Entrepreneurs against sudden changes to economic policies

A roadmap on economic policy changes is vital for the private sector since it can help them predict the future, plan accordingly and avoid shocks that may stem from a sudden shift in government strategies, said economists and entrepreneurs yesterday.

Their observation was made after the government cut export subsidies for almost all sectors, a move that was praised by experts but came as a surprise for the business community.

"An investor invests for a long time and considers all incentives. If it is cut suddenly, businesses are hit," said Mashiur Rahman, the economic affairs adviser of the prime minister.

"If they knew what would happen after five years, they would be able to plan accordingly. In order to receive more investments, a policy continuity is necessary."

The adviser spoke at a seminar titled "Bi-annual Economic State & Future Outlook of Bangladesh Economy: Private Sector Perspective" at the Dhaka Chamber of Commerce and Industry (DCCI).

Rahman said every incentive package should include a phase-out scheme in order to shield the private sector from any shocks that may emanate from its withdrawal.

"Entrepreneurs always talk about policy support to get funds at a lower rate and incentives. However, they don't seek policy support to raise productivity, but higher productivity can be a good incentive for them."

The adviser said there is a weakness in the transmission mechanism of the monetary policy of the central bank.

On the one hand, the central bank is raising the policy rate. On the other hand, it is lending money to the government at a higher volume, he pointed out.

Rahman recommended reducing the gap between the real effective exchange rate and the nominal exchange rate so that the central bank's planned crawling peg becomes easier.

Last month, the BB announced that it is going to adopt the crawling peg as per the suggestion of the International Monetary Fund.

The crawling peg is a system of exchange rate adjustments in which a currency with a fixed exchange rate is allowed to fluctuate within a band of rates.

DCCI President Ashraf Ahmed said if entrepreneurs had favourable guidelines, they could have planned accordingly.

Shams Mahmud, a former president of the chamber, said the government has cut incentives on exports suddenly.

"There should have been a prior announcement about when the incentive would be phased out."

Mahmud said most garment companies are keeping 40 percent of their production lines shut as they are finding it difficult to open letters of credit to import raw materials owing to the foreign exchange shortage.

"The cost of production has risen as wages have increased and the interest rate of loans has gone up. The cost of energy has surged though gas is not available at full pressure."

The entrepreneur said the National Board of Revenue is heaping pressures on businesses in order to give a boost to its revenue collections.

"How can we run businesses if it continues? Sometimes, it seems that we have made a mistake by investing in the country."

Mohammad Yunus, a research director of the Bangladesh Institute of Development Studies, blamed extortion in the retail market as one of the main reasons for the higher inflation.

He said there should be better coordination between the Bangladesh Economic Zones Authority and the Bangladesh Export Processing Zones Authority to attract foreign direct investments.

Md Habibur Rahman, chief economist of the central bank, said the BB has not issued any new taka in the market in the last six months.

"Rather, it has reduced the balance sheet of the central bank through the contractionary monetary policy."

In the six months to December, the balance sheet of the central bank was narrowed by 2.03 percent to Tk 372,315 crore.

"Many people are making sweeping comments that the central bank is printing money to lend to the government," he said.

The chief economist said printing money is a routine work of the central bank. "But it has printed money that is lower than the amount that has been withdrawn from the market."

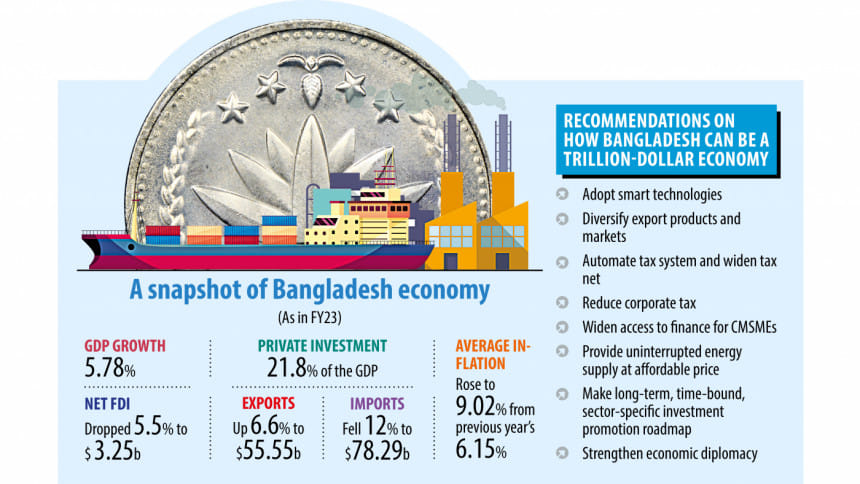

To facilitate the private sector, DCCI President Ahmed called for a lower corporate tax, a complete automation of the taxation system, widening tax nets, and reforming the Value Added Tax and Supplementary Duty Act, 2012.

"A reduction in the cost of doing business, an uninterrupted energy supply at an affordable price, and a developed logistics sector will help the private sector re-invest."

He said that the CMSME sector needs not only access to finance but also access to technology to grow.

Ashikur Rahman, a senior economist of the Policy Research Institute of Bangladesh, said macroeconomic instability is not good for the private sector.

He added non-performing loans always have a negative impact on businesses, so it is time to take serious decisions against NPLs.

He said the tax-to-GDP ratio is not up to the expected level and stressed skill development and reforms of the financial sector.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments