ADB to lend $20.8b to Bangladesh over four years

The Asian Development Bank (ADB) is expected to provide $20.8 billion in loans to Bangladesh in the next four years as the country looks to accelerate economic growth and attain the upper-middle-income status in less than a decade.

The amount is 42.3 percent higher than the $12 billion the country received in the previous four years, documents from the Manila-based lender showed.

Of the expected financing, $16.4 billion, or 78.85 percent of the total, will be extended as ordinary capital resources (OCR) loan, since the country's capacity to pay back has gone up.

The interest rate for the OCR portion is near market-based. The rest of the loan will be concessional.

The loans at near-market terms have a repayment period of 25 years and a grace period of five years. The interest rate is SOFR plus 0.75 percent.

The Secured Overnight Financing Rate (SOFR), which is replacing the London Interbank Offer Rate (LIBOR), was 5.32 percent on Thursday, data from the Federal Reserve of Bank of New York showed.

The concessional loans have the same repayment schedule, but the interest rate is fixed at 2 percent.

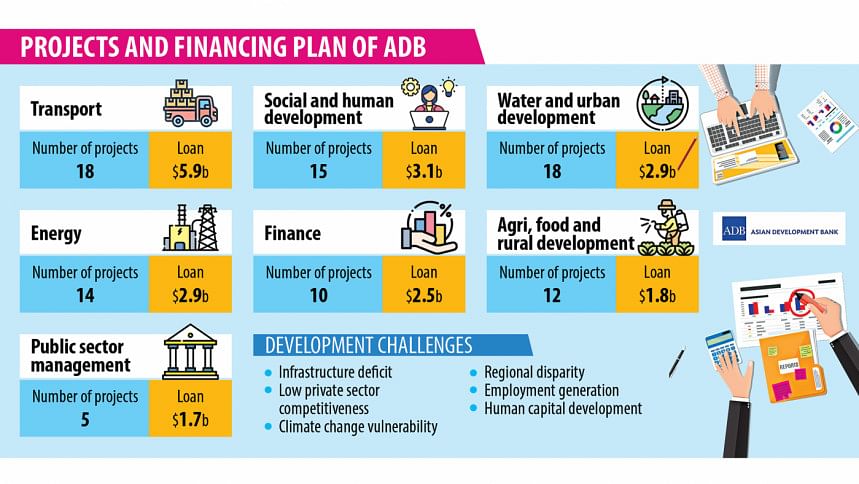

The ADB has set a loan pipeline for 92 projects in seven sectors from 2024 to 2027, the documents related to its country programme showed.

The projects included Mass Rapid Transit (MRT) Line-5 (Southern Route); SASEC (South Asia Subregional Economic Cooperation) Dhaka-Chattogram Highway Improvement Project; SASEC South Corridor Improvement Project (Faridpur-Barishal Highway); and Dhaka Power System Expansion and Strengthening Project.

The Economic Relations Division will hold a meeting with the ministries and divisions today to finalise the projects under the pipeline.

While there is no specific allocation for regular OCR loans, the ADB expects to commit around $16.4 billion between 2024 and 2027, subject to the readiness of the proposed projects.

It expects to commit around $2.3 billion for 2024, $4.2 billion for 2025, $4.9 billion for 2026, and $5 billion for 2027.

As per its pipeline, the ADB will provide $1.8 billion for 2024-2027 for 12 projects in the agriculture, food, nature and rural development sector; $2.9 billion for 14 projects in the energy sector; and $2.5 billion for 10 projects in the finance sector.

Some $3.1 billion will be given to 15 projects in the human and social development sector, $1.7 billion for five projects in the public sector management and governance sector, $5.9 billion for 18 projects in the transport sector, and $2.9 billion for 18 projects in the water and urban development sector.

The projects are in response to the bottlenecks confronting Bangladesh.

The main development challenges that Bangladesh faces include infrastructure deficit, low private sector competitiveness, climate change vulnerability, and regional disparity, said the ADB.

It is also experiencing challenges in the areas of employment generation, human capital development, social protection, and governance, it said.

Responding to these challenges and aligning with the government's growth plans, the ADB's country partnership strategy (CPS) 2021-2025 aims to boost competitiveness, employment, and private sector development, promote green growth and climate resilience, and strengthen human capital and social protection.

Currently, the government is preparing the Ninth Five-Year Plan to successfully graduate from the group of the least-developed countries in 2026 and attain the upper-middle-income country status by 2031.

The ADB said the public sector management and governance sector programme will address the economy's fundamental development challenges by mobilising domestic resources, promoting economic diversification, trade openness and investment, encouraging green growth, and strengthening institutions and governance, with a focus on digitalisation.

The transport sector's lending will pursue "transformative pathways to shifts to low carbon transport and decarbonised systems", said the ADB.

The support for the agriculture, food, nature and rural development sector will look to manage climate change and disaster risks, improve rural access to market and rural livelihoods and productivity, and strengthen institutional capacities.

The ADB said the country is navigating several macroeconomic challenges, including low revenue mobilisation and foreign exchange reserves, elevated inflation, low direct investment, and heightened banking sector vulnerabilities.

To address these issues, the government is taking proactive measures such as the implementation of a formula-based petroleum fuel price adjustment mechanism, realignment of the exchange rate, liberalisation of retail interest rate, and revenue-based fiscal consolidation, the development lender added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments