Sikder Insurance: Rules broken, yet IPO goes ahead

Sikder Insurance Company Limited has invested most of its assets in the capital market, parking funds in a single stock of scandal-ridden National Bank Ltd (NBL), in a corporate wrongdoing influenced by family ties.

And the insurer's investment in treasury bonds has not met the minimum threshold either.

Still, the company has secured approval from the Bangladesh Securities and Exchange Commission (BSEC) to raise funds from the public.

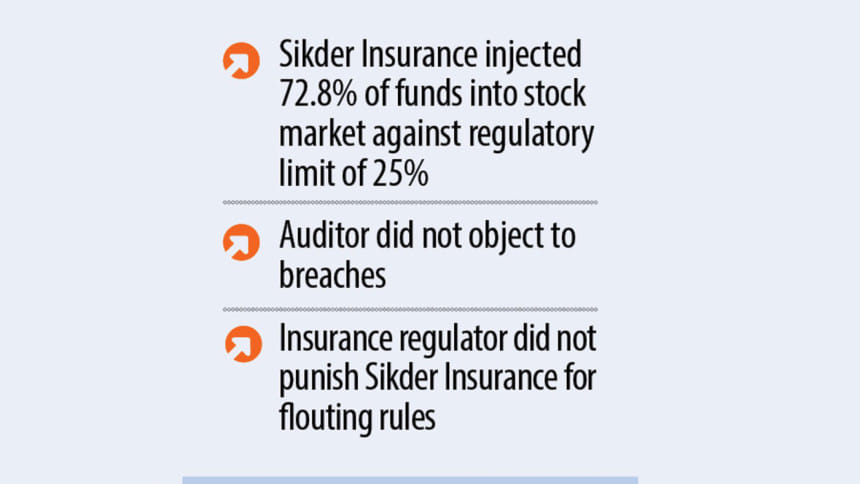

To pave the way for the initial public offering (IPO), a rating agency attached a higher credit rating to the insurance company and the auditor did not object to the breaches, while the Insurance Development and Regulatory Authority (IDRA) looked away.

Two senior officials of Sikder Insurance declined to comment over the phone, while the company did not respond to queries emailed twice by The Daily Star.

The BSEC approved the IPO in September, and Sikder Insurance, whose two owners are members of the family that controls NBL, is now raising funds of Tk 16 crore by issuing 1.6 crore ordinary shares at a face value of Tk 10 each.

Rick Haque Sikder and Ron Haque Sikder, sons of the late Sikder Group founder Zainul Haque Sikder, hold an 8 percent stake in the insurance company and 2 percent in the bank each.

The subscription of the IPO started on December 21 and ends today. The company plans to use the IPO proceeds to purchase floor space and invest in fixed deposits. It says it will invest Tk 4.8 crore in the stock market within three months of receiving the proceeds although it has already breached the limit.

The insurer has invested Tk 131.98 crore in the stock market out of its total assets of Tk 181.29 crore, according to its financial report for 2022.

That means the company has injected 72.8 percent of its funds into the stock market. Insurance rules allow an insurer to invest a maximum of 25 percent of its funds in stocks.

Surprisingly, out of the Tk 131.98 crore, some Tk 131.29 crore, or 99.9 percent of the total, were invested in NBL.

But more rules were violated.

IDRA rules stipulate that a non-life insurance company cannot invest more than 5 percent of its assets in a single stock. Sikder Insurance's investment in NBL stands at more than 72 percent.

On the other hand, it invested only Tk 2.5 crore in government treasury bonds, which is 1.37 percent of the assets. It should be at least 7.5 percent as per the rules.

In its observation sent to the BSEC about the listing proposal, the Dhaka Stock Exchange also pointed out the insurance company's failure to meet the criteria for treasury bond investments.

The company's financial statement shows that it put Tk 56 lakh as of December 31, 2021, in the worker's profit participation fund as per the Bangladesh Labour Act 2006. However, it did not distribute the money among the employees, according to the DSE.

A representative from Sikder Insurance is a nominated director at NBL, according to the NBL's financial report.

When an insurance company invests majority of its assets in the stock market, it ultimately raises concerns about its viability, a professor at the Department of Banking and Insurance at Dhaka University said, asking not to be named.

"It has kept people's funds in a risky investment tool for their own interest and to ensure a higher stake in National Bank," the teacher said.

"If the stock price falls or if it fails to provide dividends, the company's liquidity stream will be squeezed. Then, the company will be in trouble."

NEGLIGIBLE INCOME FROM STOCK INVESTMENTS

Sikder Insurance's realised gains on share investment were zero in 2021 and 2022. The dividend income was nil also in 2021, while it saw a dividend income of Tk 10,833 in 2022.

However, this dividend income did not come from NBL. Rather, it was from less than Tk 1 lakh investments in Silco Pharmaceuticals Ltd and Sea Pearl Cox's Bazar Beach Resort & Spa, according to financial reports.

NBL could not provide any dividends in 2021 and 2022 as it was struggling under huge losses -- Tk 1,123 crore in the first nine months of 2023 and Tk 3,260 crore in 2022.

Sikder Insurance also kept most of its fixed deposits in the ailing bank. Of Tk 18.9 crore in total fixed deposits, the insurance company deposited Tk 10.95 crore in the bank.

WHY WAS NBL PREFERRED?

Four members from the Sikder family held seats on the board of the bank before the central bank reconstituted it on December 21 this year to ensure corporate governance following a recommendation from the BSEC.

The new Bank Company Act allows three members from a single family to be on the board simultaneously. So, the bank was asked to bring it down to three during the annual general meeting scheduled this month.

Preferring anonymity, a top official of a non-life insurance company said Sikder Insurance's assets were used to retain the family's control in the bank.

"No company will put funds in such a weak bank without being compelled by the board."

A financial analyst described the investments as a related-party transaction.

"When an insurer invests its major assets in a company that is struggling with huge losses, it can't happen without the influence of directors."

Although Argus Credit Rating Services Ltd said in its detailed report that the insurer has huge investments in the equity market, it upgraded its long-term rating to "A+" from the previous year's "A" based on the audited financial statements up to December 2021.

When contacted over the phone, an official of the credit rating agency asked this reporter to email queries. Accordingly, the email was sent on December 20, but no reply came.

In a questionable action, the auditor, G Kibria & Co, did not object to the areas where the insurer broke the IDRA rules.

Mohammad Showket Akber, partner of G Kibria & Co, did not respond to The Daily Star's emailed request for comment.

Contacted, BSEC spokesperson Mohammad Rezaul Karim said the regulator analyses whether a company complies with the securities rules before approving the IPO.

"Since Sikder Insurance complied with all the securities rules and secured a no-objection certificate from its primary regulator IDRA, we issued the approval," he said. "It was the primary regulator's responsibility to spot any breach of rules before giving the NoC."

Investing most of the funds in a weak bank is not a breach of the securities rules. Rather, it is the violation of IDRA rules, Karim pointed out.

Mohammad Jainul Bari, chairman of the IDRA, said the regulator had sought investment-related documents from all the insurance companies and many of them have already submitted the papers.

"We are analysing whether anyone has broken rules and we have already ordered some of them to follow the rules."

Bari said some companies did not submit their investment-related data yet. "Therefore, without looking into the documents, I can't say what Sikder Insurance has done."

"As far as I know, it did not take any NoC from me. I don't know whether it received the NoC before I joined," he added. Bari joined the IDRA in the middle of 2022.

M Mosharraf Hossain, who was at the helm of the IDRA from 2020 to 2022, did not receive a phone call.

Abdur Razzak, company secretary of Sikder Insurance, asked the reporter to email the queries, but he did not respond to the email. Md Mayen Uddin, chief financial officer of Sikder Insurance, requested the reporter not to write a report about the subject.

The issue manager, Sonar Bangla Capital Management, did not reply to the email seeking comments.

GENERAL INVESTORS AT RISK

"Since Sikder Insurance's financial reports show that it violated rules, the breach should have been identified by the auditor," said Al-Amin, an associate professor of the Department of Accounting and Information Systems at Dhaka University.

"At least, the stock market regulator should have been asked because the insurer has invested in a bank whose financial health is not good. This is because such investments will create risk for general investors."

Sultan-ul-Abedin Mollah, a former member of the IDRA, said the IDRA should monitor whether companies are following rules to ensure that they don't assume higher risk by investing in the speculative market.

AB Mirza Azizul Islam, a former chairman of the BSEC, said the stock market regulator should postpone the IPO process first to protect the interest of stock investors, and then consult with the IDRA.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments