Deposits of Bangladeshi banks, nationals in Swiss banks hit lowest level ever

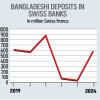

Deposits of Bangladeshi nationals and banks in Swiss banks declined by 68 percent year-on-year to 17.71 million Swiss francs (CHF) last year, the lowest ever, reflecting the falling attractiveness of Switzerland among the wealthy people to park money.

The deposits were 55.2 million Swiss francs (CHF) in 2022, according to data by the Swiss National Bank released yesterday.

This is the second year in a row that deposits kept by Bangladeshis have fallen in Swiss banks. But that does not mean that illicit outflow of capital from the country has stopped, said two analysts.

"Of course, illegal money siphoning out of the country has increased and it is taking place. But Swiss banks are not favourite destination anymore. It is not a place to keep identity secret anymore," said Ahsan H Mansur, executive director at the Policy Research Institute of Bangladesh.

"Now, Dubai, and Singapore are favourite destinations as the nearest destinations. Money is siphoned off to and is invested in real estate and business in the USA, and England."

People who have transferred money there have business operations there. They have registered firms in Dubai, Singapore, said Mansur, a former economist at the International Monetary Fund.

Switzerland had once kept the information of depositors confidential. Now it is not doing this anymore. It provides information to the state if any government seeks, he added.

Data from the Swiss National Bank showed that Bangladeshi nationals kept 13.96 million CHF in Swiss banks in 2023, the lowest since 1997.

The amount was 78 percent of the total deposits of 17.71 million CHF or $19.86 million.

The deposits at Swiss banks were Tk 233 crore in Bangladeshi taka. In the case of Bangladeshi nationals, the deposit amount was Tk 184 crore.

Mansur said Bangladeshis living in Switzerland may hold a portion of the deposits. And a portion of reserves of Bangladesh are kept there, he added.

Iftekharuzzaman, executive director of Transparency International Bangladesh, said Switzerland is one of the many destinations for illicit fund transfer.

Switzerland is a conventional destination. But since it joins global efforts against money laundering and corruption, it has lost its attraction, he added.

"Many more destinations for illegal money transfer have come up and they are more attractive," he said citing Malaysia, Singapore, and the Middle Eastern countries.

"Plus, there are offshore destinations to park money. One can buy properties in the UK, the USA and Canada, which is not easy in the case of Switzerland," added Iftekharuzzaman.

"So, the falling deposits in the Swiss kept by Bangladeshi citizens and banks does not provide any relief that illegal capital flight has declined."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments