Forex holdings in banks fall in August

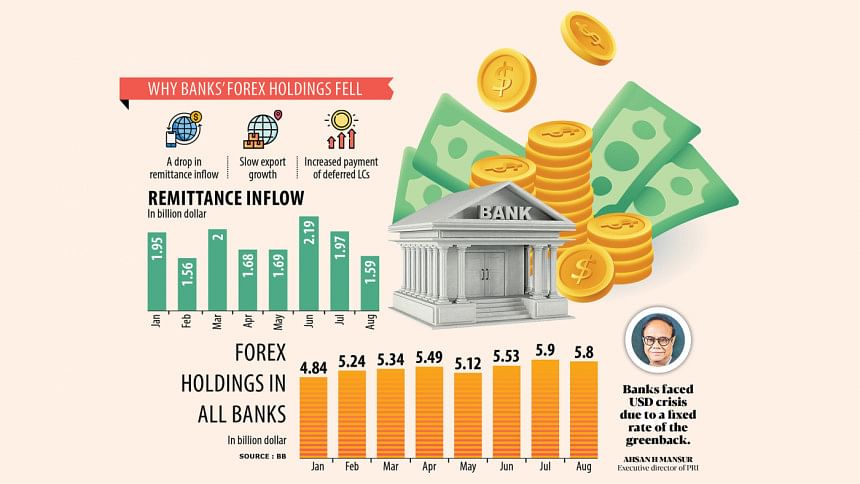

Commercial banks witnessed a drop in foreign currencies last month from that in the preceding month mainly due to a sharp fall year-on-year in the inflow of remittance and a relatively small growth in export earnings.

The gross foreign currency balance with the banks stood at $5.80 billion in August, down from $5.90 billion in July, as per the latest data of Bangladesh Bank.

However, the amount recorded in August was up 16 percent year-on-year.

The lowest figure recorded since fiscal year 2021-22 was in October last year, when the balance stood at $4.50 billion.

Last month, migrant workers sent home $1.59 billion, down 21.5 percent year-on-year, in what has been the sharpest drop since April 2020, showed the BB data.

Meanwhile, exporters earned $4.7 billion, registering a 3.8 percent year-on-year growth.

Industry insiders said the foreign currency balance of banks generally falls when remittance earnings fall and import payments increase.

The foreign currency balance of commercial banks is not a part of the country's foreign exchange reserve, they pointed out.

The country's forex reserves stood at $21.45 billion on September 21, owing to the demand for the US dollar being higher compared to the inflow.

The reserves stood at a historical high of $48 billion in August 2021. However, due to escalating import payments resulting from high commodity prices amid the Russia-Ukraine war, the reserves have been declining since May 2022.

The sharp fall of remittance earnings was the major reason behind the decline in foreign currency with commercial banks, said Syed Mahbubur Rahman, managing director of Mutual Trust Bank.

Another reason is that deferred payments of letters of credit are growing, he said.

A chief executive of a private commercial bank seeking anonymity told The Daily Star that the drop in foreign currencies was nothing new as most of the banks were facing a crisis of the US dollar for the exchange rate being fixed.

Bangladesh Foreign Exchange Dealers Association (Bafeda) and the Association of Bankers, Bangladesh (ABB) have been fixing the US dollar rate since last year as per unofficial directives of the central bank.

On August 31, they decided to buy the US dollar at Tk 109.50 and sell them at Tk 110 from the first working day of this month.

The chief executive of the private bank said they are not getting the US dollar at the Bafeda-ABB fixed rate because the kerb market was offering a higher rate.

The country's banks are facing a crisis of the US dollar as the exchange rate has been fixed, said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

Remittance and export earnings are the two main sources of the US dollar but both are not doing well now, said the economist.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments