Can Bangladesh be a semiconductor hub?

The semiconductor manufacturing sector is well-known for its complexity, high stakes and intense corporate competition. Demand has always been driven by innovation, with every new technology changing the game.

Right now, artificial intelligence (AI) is leading the way in innovation and has the potential to catapult the semiconductor industry into a new growth trajectory. Specialised hardware, or semiconductors designed with AI in mind, will be essential for enabling AI applications. In the near future, the need for AI-specific chips will soar due to the expanding need for instant computing, seamless connectivity, and advanced sensing capabilities.

Asia has a market share of approximately 90 percent in chip assembly and testing, and more than 75 percent of the world's capacity for fabricating semiconductors is based here. Taiwan is a dominant force in the industry, holding a 68 percent market share and is home to numerous cutting-edge chip manufacturing facilities.

Nearly 90 percent of the cutting-edge chips for AI and quantum computing in use today are produced by TSMC, a well-known Taiwan manufacturer.

India has made significant progress with initiatives like "Make in India" and substantial investments in semiconductor plants, aiming to become a global hub. In the 2024 interim union budget, India substantially increased funding for semiconductor and display manufacturing support.

The Indian semiconductor market, valued at $34.3 billion in 2023, is forecasted to surge to $100.2 billion by 2032. Micron, a prominent American chip company, has pledged $825 million for a facility in India, expecting to generate more than 300,000 jobs by 2026.

In the midst of the chip competition between China and the United States, Vietnam seeks to draw investment by bolstering its semiconductor industry through tax breaks and incentives. Grants and collaborative research with private firms such as FPT are planned.

Vietnam is home to Intel's main facility, but it also wants to draw in other companies like Samsung and Nvidia. By 2030, the government wants to train 50,000 engineers and added semiconductors to national development initiatives. The country may become a major player in the semiconductor supply chain.

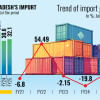

Bangladesh is witnessing a nascent emergence of the semiconductor industry, which forms the foundation of contemporary electronics. It is venturing into the semiconductor space because of growing demand for electronics worldwide and a deliberate drive towards digitalisation. Currently, the industry is mainly focused on low-end assembly and testing rather than high-end semiconductor manufacturing.

The country must take care of its vital infrastructure requirements if it hopes to develop a competitive semiconductor industry. To create a workforce with the necessary skills and knowledge, technical education and training must be improved. This development can be facilitated through collaborations with leading global educational institutions and professionals.

Research centres specialising in semiconductor technology and grants for university and industry research serve as growth-promoting factors for research and development. It takes a significant financial commitment to build cutting-edge fabrication facilities, but this can be accomplished with public-private partnerships and incentives for foreign investment.

It is essential to establish a thorough supply chain that includes vendors of machinery, components, and raw materials. This ecosystem can be developed by supporting startups and encouraging relevant companies to enter this market.

Additionally, implementing policies that support the semiconductor industry like tax incentives, befitting regulations, and protection of intellectual property rights, can attract and retain investments.

The author is an economic analyst.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments