not as much as needed to arrest the fall in the country's foreign exchange reserve and thereby reduce pressure on the external account.

Migrant workers and Bangladeshis abroad sent $1.59 billion remittance in August, which was the lowest in six months. Besides, overall remittance inflow in August was 21 percent lower compared to the same month a year earlier.

"This modest growth is not bad given the current global economic turmoil. Yet, it will not help us manage the pressure on the balance of payment as remittance has plummeted," said Mohammad Abdur Razzaque, chairman of Research and Policy Integration for Development, a private research organisation.

Economists think the export growth, which stood at 3.8 percent in August, is positive given the current global economic turmoil.

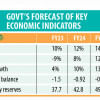

The fiscal year 2022-23 data showed that the pressure of external payment increased though Bangladesh narrowed the trade gap and current account deficit thanks to measures that cut overall imports by 16 percent.

The overall external deficit grew to $8.2 billion in fiscal 2022-23, up from $6.7 billion the previous year, according to data of Bangladesh Bank.

And amid pressure, the overall forex reserve is gradually falling. For example, the foreign exchange reserve, which was $23.34 billion on July 31 as per the International Monetary Fund standard, declined to $23.06 billion on August 30, showed central bank data.

To tackle the situation, economists have been suggesting a market-based exchange rate calculation system instead of multiple rates.

Last week, bankers decided to buy and sell the US dollar at a single rate even though some are doubtful whether it would really be a floating exchange rate.

Razzaque said there is a gap in the exchange rate between the formal and informal markets.

"And remittance flow will not increase if the exchange rate in the informal market is high," he said.

"It is not wise to control the exchange rate artificially. Rather, allowing the market to determine the exchange rate will be instrumental in attracting increased flow of remittance through formal channels and export," Razzaque added.

Replying to a question about how import induced inflation may rise because of further depreciation of taka, he said inflation cannot be controlled by restricting imports.

"It may rather fuel inflation owing to a shortage of goods in the market," Razzaque added.

Muhammad Shahadat Hossain Siddiquee, a professor of economics at Dhaka University, said remittance and export earnings are two major sources of foreign currency for Bangladesh.

But if imports continue at the current pace and export, remittance and foreign investment do not increase, the vulnerability in foreign exchange reserve may rise, he added.

Selim Raihan, executive director of the South Asian Network on Economic Modeling (Sanem), said the latest export and remittance data is concerning.

The foreign exchange reserve is falling every month, although the rate of decline has reduced. If this continues, overall reserves may drop to less than $18 billion.

"This is quite concerning. Export and remittance are two major pillars of the economy, but such a low growth of export will not be enough to reduce pressure on the reserves," he added.

Raihan, also a professor of economics at Dhaka University, said there is still a large gap in exchange rates between the official and kerb markets.

The chance of recovery in remittance flow through formal channels is low as the tendency to siphon money out of the country rises ahead of any general election, he added.

Raihan also said policy makers should have taken measures long ago to tackle the challenges the economy has been facing over the last one-and-a-half years.

"Today's challenge is the result of faulty policies and poor economic management. The situation has come to a point where a handful of measures will not be enough. So, it appears the pressure on the economy is likely to increase," he added.

Raihan recommended the government form a high-powered panel including economists and experts to address the challenges.

Estiaque Bari, senior lecturer of economics at East West University, said one of the reasons for the decline in remittances is the gap in exchange rates between the formal and informal markets.

Even after adding 2.5 percent incentive given by the government, the official rate stands below the rate offered at the kerb market, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments