FDI slips but stays above $3b

Foreign direct investments to Bangladesh snapped its rising trend in 2023, highlighting the nervousness outside investors face in pumping money into a country whose foreign exchange regime is experiencing one of its worst periods in recent times.

Central bank data showed yesterday that Bangladesh received $3.004 billion in FDI last year, a decrease of 14 percent from $3.5 billion in 2022.

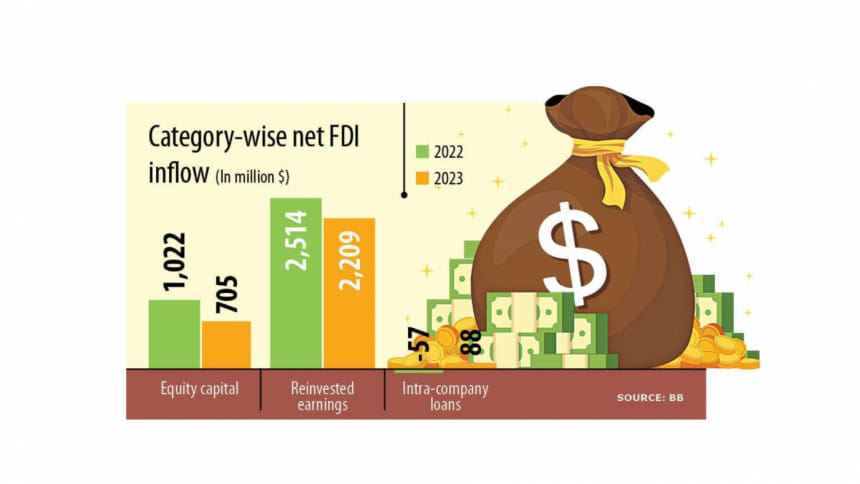

Inflows of equity capital, which refers to investors' purchase of shares of an enterprise in a country other than their own, plummeted 31 percent to $705.83 million from $1.14 billion in 2022.

Reinvested earnings, which happen when a company ploughs back its profits instead of repatriating, declined 12.1 percent to $2.21 billion. Intra-company loans, however, rose to $88.91 million from a negative $57.65 million in 2022.

M Masrur Reaz, chairman of the Policy Exchange Bangladesh, a think-tank, said the drop is disappointing.

"And it comes at a time when the country needs foreign currencies to ride out the macroeconomic challenges that have persisted for the past two years. This is even more important when FDI-led diversification of the economy is needed."

He, however, said the decline is not surprising. "This is because our capabilities in attracting FDIs have not increased in line with our economic success and the economy's growing strength."

Reaz also said there is also a lack of targeted strategies and promotion to bring in foreign investments.

"Weaknesses in business climate, the trade policy, in the logistics sector and the outdated regulatory framework also did not help."

The former economist of the International Finance Corporation said FDI has been the clear victim of the macroeconomic challenges.

"When there is volatility in the exchange rate, a fall in foreign currency reserves, import compressions and production disruption, foreign investors don't feel encouraged in investing in a country."

The reserves slipped below the $19-billion mark earlier this month owing to elevated global commodity prices, supply disruptions, a slowdown in external demand, and a shift in remittances back to informal channels. It was $40.7 billion in August 2021.

This forced the central bank to limit imports of luxury and non-essential goods. The taka has lost its value by 35 percent against the US dollar in the past two years.

In 2023, gross FDI inflows were $3.97 billion, recording a decrease of 17.8 percent compared to 2022. The trend has continued in 2024.

The gross inflows, which include capital repatriation, reverse investment, loans to parents, and repayments of intra-company loans to parents, fell 4.92 percent to $3.21 billion in July-March of the current financial year, according to the Metropolitan Chamber of Commerce and Industry.

The fall in the FDI explains why the financial account, a key component of the balance of payments, has been stuck in deficit for a long time.

The financial account covers claims related to FDI, medium and long-term loans, trade credits, net aid flows, portfolio investments, and reserve assets.

The deficit in the financial account stood at $9.25 billion in July-March of 2023-24, according to the BB.

Bangladesh received the highest net FDI from the United Kingdom, which channelled $613.93 million, or 20.4 percent of the total.

Some $366.96 million came from the Netherlands, $314.9 million from the United States, $259.54 million from China, $181.43 million from South Korea, and $176.87 million from Norway.

In 2023, the manufacturing sector attracted the maximum net FDI, bringing in $1.26 billion. The power, gas and petroleum sector came second with an inflow of $581.27 million.

The trade and commerce sector received $551.97 million, the transport, storage and communication sector got $290.11 million, and the services brought in $208.52 million.

FDI stock in Bangladesh was $20.55 billion at the end of 2023, down 5.1 percent from a year prior, BB data showed. It also fell in 2022, the first decline in 19 years.

Zaved Akhtar, president of the Foreign Investors' Chamber of Commerce & Industry, said there are a few provisions in the current tax regime that are creating an unfair tax burden on businesses. Such rules are adversely impacting the growth of investment and FDI.

This can be best illustrated by how treating disregarded expenses as separate taxable income imposes an unjust additional tax liability on businesses, thereby raising their operational costs, he said.

This is particularly problematic because it undermines efforts to cultivate a business-friendly environment, he said.

Moreover, the FICCI chief says, the taxes are considered as deducted or collected and the minimum tax can't be carried forward or refunded, further complicating the tax framework.

"Reforming such unfavourable rules is crucial to lessen the financial burden on businesses, which will in turn stimulate investment, and foster a more supportive business climate."

Masrur Reaz urged the government to come up with a mid-term and long-term plan to attract a higher volume of FDIs.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments