No headway in curbing banks’ bad assets

The formation of an asset management company to reduce bad assets has been in limbo for about four years as the government is yet to decide whether it will be owned by the state or the private sector.

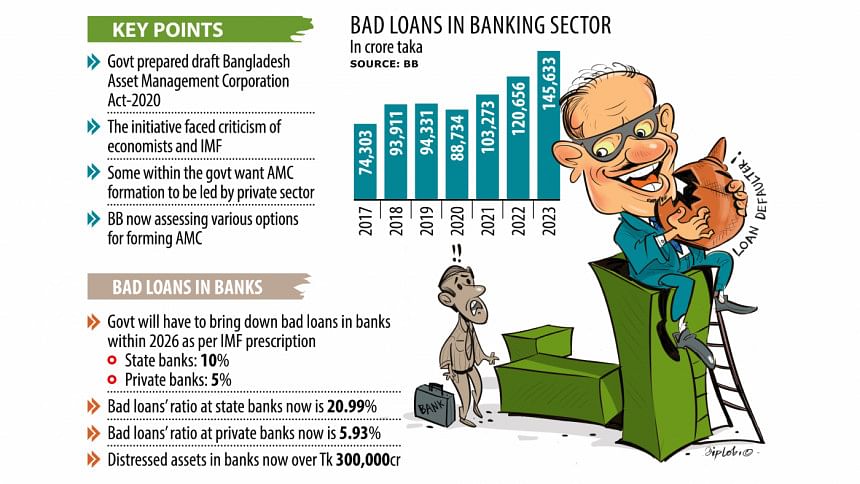

In 2020, the government disclosed the idea of setting up a state-run corporation to buy and trade distressed assets as part of its efforts to help banks clean out their bad loan problems. The Financial Institutions Division (FID) of the finance ministry drafted the Bangladesh Asset Management Corporation Act 2020 (Bamco) to this effect.

The FID has later backtracked following criticism from different quarters, including the International Monetary Fund (IMF), about the formation of a public corporation since state enterprises have usually underperformed in the country.

Experts argue that it will not be wise to use taxpayer money to purchase distressed assets, which have surged to an unprecedented level, hurting the financial sector, in particular, and the economy in general.

Some within the government want the asset management company to be formed by the private sector and some back the idea of keeping it under the control of the state, creating uncertainty, according to several officials of the FID and the Bangladesh Bank who are directly involved with the process.

A senior official of the central bank said the BB has again started the primary work on whether the asset management company can be formed by the private sector.

"We are now studying it and examining the experience of other countries."

He said some countries have witnessed positive results by forming state-run asset management companies while some experienced better results by keeping them under private ownership.

"Therefore, we are yet to reach any conclusion whether the company will be formed by the government or the private sector."

The issue of establishing the asset management company has surfaced again because the government will have to reduce the bad loans of state-run banks to 10 percent and private commercial banks to 5 percent by 2026 in line with the prescriptions of the International Monetary Fund (IMF) as part of its $4.7 billion loan programme.

At the end of December, bad loans in the banking sector stood at Tk 1,45,633 crore, which accounted for 9 percent of the funds disbursed, BB data showed.

Bad loans held by state banks totalled Tk 65,781 crore, making up 20.99 percent of their outstanding credits. Defaulted loans of private banks were Tk 70,981 crore, which was 5.93 percent of their outstanding loans.

The distressed assets in the entire banking sector stood at Tk 3,75,000 crore last year. These include defaulted loans, rescheduled loans, written-off loans, and the credits that were regularised following court orders.

Last month, the central bank, in its guideline for the merger and amalgamation of banks and non-bank financial institutions, hinted at the formation of an asset management company. It, however, did not share any details.

The principal task of an asset management company is to buy and sell default loans and create a competitive market to trade distressed assets.

Syed Mahbubur Rahman, a former chairman of the Association of Bankers Bangladesh, said asset management companies must be accountable and follow good governance practices, be it formed by the government or the private sector.

"Buying the bad assets should not be its sole responsibility – its purpose must be right."

Citing India's example, the managing director of Mutual Trust Bank said privately run asset management companies are doing better than those in the public sector in the neighbouring nation.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments