Stock indices at nearly 4-year low

Major indices of Dhaka Stock Exchange (DSE) yesterday extended their losing streak, marking a third day of decline after the government unveiled its proposed national budget for fiscal year 2024-25.

The DSEX, the benchmark index of the country's premier bourse, dropped 0.70 percent to close the session at 5,070 points. This is the lowest point to be reached since December 9, 2020, when the index stood at 5069.88 points.

The DSEX shed a total of 167 points, or 3 percent, over the past three days with many analysts pointing to some proposed budgetary measures as the reason for its decline.

For example, the government plans to reinstate capital gains tax of at least 15 percent on investors' income of more than Tk 50 lakh.

However, the DSE Brokers Association (DBA) has urged the government to hold off on this move for at least another year as it could worsen the market's condition by eroding investor confidence.

Citing how the local stock market has been in a bear-run for about four years now, DBA President Saiful Islam said while they are not against the capital gains tax, now was not the right time for such a measure.

"Floor prices prevented many investors from trading shares in the past two years," he said while speaking at a press conference at the DSE members' lounge in Motijheel yesterday.

Besides, the indices have been falling constantly ever since the lifting of the mechanism limiting price falls, leading to the negative sentiment that now prevails across the market, he said.

And other than investors, even the Bangladesh Securities and Exchange Commission (BSEC) did not know that such a tax measure would be proposed. So, many stakeholders were surprised when the decision was announced, he said.

Against this backdrop, Islam suggested that the National Board of Revenue (NBR) should not only put off imposing the tax, but also simplify its definition so that the investors can properly understand the way it comes into effect.

Additionally, an explanation should be circulated regarding whether investors will be allowed to carry forward their capital losses for adjustments with potential gains in subsequent years when calculating the tax.

"Many investors are becoming impoverished while many intermediaries are becoming sick due to the prolonged bear-run," he said.

The government currently charges Tk 0.05 on every Tk 100 worth of turnover, which is much higher compared to the rates in neighbouring countries, Islam said while urging to reduce it to Tk 0.02.

He also said the budget should have a roadmap on listing state-owned enterprises as it would boost investor confidence.

Investors are currently leaving the market due to a lack of confidence, he added.

Pointing to the example of a leading brokerage house, the DBA president said it once used to open 24 to 25 beneficiary owner accounts every day. Now though, it could open just 25 beneficiary owner accounts in the past five-and-a-half months.

"Investors are the heart of the capital market, so how will the market stay alive if they leave?" he asked.

Answering a question on whether the market will bounce back thanks to the tax measures, Islam said the market suffers mainly due to a lack of good companies, lack of transparency in listed companies and low capability of institutional investors.

"The investor culture is not up to the mark as most of them run behind short-term profits," he added.

Regarding the activities of the DSE, Islam said the stock exchange has two mandates after demutualization -- one is making it profitable and the second is regulating the market as a primary regulator.

"As a shareholder of the DSE, I can say that its performance is not up to the mark," he added.

Islam also pointed out that the bourse has been missing a chief technology officer for a year while its chief operating officer post has been vacant for months.

"The DSE chairman acknowledged they are not adequately empowered to regulate the market," he said.

And although the independent directors are well established in their other engagements, they could not bring any positive change for the market and its investors, he said.

"So, time has come to review the demutualization act," Islam added.

The DSES, the index that represents Shariah-compliant companies, slipped 0.89 percent to 1,093.78 points while the DS30, which comprises the best blue-chip stocks, shed 0.48 percent to hit 1,803.06 points.

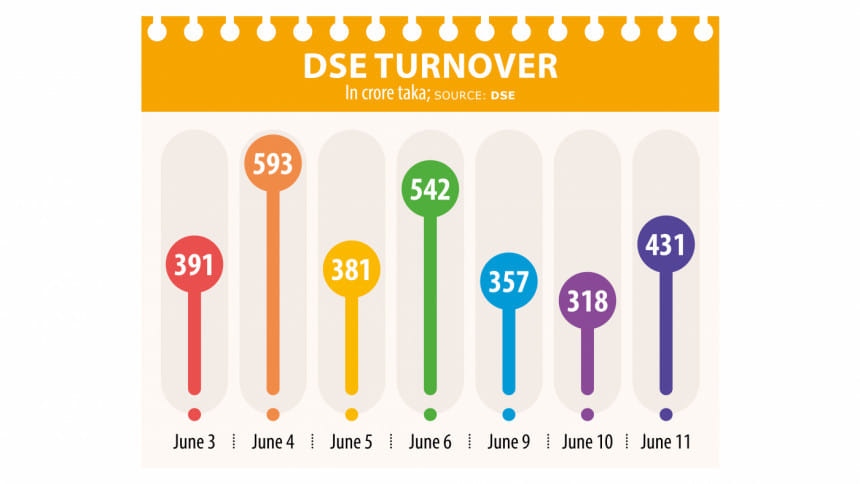

Turnover of the DSE, which is the total value of shares which changed hands on the day, rose 35 percent to Tk 431 crore.

Among the shares to undergo trade, 51 advanced, 308 declined and 35 remained unchanged.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments