Liquidity stress at Islamic banks shows no sign of abating

Liquidity in Shariah-based banks in Bangladesh remains tight due to a dip in deposit collection and the banks' inability to make the most of the central bank support to overcome the situation, Moody's Investors Service said in a report.

The report, published by the US-based global ratings agency on Thursday, said the latest data from Bangladesh Bank shows that liquidity stress for the sector is persisting.

"The liquidity shortfalls are credit negative as many Islamic banks could face difficulty meeting short-term obligations."

On Tuesday, Fitch Ratings also highlighted the liquidity challenges facing the Islamic banking segment.

The system-wide investment (loan)-to-deposit ratio of Islamic banks stood at 101 percent in June this year, up from 94 percent a year earlier, according to the central bank data.

"Such a high ratio means that liquidity continues to be tight after shrinking substantially," reads the Moody's report.

The liquidity situation at the Shariah-compliant banks worsened in recent times after enjoying a sound liquidity base year after year.

At the end of 2022, all 10 full-fledged Islamic banks met regulatory liquidity requirements, but six months later four of them did not have sufficient liquidity to meet the minimum cash reserve and statutory liquidity ratios.

While the other six remained in compliance as of the end of June 2023, their excess liquidity levels were modest, said the Moody's report.

The excess liquidity in the sector was down 66.59 percent year-on-year in June, according to BB data.

Settlements of letters of credit (LCs) for importers and strong demand for credit amid slow deposit growth have strained liquidity at Islamic banks, the report said.

Besides, jumps in expenses due to high inflation have reduced households' capacity to save, leading to a slowdown in inflows of deposits, the main source of funding for banks.

Bangladesh's inflation rate rose to 9.7 percent in June 2023 from 7.6 percent a year earlier.

Inflation also shows no sign of cooling as it surged 23 basis points to a 12-year high of 9.92 percent in August, according to the Bangladesh Bureau of Statistics.

This means the banks' efforts aimed at recovering from the liquidity crisis by reversing the trend of deposits may not yield the expected outcome in the coming days since savers' capacity to park funds has continued to be under strain.

Besides, a near double-digit inflation rate has kept the weighted average deposit rate, which stands at less than 5 percent, in the negative territory, making parking funds in the entire banking sector unattractive for many savers.

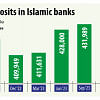

The deposit growth in the Islamic banking segment plummeted to nearly 2 percent in June this year from 11 percent in the same month last year, BB data shows.

A number of loan scams at some Islamic banks recently also resulted in a sizeable outflow of customer deposits from the sector.

The investment (loan) growth for the Shariah-compliant lenders stood at about 15 percent in June last year but it fell to less than 10 percent in June this year.

In order to help Shariah-based banks overcome the fund crisis, the BB introduced two liquidity facilities for them in December 2022 and February 2023.

The programmes -- the Islamic Banks Liquidity Facility (IBLF) and the Mudarabah Liquidity Support (MLS) -- are meant to provide Islamic banks with alternative sources of funding and help them plug their short-term liquidity shortfalls.

"However, the central bank measures will not significantly alleviate liquidity stress for Islamic banks because they have small amounts of assets they can collaterise to use the facilities," said the Moody's report.

Bangladesh had the eighth-largest Islamic banking market globally in 2022, with a total asset of Tk 497,000 crore, ahead of Indonesia, Bahrain, Pakistan, Egypt, Jordan and Oman, according to Fitch Ratings.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments