BB roadmap to knock down bad loans

The Bangladesh Bank yesterday unveiled its roadmap for reining in the runaway defaulted loans to a reasonable level and bringing in good governance to the banking sector, which is progressively becoming an Achilles heel of the economy.

The roadmap, which has been vetted by the International Monetary Fund, consists of 17 action plans that were adopted after analysing the defaulted loan scenario of the last three years.

If implemented faithfully, the banking sector's defaulted loans will come down to less than 8 percent of all outstanding loans by June 30, 2026. The state banks' defaulted loans will be less than 10 percent and that of private banks will be under 5 percent.

The practice of giving out loans beyond limits, for vested interests and against fake documents will stop entirely too, said BB Deputy Governor Abu Farah Md Nasser at a press conference after the BB's 432nd board meeting, where the roadmap was approved.

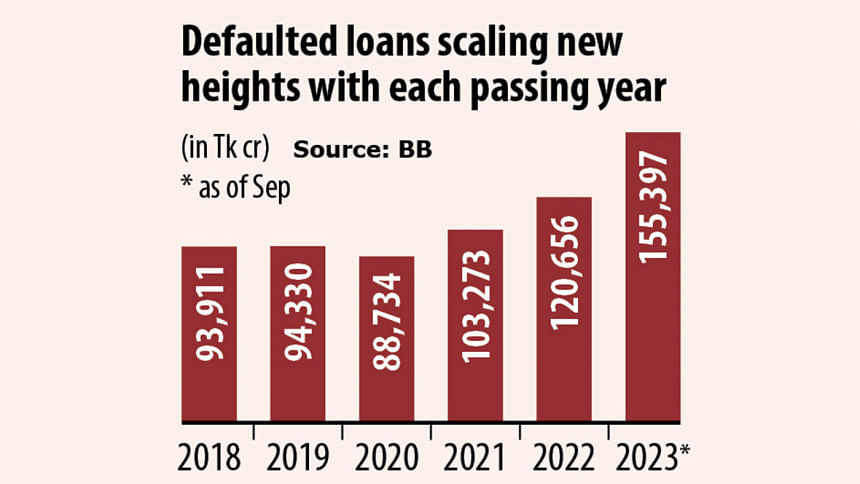

At the end of September last year, defaulted loans amounted to Tk 155,397 crore, which is 9.93 percent of the total outstanding loans.

Bad loans accounted for as much as 21.7 percent of outstanding loans at state banks. The ratio stood at 7.04 percent for private banks, according to BB data.

The roadmap consists of letting banks write off loans that have been in the 'bad and loss' category for two years by keeping 100 percent provisioning against those. At present, banks have to wait for three years before they can write off the loans.

This is expected to bring down the bad loan volume by Tk 43,300 crore, or 2.76 percent, as per BB's estimates.

Banks will have a separate department called the 'write-off loans recovery unit' under the direct supervision of the managing directors or chief executive officers. And recovery of the written-off loans will be part of the bank CEOs' key performance indicators (KPIs).

Banks will not be able to show the interest accrued against stressed assets as income until the loans are regularised or realised. Until then, banks must show the interest accrued separately in their balance sheets.

The BB is also working on the necessary law to set up an asset management company to buy banks' bad and written-off loans; the received money will be added to the bank's income account.

The relaxed loan repayment facility that was enjoyed by businesses will not be extended in the coming days, as part of the BB action plans.

The definition of term loans will be brought in line with international best practices.

Banks will have to strengthen their legal department and they will be given targets for alternative dispute resolutions under the Money Loan Court Act 2003.

The central bank will also form rules and policies to take measures against the wilful defaulters as defined by the Bank Company (Amendment) Act 2023.

Bank officers who recover defaulted loans will get special incentives.

The collateral against loans must be assessed by listed evaluation companies, as per the action plan.

The central bank has also come up with six action plans to bring good governance in the banking sector.

Some of the weak banks will be merged with the robust ones with the condition that no one can be fired for three years after the merger.

The central bank will amend the criteria of what is construed as fit and proper when it comes to appointing shareholder-directors. Their responsibilities will be revised too. New policies will be formulated regarding the appointment of independent directors and their responsibilities and remuneration.

Changes have been made in the selection process for appointment and re-appointment of bank MDs.

The single-borrower exposure limit will not be exceeded in any way.

Training and professional examinations will be made mandatory for the promotion of bank officers.

"The intentions are noble but now we want to know how they will be implemented -- political commitment is very essential here," said Ahsan H Mansur, executive director of the Policy Research Institute of Bangladesh.

The banking sector has become weak due to the inactive role of the central bank, said Salehuddin Ahmed, a former BB governor.

"This reform plan is not new -- such types of policies were introduced before but were hardly executed. BB has now announced this roadmap to show that it is very active."

Without the independence of the banking regulator, such reform plans will only remain on paper and not in action.

"The banking regulator must have enough strength to tackle the political interference and pressure from the influential groups," Ahmed added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments