Imperfect competition, subsidies and bailouts: Where is the policy balance

In the realm of economic policymaking, governments around the world pursue fairness and a competitive business environment to ensure the best use of scarce resources. There are three main tools for this: (i) economic and financial incentives and legal measures to strengthen market competition; (ii) providing subsidies to encourage production and consumption of certain goods and services at lower costs; and (iii) providing bailouts to a company, a bank or public enterprise to continue operation or strengthen operational capacity, and improve sustainability by paying off debts. In Bangladesh, these three tools are not necessarily used consciously together to see their consequences on the price level, business incentives, and sustainability of financial institutions.

With regards to perfect competition, which is only found in economic textbooks, but is hard to find in reality in full, competition is something that most governments around the world pursue as an economic principle in line with the views of neoclassical economists who argue that it maximises economic efficiency and social welfare. It is strongly believed that when firms compete with one another, it leads to lower prices and better quality of products, often via innovation and the use of better technology. The underlying assumptions on why governments want perfect competition are many. First and foremost, it ensures that a maximum number of buyers and sellers interact in the market to fix the price of a product in which supply matches demand, and this would probably set the lowest price that ensures enjoyment of the product by a large number of people. On the contrary, if any particular producer attempts to manipulate the market in pursuit of short-term gains, competition will evaporate, there will be a limited number of sellers and buyers, and a large number of potential consumers will not be able to interact in the market and ultimately buy the product because of its high price.

Despite the wisdom behind "perfect" competition, backed by the government, private sector, economists, bankers, and other actors, underscored by a level playing field in the economic and financial sense and policies and legal framework drawn up to support this idea, we see that they fail to properly analyse the market mechanism in the context of the country and ensure that the principles behind the notion of perfect or near-perfect competition are sound. It is possible to improve the situation by taking appropriate measures. The Marshallian economists built very nice models showing supply and demand interacting to achieve an equilibrium price level. But economists like Joan Robinson and Edward Chamberlin criticised some unrealistic assumptions of the perfectly competitive market model. Despite this, the fact remains that under an environment of imperfect competition, producers can manipulate the market and sell their products and services at a higher price, create artificial barriers to entry for other firms in the industry, and create a monopoly or near-monopoly-like situation. There are several terms used in economics textbooks to characterise imperfect competition—these are monopoly, oligopoly, monopolistic competition, monopsonies, and oligopsony.

The Bangladesh government established an institutional mechanism through the Competition Act of 2012 and the Competition Commission established in 2016, to monitor the level of competition in the country. The preamble of the Competition Act runs as follows: "In the context of the country's gradual economic development, it is expedient and necessary to make provisions to promote, ensure, and sustain a favourable environment for trade competition, as well as to prevent, control, and eradicate collusion, monopoly, and oligopoly, combination or abuse of dominant position, or anti-competitive activities."

The strategies some private companies pursue to gain undue advantages in the market, bypassing the principles of perfect competition, are a subject of scholarship that aims to unfold the mechanism through which this is done and how to reduce such practices. From this knowledge, along with the theories of perfect competition, the theories of imperfect competition are also being developed in Western countries, to unmask the true face of imperfect markets. In Bangladesh, the Competition Commission started its journey very recently, in 2020, after the appointment of the Commission members. The Commission has been assessing the country's competition situation but has yet to undertake any major actions. It should start identifying areas of unhealthy market competition as a fundamental requirement for a well-functioning economy, as competition aspects will be more closely observed by our international trading partners for products like garments, pharmaceuticals, and other products, as Bangladesh loses flexibility in implementing the intellectual property rights after it becomes a developing country by 2026.

Competition law is not an end in itself and to use it, we need to have a good understanding of how markets work. If there is insufficient competition in any sector/product, dominant firms and business syndicates can use their market power to charge higher prices. The government needs to guarantee fair competition which allows the market economy to allocate resources efficiently, help achieve higher economic growth rates, and ensure fairness in a capitalist market system.

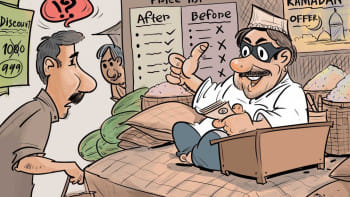

In the United States, antitrust laws and in the UK, Competition Act, 1998 exist. About 140 countries in the world have their competition laws. These laws are used to regulate the conduct of businesses, promote competition, and prevent monopolies and collusion by several firms to form a cartel that limits competition and secures the power to dictate prices. It is a constitutional obligation in many countries including Bangladesh to ensure an egalitarian and competitive socio-economic environment and check anti-authoritarian behaviour not only in the political sense but also in the socio-economic sense, such as monopolies and business syndicates (cartelised monopoly) which reduce social welfare by not letting production or supply reach an optimum level. As has been alleged, this tendency of collusion pursued by many suppliers for essential consumer items like onion, edible oil, and eggs in Bangladesh, can cause general inflationary pressure prompting public protests. Bangladeshi people have been suffering from inflation for a while now, and the government has been committing to lowering prices of food and non-food items without seeing prices coming down much, many people are blaming the powerful business syndicates who control the prices.

The second traditional tool for price support in Bangladesh is a subsidy, which is used in the case of fuel, gas, electricity, fertiliser, foodgrains, etc. to keep market prices low and allow low-income groups access to them. While subsidy as a price stabilisation tool can be used to help poorer segments of society by keeping prices of essentials down, critics claim that large-scale use of subsidy can interfere with the free market and, therefore, distort the use of factors of production and cause inefficiencies in the economy. Subsidies favour some companies over others which may create unfair market conditions and unhealthy market competition. Taking advantage of subsidies, these companies may engage in rent-seeking, and cause inequality in society.

In recent years, special bailouts have been used in Bangladesh, not to help the poor but mainly the rich. For example, in the case of supporting financial institutions such as banks, to help companies who borrowed money from banks, to enable them to pay back loans at a lower rate and over a longer period. The bailout given to defaulting bank borrowers drew criticism since the total non-performing loans (NPLs) remained very high at Tk 156,000 crore in June 2023. One important thing to mention here is that in the developed world, imperfect competition mainly refers to companies that run monopoly businesses, and anti-trust laws are aimed at controlling high prices. In Bangladesh, however, controlling high prices is not the only issue to deal with in the realm of imperfect competition. Still, it can potentially look at the case of the government's support to reschedule bank loans that can keep bank interest rates low for those who have been given the favour of paying back loans under this arrangement but has the same weakness of allowing multiple interest rates, which can lead to unfair market competition.

In Bangladesh, imperfect competition can occur due to the use of both direct price mechanisms by monopolies and indirect ways such as giving financial support to a select group of investors and companies and not to others, thereby giving an advantage to some. Any subsidised credit facility, for example, will provide low-cost production opportunities to some investors and not to others who have to produce at higher costs, making it difficult to compete in the market. Whereas imperfect competition can hurt consumers, in the particular context of Bangladesh, where poverty, inequality, and lack of access to health and other services for the poor exist, ongoing subsidy and bailout strategies of the government along with ensuring competition in the market are all relevant macro-economic policy options. The three options mentioned above need to be considered together, however, and not be seen as stand-alone policy options. All the ministries and financial institutions responsible for implementing them must coordinate to obtain the best outcomes from using these important tools.

Dr Nawshad Ahmed is an ex-UN official, an economist, and an urban planner. His latest book is "Social Protection Programmes in Bangladesh: Expectations and Achievements" (written in Bangla).

Views expressed in this article are the author's own.

Follow The Daily Star Opinion on Facebook for the latest opinions, commentaries and analyses by experts and professionals. To contribute your article or letter to The Daily Star Opinion, see our guidelines for submission.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments