Businesses to face inflation, currency headwinds in year ahead too

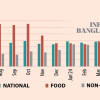

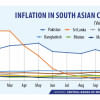

Businesses in Bangladesh will face challenges in managing the impacts of higher inflation and exchange rate in 2024 as well while the cost of production and operation may increase amid the rising bank interest, several business and corporate leaders warn.

However, they predict that the situation may improve slightly in the second half of the calendar year if the new government takes time-befitting measures to repair the cracks in the economy.

"Managing inflation and stabilising the currency will be the most important challenges in 2024," said Asif Ibrahim, vice-chairman of Newage Group of Industries, a top exporter.

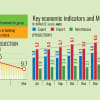

The outgoing year was full of uncertainty for many businesses and corporates as importers suffered a lot owing to the shortage of foreign currencies and exporters struggled to maintain the international price level against competing countries.

Imports plunged as the government and the central bank took measures to stop the fall in the forex reserve level. This impacted the purchase of capital machinery and industrial raw materials from international markets.

Foreign investors experienced difficulty in repatriating profits and new investors were constrained by the liquidity crunch, according to Mamun Rashid, managing partner of PwC Bangladesh.

The former banker said official channels saw only 50-60 percent of the possible remittance pie as the higher dollar rate drew remitters to informal platforms.

"Despite some dip in some markets, exporters maintained an overall buoyancy although non-realisation of proceeds made headlines throughout the year," he said, adding that inflationary pressure has kept the middle- and low-income groups under stress throughout the year.

Md Saiful Islam, president of the Metropolitan Chamber of Commerce and Industry, said geopolitics will be a factor for businesses in 2024.

His worry stems from the persisting challenge posed by the Russia-Ukraine war to the global economy and Bangladesh.

"Additionally, political stability in Bangladesh is important and businesses need policy support to overcome the ongoing crisis," he said.

Ashraf Ahmed, president of the Dhaka Chamber of Commerce and Industry, sounds more optimistic about 2024.

He said next year's challenges will centre around recovering from the events of 2023 and finding investments for growth.

"On the other hand, we expect the foreign exchange challenges to ease. 2024 should be a much better year for businesses as the macroeconomic scenario at home and abroad may improve, inflation may decline and the fear of a global recession may recede."

According to Ahmed, 2023 was a reminder that the fundamentals of interest and exchange rates and risk management should never be forgotten.

Selim RF Hussain, chairman of the Association of Bankers, Bangladesh, said: "We have been facing some challenges since the outbreak of the Russia-Ukraine war. We had not seen macroeconomic instability to this scale in the past."

"We have also not seen such challenges in managing the balance of payments."

The managing director of BRAC Bank thinks policymakers took various measures to tackle the situation, but the responses were less than optimal, and the restrictions, particularly on interest rates, created a lot of problems.

He says 2024 will be a difficult year.

"The condition of five to six banks has worsened and measures have to be taken so that problems in these banks don't spread and turn into a systemic problem."

Hussain says influential people exert a lot of power in the banking sector.

"We have to come out of that. We need a lot of reforms in the banking sector. Reforms are also necessary to recover bad debts."

He said globally challenges exist owing to geopolitical tensions, and the risk of a wider conflict in the Middle East.

"The interest rate in the West, the main export destination of Bangladesh, is still high. The export sector may face challenges."

Md Zaved Akhtar, chairman and managing director of Unilever Bangladesh Ltd, said Bangladesh is likely to move to a higher inflation regime in 2024.

"Therefore, the country needs to make a fine balancing of currency corrections while taming any inflationary impact, maintain a strong BoP, and build resilience in financial account management. All of these will ensure sustainable growth of our businesses and country."

Ahsan Khan Chowdhury, chairman and CEO of Pran-RFL Group, says the outgoing year was challenging for the business community due to the dollar crisis and the high cost of imports.

Since a new government is expected to take some reform measures regarding the currency, the pressure on businesses may ease to some extent, he said.

"The domestic market may rebound as the political situation will remain stable," he said, adding that there will be challenges for businesses if the country faces any sanction from the West.

Tapan Sengupta, deputy managing director of BSRM, the largest steel-maker in Bangladesh, says they don't see a glimmer of light at the end of the tunnel to predict an improvement in business in the first quarter of 2024.

"The challenges for businesses will continue in 2024."

"However, if political stability is there and the economic and political situation improves both locally and globally, we may expect an improvement in the second half of 2024."

Mohammed Amirul Haque, managing director of Premier Cement Mills Ltd, thinks escalated inflation and a high rate of bank interest will increase the cost of doing business in 2024.

He added if the foreign exchange crisis improves, businesses will fare well in 2024.

"Exports will improve when the forex reserve situation gets a boost as the manufacturing sector will be able to import necessary raw materials."

Shams Mahmud, a former president of the DCCI, said industries in 2023 have gone through some shocks, especially in terms of abrupt increase in energy costs, the depreciation of the taka, the lifting of interest rate cap, and the spike in the rate of inflation, which have affected almost all spheres of people.

"In 2024, we hope to see major reforms, especially in taxation, financial, and energy sectors."

Mamun Rashid thinks if the early January election can be held peacefully and without much controversy, Bangladesh is poised for good growth given rising consumer demand.

"Many investments are awaiting provided there is more predictability in foreign exchange and interest rates."

He thinks development assistance from multilateral and bilateral partners is likely to continue. Foreign aid disbursement, however, might face extended scrutiny due to possible enhanced political risk.

Asif Ibrahim said external factors such as global trade dynamics, commodity prices, and geopolitical events can impact Bangladesh's economy in 2024.

The entrepreneur, however, thinks the textile and garment industry can capitalise on higher global demand for affordable clothing as long as it continues to focus on quality, sustainability, and ethical practices.

Challenges and opportunities for the economy and businesses in the new year will depend on a variety of factors, including domestic policies, global economic conditions, and industry-specific dynamics, said Ibrahim.

He suggested businesses adapt to changing conditions and seize on opportunities for growth and development.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments