BB asks Islami Bank to explain why it buys dollars at higher rate

The Bangladesh Bank has asked Islami Bank Bangladesh to explain why it is buying US dollars from foreign exchange houses at a rate that is higher than the fixed price.

On December 14, the central bank sent a letter to the managing director of the Shariah-based bank to this effect, seeking an explanation.

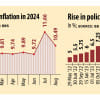

As per the rates announced in November and December this year by the Bangladesh Foreign Exchange Dealers Association (BAFEDA) and the Association of Bankers, Bangladesh (ABB), banks can buy each dollar from remitters and exporters at Tk 109.75 and sell them to importers at Tk 110.25.

Banks are allowed to give a maximum of 2.5 percent in incentives to foreign exchange houses. They, however, are not eligible for the 2.5 percent incentives provided by the government to remitters.

"Your bank is buying foreign currencies from foreign exchange houses at a higher rate than the rate declared by the BAFEDA," the central bank said in the letter.

According to the letter, when contacted over the phone, the head of treasury of Islami Bank said some foreign currencies had been purchased at a higher rate as per the advice of the high-ups.

The treasury head was advised to refrain from such anti-market activities, but he did not contact the central bank informing it about its steps. The bank is still buying foreign currencies at a higher rate, the letter said.

BB Spokesperson Md Mezbaul Haque and Islami Bank Managing Director Mohammed Monirul Moula could not be reached for comments.

Between December 1 and December 22, Islami Bank received $582 million in remittances, the highest in the banking sector.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments