Janata’s great leniency to an errant client

Troubled state-run lender Janata Bank continues to be overly lenient towards AnonTex Group, one of its five large borrowers, despite negligible loan recovery in 13 years from the garment manufacturer.

At the 746th meeting of the board of directors of Janata Bank that was held on November 28 last year, a Tk 3,359.19 crore interest waiver was extended to AnonTex on the condition that it pay back the principal amount within June 15 this year.

Otherwise, the loans will be shown classified, according to the meeting minutes.

At the end of 2022, AnonTex's liabilities to Janata stood at Tk 7,726 crore, which is 334 percent of the bank's paid-up capital. As per rules, the four state-run banks are not allowed to lend more than 25 percent of their paid-up capital to a single party. At the end of June, Janata's paid-up capital stood at Tk 2,314 crore.

AnonTex, whose website beams British brands Tesco and New Look and Spain's Zara as clients and $150 million as annual turnover, failed to repay the sum.

Keep reading -

- Ghosts within Janata Bank

- AnonTex riding on BB favours

- AnonTex seeks favour to reschedule loans

- Janata Bank gets go-ahead to regularise AnonTex's default loans

- ANONTEX LOAN SCANDAL: BB seeks explanation from Janata MD

And yet, at the 778th meeting of the Janata board held on July 25, the garment manufacturer was given until the end of the year to pay back the sum. In other words, AnonTex's defaulted loans will remain unclassified until December 31, according to the meeting minutes.

However, the bank imposed a new condition this time: sell two of its two companies and repay a portion of the total liabilities by September 30.

This was not the only count of leniency extended to AnonTex by Janata, which has the highest amount of defaulted loans in the banking sector as of March.

Between 2010 and 2015, the bank disbursed about Tk 3,527.9 crore to 22 companies of AnonTex Group.

A 2018 central bank investigation found that a lion's share of the loans was obtained through forgery and irregularities and -- such loans are not eligible for any additional facility like interest waiver.

The Bangladesh Bank ordered Janata to conduct a functional audit and take legal action against those involved in the scam.

Janata got around to appointing the audit firm only in July -- five years after the BB directive.

Md Abdul Jabber, Janata's managing director and chief executive officer from April, declined The Daily Star's request for comment.

"If we suspend the facility, then it would not bring any positive things for both the client and the bank because we need to recover the loans," SM Mahfuzur Rahman, chairman of the Janata Bank board, told The Daily Star.

Rahman joined the bank as its chairman in July 2020.

The bank has already recovered a small amount of the group's loans as a down payment when extending the interest waiver, he said.

"There is a provision to waive interest subject to the recovery of cost of funds. This is a standard practice used for recovering bad loans," he added.

When the interest waiver facility is extended, clients are given a year to clear the liabilities, according to Md Younus (Badal), managing director and chairman of AnonTex Group.

"But we were given six months. By that reasoning, the time extension by the Janata board is fair. We contacted some other banks and they are willing to take over the loans from Janata," he told The Daily Star.

Younus said his factories are running in full swing.

"In the last 10 years, we received working capital loans for only four companies and the remaining 18 companies did not get any working capital loan facility. That is why we faced trouble repaying the bank loans."

AnonTex has mortgaged adequate land against the loans, he said.

Asked about the allegations of forgery and irregularities found by the 2018 central bank investigation, Younus said: "Forgery has not been proven yet."

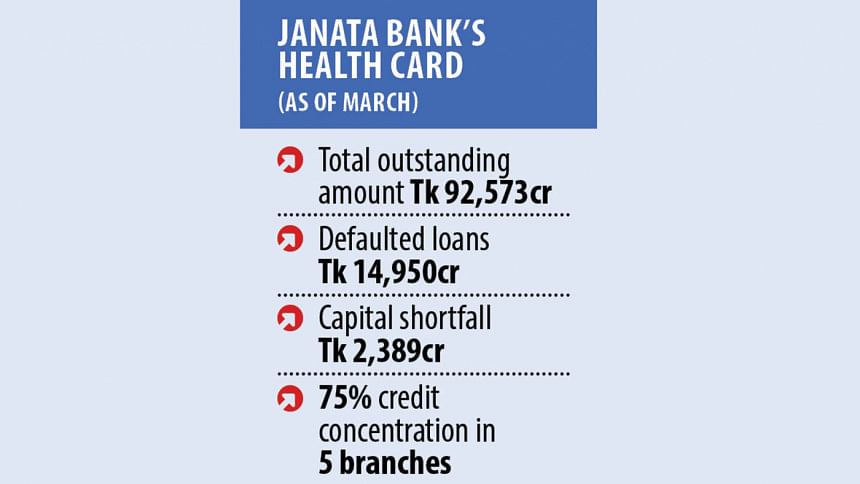

Industry insiders, however, said such loan irregularities are one of the key factors behind the ailing financial health of Janata, which has a capital shortfall of Tk 2,389 crore at the end of March.

Once a reputed state-run commercial bank, Janata's financial health took a turn for the worse centring on loan scams of AnonTex and Crescent Group.

At the end of 2017, the bank's bad loans stood at Tk 5,818 crore. At the end of March, it was Tk 14,950 crore, which is about 11.4 percent of the banking sector's total defaulted loans at the end of March.

The lender is now facing a liquidity shortage due to lacklustre loan recovery, said its top officials, who spoke on the condition of anonymity for fear of reprisal.

"Janata Bank has become an ailing financial institution due to lack of accountability and impunity," said Salehuddin Ahmed, a former BB governor.

The bank's board of directors and management committee are largely liable for the present situation of the bank, he said.

"It is very sad news that the bank's authority did not punish those who were involved in the AnonTex loan irregularities," he said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments