Key stock index sheds 352 points in eight days as market keeps bleeding

The Dhaka Stock Exchange (DSE) fell for the eighth consecutive day yesterday as both local and foreign investors went for sales amid lingering economic uncertainty and disappointing corporate earnings while institutional firms sat idle.

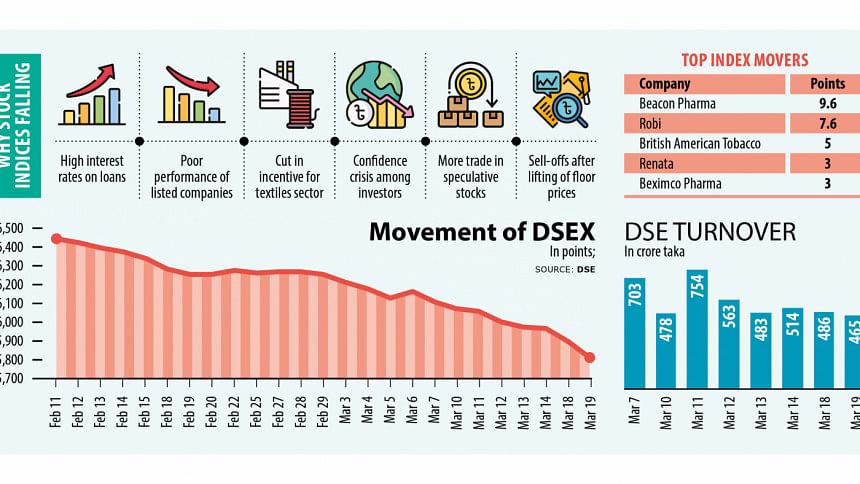

The DSEX, the benchmark index of the premier bourse of Bangladesh, dropped 84 points, or 1.42 percent, to close at 5,814. The decline prompted the DSEX to plunge to a 35-month low.

In the last eight sessions, the index lost 352 points, or 5.7 percent. The bourse plunged 610 points, or 9.4 percent, in the last 25 trading sessions. The panic among the investors wiped out the market value of all stocks by Tk 64,201 crore, or 8.53 percent.

"Investors over-reacted after witnessing disappointing earnings reported by large, capital-based blue-chip stocks," said Shekh Mohammad Rashedul Hasan, managing director of UCB Asset Management.

"Some of the companies' performance was lower than expected. But the performance may not remain the same. Rather, they can earn more from interest incomes as they are sitting on piles of cash."

The growing deposit rates in the banking sector and the higher return against treasury bonds are forcing savers to move funds away from all other savings instruments in the money market, said the top official of a merchant bank.

However, the bearish run has not been entirely surprising.

Because of the floor price, most stocks were untradeable for more than 18 months. But once the Bangladesh Securities and Exchange Commission began removing the cap from January this year, investors finally got the chance to sell shares.

"Some people needed liquidity but their funds had been stuck for around two years. They are now in a selling mood," said an official of an asset management company.

Despite recent improvements on the export and remittance fronts, investors' perception is not positive about the economy since the foreign currency reserves have still not reached the comfortable level seen two years ago, while higher inflation shows no signs of cooling.

The elevated level of consumer prices could mean an extension of lower sales for the listed companies in the coming months.

"Foreign investors are also selling shares as they fear that the local currency may weaken further against the greenback," the official said.

The taka has lost its value by about 30 percent in the past two years against the US dollar while the forex reserves have halved since August 2021.

The asset manager said in the last two years, most of the funds chased speculative stocks while large, capital-based stocks were rarely changed hands.

"The large-cap stocks have dropped massively in the last few days following the withdrawal of their floor price."

He said most of the stocks have become lucrative now, so people should inject funds in the market now.

Also yesterday, the DSES, the index that represents shariah-compliant firms, dropped 17 points, or 1.42 percent, to 1,268. The DS30, which comprises blue-chip stocks, shed 22 points, or 1.10 percent, to end the day at 2,020.

Turnover slipped to Tk 465 crore from Tk 486 crore. Among the stocks transacted, 41 advanced, 319 dropped and 36 remained unchanged.

Although the benchmark index plunged, junk stocks were on the gainer's list: Central Pharmaceuticals topped the chart with an increase of 7 percent, ICB Islamic Bank rose 5 percent, and Jute Spinners gained 4.5 percent.

People's Leasing and Robi Axiata both shed 10 percent. Khulna Printing & Packaging dropped 8.7 percent, Tamijuddin Textile Mills fell 8.2 percent and Golden Son was down 8 percent.

Stocks in the Chattogram bourse also dropped yesterday. The Caspi, the broad index of the bourse in the port city, fell 275 points, or 1.62 percent, to 16,653.

Shibly Amran, chief executive officer at Community Bank Investment, said most of the macroeconomic indicators are positive as export earnings rose and remittance increased.

Remittance inflow soared 39 percent year-on-year in February to $2.16 billion, the highest in eight months. Exports grew 12 percent to $5.18 billion in February.

Amran said the dollar rate in the kerb market is close to Tk 120. "It indicates that the dollar price is almost stable, so the market may rebound soon."

In a press release, the DSE Broker's Association said it hopes that the market will make a comeback as macroeconomic indicators are showing improvement.

The statement was released after a virtual meeting of top officials of 30 large brokerage houses.

Since the floor price was lifted, the price fall is normal and it is taking place because of corrections, it said.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments