Forex reserve target for IMF loans may be revised down to $18b

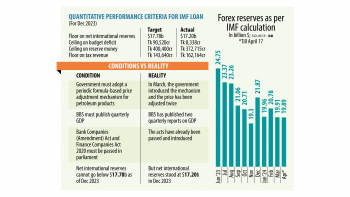

Bangladesh has proposed that the International Monetary Fund (IMF) revise down the Net International Reserves (NIR) target for June to below $18 billion since the existing target will be difficult to achieve due to the prevailing external sector situation.

At present, the NIR target set by the IMF for June stands at $20.11 billion. Meeting the target is one of the conditions for Bangladesh to secure the fourth tranche of a loan under the global lender's $4.7 billion loan programme.

The latest proposal was made to the IMF's visiting mission yesterday during a joint meeting with officials of the finance division and central bank at the finance ministry in Dhaka.

Tomorrow, the IMF mission will hold its closing meeting with Bangladesh Bank Governor Abdur Rouf Talukder, where they will finalise the revised figure, a central bank official said.

The mission will then meet with Waseqa Ayesha Khan, state minister for finance, and hold a press briefing afterwards.

Today, officials of the finance ministry and central bank will have a meeting with the IMF mission about the next course of action in the reform programme.

An eight-member IMF mission, led by Chris Papageorgiou, has been in Dhaka since April 24 for the second review of the loan programme, after which the third tranche of the loan, worth $681 million, will be released.

The third tranche is expected to be released in June.

Bangladesh met all but one condition for the third tranche, related to NIR. The revised NIR target was $17.78 billion in December last year, but the country fell short by $58 million.

However, officials said they were hopeful of getting the third tranche on time despite falling slightly short of the target.

They added that the IMF may set new or revised targets for the fourth and fifth tranches.

Since the launch of the IMF's loan programme, Bangladesh has been unable to meet the conditions set for net international reserves.

As Bangladesh could not meet the target set for June last year, the country had to get a waiver to secure the second tranche of the loan.

Officials said it would be difficult to meet the NIR target set for June this year since the country's foreign reserve situation has not improved since December last year.

Bangladesh expected to get significant budget support from various development partners, but it is unlikely the country will get any support by June this year other than $500 million from the World Bank.

Moreover, as global uncertainties persist, there is less possibility that interest rates in the international market will come down.

As a result, Bangladesh's private sector short-term foreign borrowing has been declining gradually since mid-2022 and that trend may continue until December this year, according to the central bank's estimates.

That decline piled pressure on Bangladesh's forex reserves as the country's outstanding short-term foreign borrowing declined to $11 billion in February this year from more than $16 billion in mid-2022.

Also, there is no sign that the pressure on the financial account of the Balance of Payment (BoP) will ease.

According to central bank statistics, during the July-February period of the current fiscal year, the current account balance, a major component of the BoP, stood at a surplus of $4.7 billion.

In contrast, the financial account, another key part of the BoP that includes foreign direct investments and short, medium, and long-term loans, showed a $8.3 billion deficit.

This is nearly four times the deficit that the account was showing in the same period of the year prior.

On the other hand, the net trade credit deficit stood at $10.75 billion in the same period compared to $3.55 billion the year prior because export proceeds fell.

A central bank official said the visiting IMF mission accepted the reality of Bangladesh's external situation and agreed to revise down the NIR target.

Meanwhile, although Bangladesh met the floor tax revenue collection target for the third tranche in December last year, it may fail to meet the target set for the fourth tranche of collecting Tk 394,530 crore by June.

To meet the June target, 20.39 percent growth in tax revenue collection is required.

However, in the first seven months of the current fiscal year, tax revenue collection growth was 12 percent.

As per finance ministry estimates, a maximum of Tk 380,000 crore can be collected by the end of June.

A finance ministry official said they requested the IMF to slightly revise down the tax revenue target but it is unclear whether they will agree.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments