Export, remittance earnings limp along

The export and remittance sectors of Bangladesh ended 2023 on a disappointing note, compounding pressure on the economy as it desperately tries to find solutions to the lingering crisis.

The less than 3 percent year-on-year growth in earnings from the two biggest sources of foreign currencies for the country means its woes originating from the international currency crunch continue into the new year.

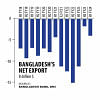

Earnings from merchandise shipments rose 1.99 percent to $55.78 billion in the just-concluded calendar year because of the slowdown in apparel sales in the international markets, data from the Export Promotion Bureau (EPB) showed yesterday.

Migrant workers sent home $21.91 billion in 2023, a year-on-year increase of only 2.96 percent, according to the central bank.

The lower-than-expected export and remittance earnings have a direct impact on the foreign exchange reserves, which have fallen to a level enough to bring about an unprecedented cost of living crisis and a drastic fall in the value of the local currency.

The sharp decline in the forex stock has created headaches for policymakers after the country failed to meet the International Monetary Fund (IMF) threshold on minimum international reserves as part of the conditions of the $4.7 billion loan programme.

The lower receipts from exports and remittances are set to persist in the coming months.

Bangladesh is expected to receive $23 billion in remittances in 2024 while the export sector is projected to post a growth of 12.4 percent in the financial year that ends in June.

Exports display slower growth

The earnings from the merchandise shipments rose marginally in 2023 owing to the persistently lower demand among western consumers amid high inflationary pressure, the dragging Russia-Ukraine war and the outbreak of the Middle East crisis.

Garments, which contribute nearly 85 percent to the national income, did not fare well, largely owing to the fall in orders and the shutdown of production in many factories following labour unrest between September and the first week of December when the minimum wage for apparel workers was announced.

The earnings declined 1.06 percent $5.30 billion in the last month of the year, according to the EPB. It, however, grew 0.84 percent to $27.54 billion in July-December, the first six months of the current financial year of 2023-24.

The shipment increased 1.72 percent to $23.39 billion in the first half.

Woven garment exports fell 4.12 percent to $9.91 billion in July-December and knitwear shipments rose 6.48 percent to $13.48 billion.

"Compared to other garment-exporting nations, we performed well given the volatility in the global economy," said Faruque Hassan, president of the Bangladesh Garment Manufacturers and Exporters Association.

He says the garment sector was severely affected by the fallout of the coronavirus pandemic and the wars and the lower gas pressure and the poor performance by customs, VAT and bond authorities.

The business leader hopes that the export trend may improve from April or May this year as stocks with clothing retailers would run out by the time.

Non-garment items also did not perform well in July-December.

The leather and leather sector earned $523.03 million, registering a 17.93 percent negative growth. Jute and jute goods exports fell 10.24 percent to $436.12 million.

Home textiles' earnings plunged 38.48 percent to $369.91 million. Frozen and live fish fetched $215.13 million, down 12.68 percent. Non-leather footwear shipments increased 1.85 percent to $246.15 million.

Remittances in the slow lane

The underperformance of the remittance sector rang louder since more than 30 lakh people have gone abroad from Bangladesh in the past three years alone. However, the record outflow did not reflect the funds transferred by remitters to their beneficiaries at home.

Earnings stood at $21.28 billion in 2022 and $22 billion in 2021, central bank data showed.

Expatriates sent home $1.99 billion in the last month of 2023, up 3.09 percent from November when the inflow amounted to $1.93 billion. December's receipts were 17.07 percent higher year-on-year.

The inflows were lower despite a spike in the number of Bangladeshis going abroad for jobs and up to 5 percent combined incentives available from the government and banks.

Experts have blamed the huge gap between the formal and informal exchange rates, the expanding hundi system, and the lack of motivation.

More than 13.07 lakh people left the country in search of jobs last year, according to the Bureau of Manpower Employment and Training.

Ali Haider Chowdhury, secretary general of the Bangladesh Association of International Recruiting Agencies, said the lack of proper facilities for migrant workers and the difference between the formal and informal exchange rates of the US dollar were the major reasons behind the slow growth in remittance earnings.

"Most of the workers are interested in sending money through informal channels because it is easier and offers higher rates than in the formal platform."

"The workers are going abroad to earn money, so they will definitely prefer the channels that give them the better rates."

Chowdhury says the formal-informal rate gap could be as high as Tk 7 per US dollar.

In Bangladesh, a one-per cent deviation between the formal and informal exchange rate shifts 3.6 percent of remittances from the formal to the informal financial sector, the World Bank said in May.

Chowdhury also highlighted the difficulty some undocumented workers face in remitting money through formal channels due to a lack of proper documentation.

Syed Mahbubur Rahman, managing director of Mutual Trust Bank, said although the exchange rate gap is a factor, the earnings will not pick up even if the exchange rate goes up.

He said the growing use of hundi, an illegal cross-border transaction system, is the major reason for the lower remittance flow.

The hundi system was believed to have been used in transferring nearly half of remittances to Bangladesh even before the coronavirus pandemic when the formal-informal rate gap was not as wide as it is today.

"But banks and the Bangladesh Bank will not able to stop hundi. It is the law enforcing agencies that can eliminate it," Rahman said.

Zahid Hussain, a former lead economist at the World Bank's Dhaka office, said the export outlook is good for the upcoming days because there is a demand for garments in the global market.

"But there is some uncertainty whether we are able to compete with our competitors."

The economist also cited internal factors such as the gas crisis and labour unrest for the lower earnings. "If the gas crunch mitigates and the unrest does not emerge again, there will be no problem for the export sector."

He, however, warns that the forex reserve situation would not improve even if exports grew.

"This is because we have seen a huge gap between exports and actual export realisation in recent times."

The unrealised export proceeds -- the difference between export shipments and realised export proceeds -- increased to $9.6 billion in the last fiscal year, amounting to 2.1 percent of GDP, according to a document of the IMF.

"The export realisation will not increase if there is mismanagement in the forex market," Hussain said.

Hussain called for the suspension of the US dollar rate-setting by the Bangladesh Foreign Exchange Dealer's Association (BAFEDA) and the Association of Bankers, Bangladesh (ABB).

"Otherwise, export earnings will not go up. The same is true for the remittance sector," he said, adding that a market-driven exchange rate should be introduced.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments