Private sector credit growth drops to single digit

The private sector credit growth in Bangladesh nosedived to single digit in July as both banks and borrowers face multiple challenges amid lingering economic uncertainty at home and abroad and the growing political crisis centring next year's national elections.

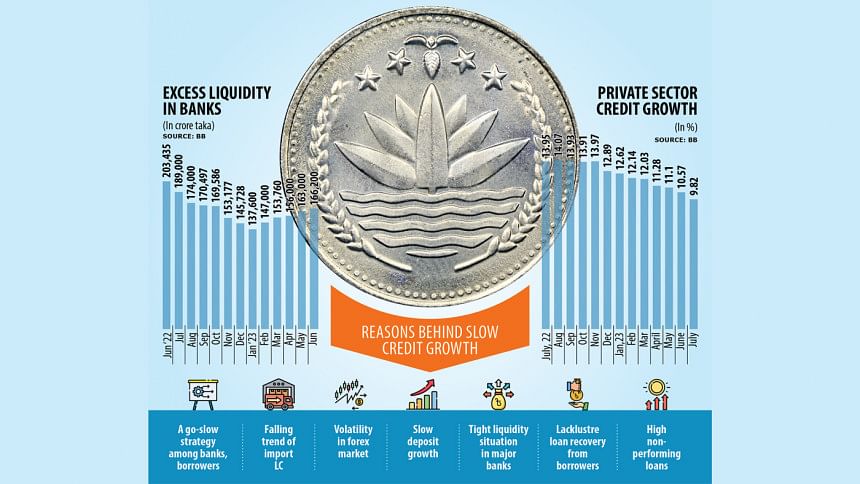

In the first month of the current financial year of 2023-24, the credit growth fell to 9.82 percent from 10.57 percent a month ago, Bangladesh Bank data showed.

July's credit expansion was the lowest since October 2021 when it stood at 9.44 percent.

A tight liquidity situation in the banking sector, falling trend of the opening of letters of credit (LCs), volatility in the foreign exchange market, slow deposit growth, and lacklustre loan recovery pushed down the credit growth, said bankers.

July's growth was 1.08 percentage points lower than the BB target of 10.90 percent set for the first half of the fiscal year.

The lower credit growth might be interpreted as a blessing in disguise since it may contribute to reining in runaway inflation and the lowering of demand for the US dollar, which has strengthened by as high as 30 percent against the taka in the past one year, making imports costlier.

But a lower loan growth might not be good for the economy at the end of the day.

"We are passing through a difficult time and this is very concerning that the private sector credit growth continues to dip in a growing economy," said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

A major portion of credit growth comes from the LC opening for imports, but it has fallen sharply as uncertainty lingers.

In July, LC opening stood at $4.37 billion, down 31.19 percent from $6.35 billion registered in the same month in the previous fiscal year, according to BB data.

LC opening for capital machinery import fell 22.17 percent to $179 million while that for industrial raw materials plummeted 36.12 percent to $1.35 billion.

The downward trend of capital machinery and industrial raw material imports indicated a near stagnation in the industrial sector.

"If it continues in the upcoming days, industrial production will come down and this will lead to a rise in overdue loans and forced loans," said Rahman, also a former chairman of the Association of Bankers, Bangladesh, a platform for chief executives of lenders.

Forced loans are created when clients fail to make their LC payments on maturity.

Banks' capacity to lend has also come under strain as the sector is facing tight liquidity, driven largely by slower deposit growth and a persistently higher exchange rate of the taka against the US dollar.

In June, the surplus liquidity in the banking sector slipped to Tk 1,66,200 crore from Tk 2,03,435 crore a year ago, BB data showed.

The private sector credit growth is projected at 11 percent at the end of FY24.

"Consumer demand has been adversely impacted by the skyrocketing inflation, which has led to a slower credit demand," said Sohail RK Hussain, managing director of Meghna Bank.

Inflation stood at 9.69 percent in July but it was at 9.94 percent in May, an 11-year high, as per the Bangladesh Bureau of Statistics.

Hussain said imports of luxury products, including automobiles, have sharply dipped due to the austerity measures taken by the government and the central bank to save foreign currencies, whose reserves have declined by about 25 percent.

The senior banker also blamed the slower credit recovery for the decline in the availability of loanable funds.

Customers have adopted a wait-and-see approach centring the national election, he said.

"Businesses are also facing difficulties in importing raw materials and capital machinery due to the ongoing US dollar crisis. A number of expansion projects have been deferred."

Md Shahidullah Azim, vice-president of the Bangladesh Garment Manufacturers and Exporters Association, said business activities are squeezing so businesspeople are not interested in securing fresh bank loans.

"Export orders have fallen due to the volatility in the global economy."

Azim, also the managing director of Classic Fashion Concept Ltd, said the inflow of US dollars has reduced significantly in recent times.

"This has negatively affected imports and thus production. After all, banks are very conservative in disbursing loans."

Salehuddin Ahmed, a former governor of the central bank, said the private sector credit growth falling to single digit is not a good indicator.

He warned that employment generation would not pick up if the economy and the business sector stagnate.

According to the economist, banks are witnessing a fund crisis as people are holding more cash owing to a number of recent loan scams and a weighted average deposit rate that continues to be way lower than the inflation rate.

Cash outside the banking system soared to Tk 2,91,913 crore in June from Tk 2,55,829 crore in May, according to central bank data.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments