Inflation hits seven-month high

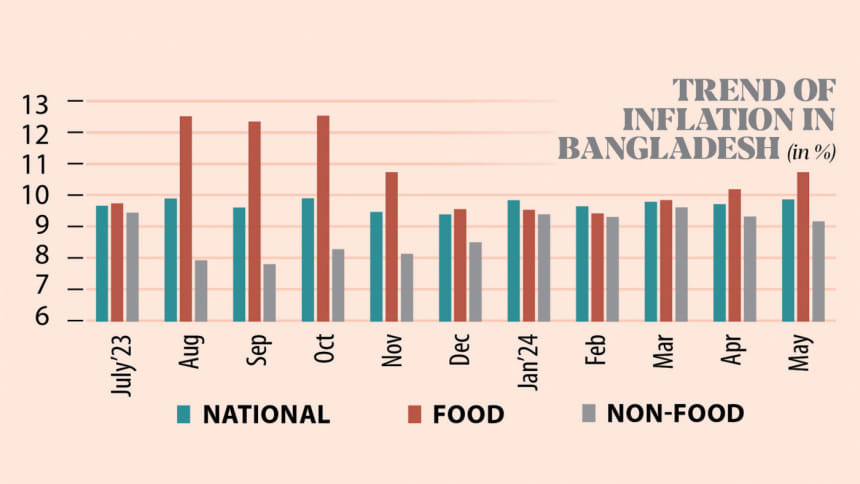

Inflation, fuelled by higher food prices, climbed 15 basis points to 9.89 percent in May from 9.74 percent a month earlier, figures from Bangladesh Bureau of Statistics showed yesterday.

This is the highest rise on the Consumer Price Index in seven months.

Food inflation surged 54 basis points to 10.76 percent from 10.22 percent while non-food inflation slipped 15 basis points to 9.19 percent from 9.34 percent in April.

In fiscal 2022-23, the average inflation rate was 9.02 percent, far higher than the average of 6 percent in recent years.

The Consumer Price Index grew by an average of 9.73 percent in the first 11 months of fiscal 2023-2024, which was 8.64 percent during the same period a year ago, BBS data showed.

"The persistent high inflation is continuously pushing the low-income groups against the wall," said Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development, a non-profit institution.

Following the pandemic, the coping capacity of the low-and fixed-income groups has fallen significantly, which forced them to cut spending on basic needs, he said.

"Now, they are perplexed. It is a big challenge for the government to protect them."

In the budget for fiscal 2024-2025, scheduled to be announced on June 6, the government should keep enough measures to support these groups, he said.

Echoing his words, Prof Selim Raihan, executive director of the South Asian Network on Economic Modeling (Sanem), said the new budget should concentrate on expanding social safety net programmes as much as possible for the next year.

Referring to a new study, Bangladesh Institute of Development Studies (BIDS) recently showed that food inflation in rural areas remained around 15 percent in December, much higher than the official food inflation rate of 9.41 percent.

"The stubborn inflation trend indicates that the monetary policy isn't working properly. Inflation has just maintained its upward trend," said Mujeri, a former chief economist of the central bank.

Bangladesh Bank has tightened the policy rate repeatedly in recent times to tame high inflation.

"But the situation has taken such a turn that it is not possible to bring down inflation, using the monetary tools alone," he said.

Since March last year, inflation has stayed above 9 percent, BBS data shows.

In order to ensure a smooth supply chain in the commodity market, the government will have to focus on fiscal policy, along with the monetary policy, said Mujeri.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments