Cut expenses since tax receipts won’t go up overnight

The government should reduce expenditures to free up funds for the implementation of development projects since accelerating revenue collections is not possible overnight, said a noted economist yesterday.

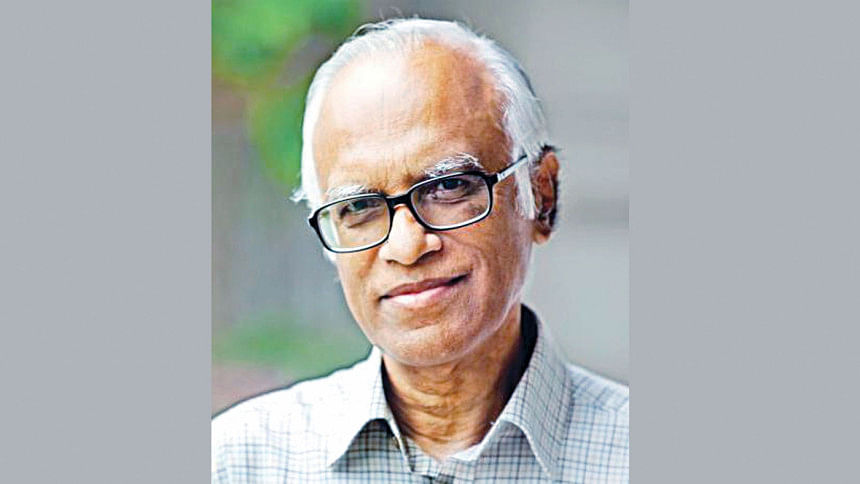

"Implementation of development projects by borrowing money from home and abroad is not a good decision," said Wahiduddin Mahmud, a former adviser to a caretaker government.

The economist was speaking at a debate competition on revenue collection at the Bangladesh Film Development Corporation in Dhaka. The Debate For Democracy (DFD) organised it.

In Bangladesh, the tax-to-gross domestic product (GDP) ratio is not growing. Rather, the ratio is declining. Today, the country has one of the lowest tax-to-GDP ratios in the world.

Therefore, it is difficult for the government to execute development projects from the current level of revenue collections. Similarly, the government needs to spend a lot of money on the salaries of its employees and on pensions.

"The reduction of this type of fixed costs is not possible," said Mahmud.

Amid the lower revenue receipts, one of the options that the government is left with is printing money to meet the budget deficit and expenses.

"It is also not a good decision since it is harmful to the economy," said Mahmud, also a former professor of economics at the University of Dhaka.

The economist said Bangladesh sometimes feels complacent that the country will never default on foreign loan payments and there is a space for borrowing more from the external sector. "But it can create a loan trap for Bangladesh."

The faulty budget management can also create a debt trap even when borrowing is made from local sources, he warned.

"If the government keeps borrowing from local banks and continues repayments of the loan, it will create a trap. It is one kind of vicious cycle."

Prof Mahmud said development spending can't be elevated because of the weakness in revenue collections. "As a result, Bangladesh's expenditure in the education and health sectors has been one of the lowest among the developing nations."

Still, Bangladesh attained some incredible success in social sectors by reducing the child mortality rate, raising girls' school enrolment rate, and improving life expectancy.

"The development in the social indexes was made possible with low-cost solutions like oral saline and vaccines. However, if the successes have to be continued, the allocation in health and education should go up and the service quality in the two sectors should be improved."

He suggested reducing inflation and foreign debts to restore the stability of the economy.

"Only the construction of infrastructures can't ensure sustainable development because the government is relying on foreign debts to build them."

The economist said although the government's foreign debt did not reach an alarming level, the borrowing rate is growing alarmingly.

He said many businesses don't deposit the value-added tax they collect while selling goods although the prices of commodities have gone up owing to the spike in the VAT rate.

"More revenue collection from the source tax is possible, but it is not a good approach."

He urged domestic industries to cut their reliance on imports as the country will not qualify for the unilateral tariff facility after the graduation of the country from the group of least-developed countries to a developing nation in 2026.

Rather, the government should cut corruption to accelerate revenue generation, he said.

In replying to a query from a journalist, the economist also questioned why the International Monetary Fund has shown generosity by relaxing the terms before releasing the first and second tranches of its $4.7 billion loan.

"The current level of foreign currency reserves is not alarming, but the way it is falling is alarming."

Prof Mahmud said allocating expensive new cars to deputy commissioners and upazila nirbahi officers is one kind of expenditure and asked about the whereabouts of the old cars.

While moderating the competition, Hassan Ahmed Chowdhury Kiron, chairman of the DFD, called for improving food safety, reducing the incentives on export receipts, and increasing social safety net allocations.

Eden Mohila College won the competition beating the University of Barishal.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments