IMF suggests raising tax-free income limit to Tk 5 lakh

The International Monetary Fund has suggested the National Board of Revenue (NBR) restructure the personal income tax slabs and increase the tax-free income limit to Tk 5 lakh from the existing Tk 3.5 lakh.

The visiting tax policy mission of the Washington-based lender recommended abolishing the lower slab of 5 percent, saying the marginal tax rate should be 10 percent on income between Tk 5 lakh and Tk 8 lakh.

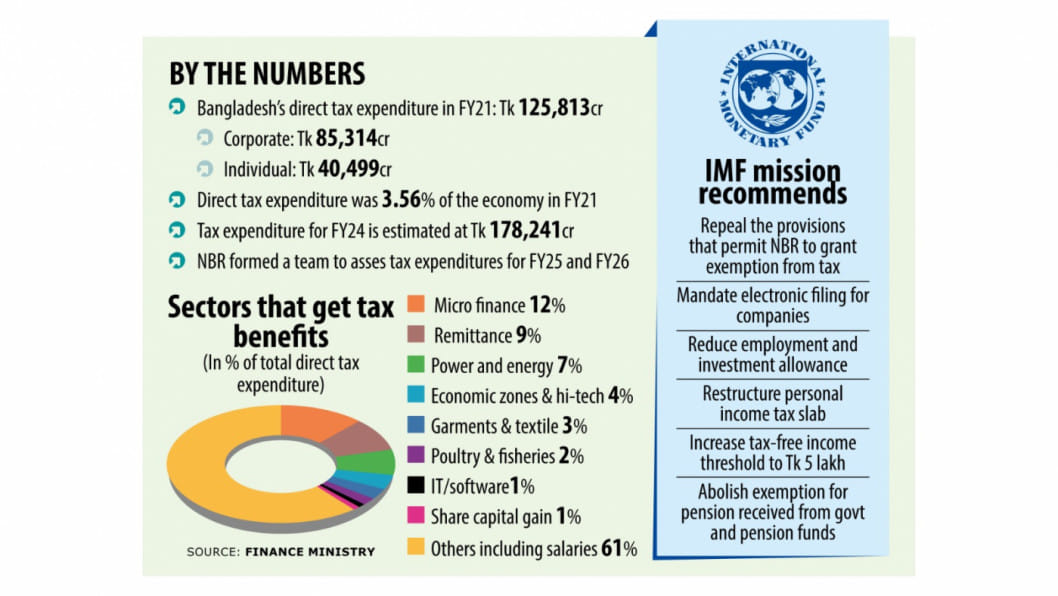

It also called for repealing the provisions that permit the NBR to grant tax exemptions and urged the tax authority not to extend the concessions after the expiry of the existing benefits.

In order to improve collections, the team said the NBR should make it mandatory the electronic filing for companies from the next fiscal year beginning in July.

The advice comes as Bangladesh's tax-to-GDP ratio continues to be one of the lowest in the world despite rising per capita income.

The lender recommended the government initiate measures that yield an additional tax receipts worth 0.5 percent of the GDP in the current fiscal year ending on June 30.

The team, comprising David Baar, Arbind Modi, and David Wentworth, made the observations during a presentation to the NBR chairman and income tax officials at the revenue authority's headquarters in Dhaka yesterday.

The delegation shared the observations after training taxmen to assess tax expenditures so that the government can eliminate less effective exemptions, broaden the tax base and increase revenue collection, a condition of the IMF's $4.7 billion loan programme for Bangladesh.

According to the NBR, the total estimated amount of direct tax expenditure, which includes exemptions and rebates, was Tk 125,813 crore in 2020-21. Of the sum, tax subsidies given to corporates amounted to Tk 85,314 crore while Tk 40,499 crore was given at the individual level.

Tax expenditures are estimates of tax revenue that government forgoes as a result of legislative provisions that deviate from standard tax treatment. This includes deductions, exemptions and rebates.

The NBR said the total amount of projected direct tax expenditure for 2023-24 will be Tk 178,241 crore.

In its presentation, the IMF team said a tax expenditure should be the most effective policy response to a clearly defined policy need that is aligned with the roles, responsibilities and current priorities of the government.

It described preferential treatment of domestic businesses as incompatible with World Trade Organization rules.

"International best practices will increase the competitiveness of both import-substituting and export-oriented businesses and help attract foreign direct investments."

In the short-term, the IMF said, bad measures should be repealed and a complete evaluation for relevance, effectiveness, economic efficiency and equity should be undertaken.

The team, citing the tax holiday part of the Income Tax Act 2023, favoured cancellation of the provision in the law so that the tax administration can't provide exemptions to businesses through regulatory changes.

"Preferential treatment for mineral and petroleum extraction should be scrapped."

In order to improve tax reporting, the IMF suggested the NBR quickly extend the e-return framework to cover corporate tax.

The tax administration has computer hardware and software and the IMF can help develop the corporate income tax e-return, it said.

The team, however, suggested an evaluation of the depreciation allowance rates and allowances for corporate income tax. It said losses of businesses can be allowed to carry forward for at least 10 years.

The mission called for an evaluation of tax reliefs and the introduction of legislative amendments to implement those that remain relevant, effective, economically efficient and equitable.

It said pension and provident fund contributions, provident fund investment incomes and pension benefits should be taxed once.

The best practice is not to tax contributions or pension fund investment incomes and is to subject pension benefits to the standard personal income tax rates and slabs, said the team.

The IMF's team proposed a review and revision of tax returns to ensure comprehensive data is collected and urged the NBR to go for electronic return filing and payments in phases.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments