Tax receipts grow at healthy clip, still NBR likely to miss target

The National Board of Revenue (NBR) posted about 16 percent year-on-year growth in tax collections in the first 10 months of the current fiscal year. Still, it might be tougher for it to attain the government's goal of raising Tk 410,000 crore by the end of 2023-24, which ends on June 30.

Two research agencies also said the target, which many have described as ambitious at the beginning of the year, would once again remain unachieved.

If economists' projection turns into reality, it would be the 12th consecutive year that the NBR would miss the revenue generation goal.

The revenue administration raised Tk 289,376 crore in July-April of 2023-24, which represented 70 percent of the revised target for the financial year, according to the provisional data of the NBR.

This means taxmen will have to collect Tk 120,624 crore in the remaining two months of FY24.

"It looks like there will be a major shortfall by the end of June," said Prof Mustafizur Rahman, a distinguished fellow of the Centre for Policy Dialogue, a private think-tank.

Although a large chunk of revenue is deposited in the state coffer towards the end of a fiscal year, there might be a big gap between the revised target and the actual collection.

"The tax collection target is likely to be missed," said MA Razzaque, research director of the Policy Research Institute of Bangladesh, also a think-tank.

"It's difficult for the NBR to raise revenues as per target because the economy is witnessing slowdown, and the government has put in place import restrictions."

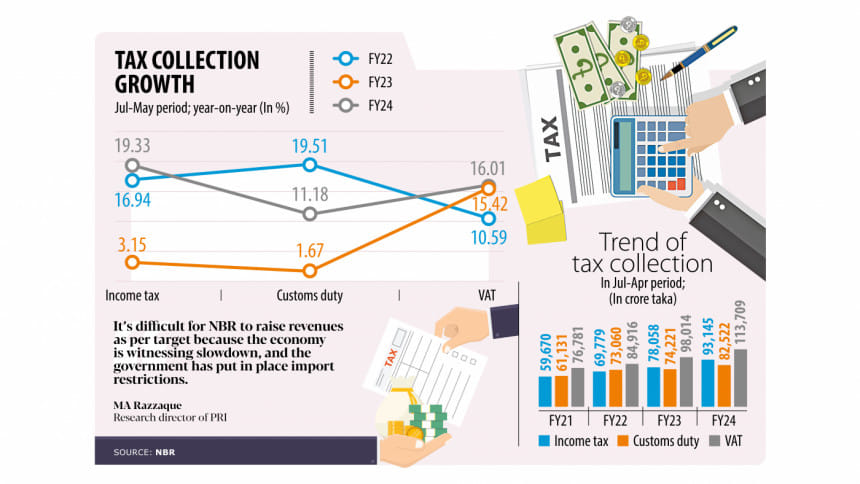

NBR data showed that tax collection from international trade grew 11.18 percent year-on-year to Tk 82,522 crore in July-April owing to falling imports as the government has put in place curbs to save dollars amid the protracted foreign exchange reserve crisis.

Income tax receipts rose 19.33 percent to Tk 93,145 crore, while the collection of value-added tax, the biggest source of revenue, grew 16.01 percent to Tk 113,709 crore.

Still, there are many businesses that don't deposit the VAT they collect while selling goods, said Wahiduddin Mahmud, a former adviser to a caretaker government, on Saturday.

If the NBR, which mobilises more than 85 percent of the state's revenue, misses the goal, the country's fiscal space will squeeze further and will face deeper problems in the coming days.

This is because the government won't be able to spend on development programme and repay the interest of both domestic and foreign loans, according to Razzaque.

"If we need loans again to repay loans, the country may fall into a vicious cycle."

In Bangladesh, the tax-GDP ratio remained among the lowest in the world at an estimated 7.38 percent in 2022-23.

But Bangladesh has the potential to raise more taxes.

According to a recent study of the PRI, Bangladesh would receive an additional Tk 65,000 crore in taxes if collections can be increased by two percentage points through the expansion of the tax net and compliance with regard to personal income. This may raise the tax-to-GDP ratio to 10.4 percent.

If the government invests the additional revenue, it will increase the GDP growth by 0.2 percent, the PRI said.

CPD's Rahman said the lower revenue collection may hamper the government's expenditure plan.

"The investment for NBR's digitalisation is a must and there must be proper coordination. It also needs to focus on enhancing the capacity of the officials and adopt technologies."

He urged the NBR to prioritise the direct tax and align expenditures with incomes. "It will help reduce tax evasion."

Speaking to The Daily Star recently, Sadiq Ahmed, vice-chairman of the PRI, said there is no shortcut to digitalisation of the tax system and there is no reason why a country can't put it in place within six months to nine months.

The former World Bank official described the emphasis on VAT and duties as primitive. "We will have to get rid of this."

He said India has raised its tax-to-GDP ratio from 12 percent to 18 percent in five years. "Therefore, raising the ratio is possible."

Ahmed said penalties for tax non-filing and tax-dodging should be severe and the tax files of the rich and the wealthy should be natural candidates for audits.

The government is likely to set a revenue generation target of Tk 4.80 lakh crore for the NBR in 2024-25, which is an increase of 17 percent compared to this year's target and exceeds the board's average annual revenue growth of 11 percent over the past five years.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments