Islamic banks’ liquidity plummets 77% in 3 months

Liquidity at Islamic banks in Bangladesh has decreased drastically, deepening a lingering cash crunch at the crisis-hit Shariah-based banks.

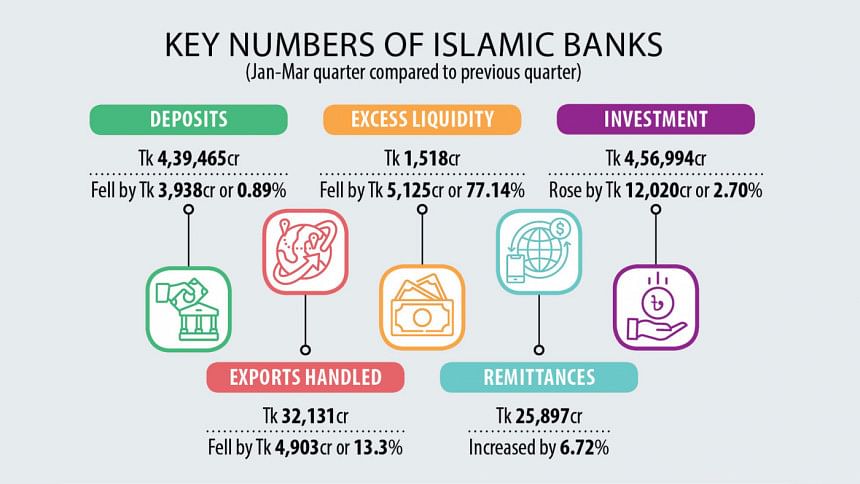

Excess liquidity at Islamic banks fell by 77.14 percent to Tk 1,518 crore at the end of March this year, according to the Bangladesh Bank's latest quarterly report on Islamic banking.

It was Tk 6,643 crore at the end of December last year.

This means that the excess liquidity dropped by Tk 5,125 crore in the span of just three months.

Year-on-year, the March figure was down by 27.82 percent, meaning Tk 585 crore.

Excess liquidity is calculated after a bank has met the regulatory requirements of cash reserve ratio (CRR) and statutory liquidity ratio (SLR).

Shariah-based banks must keep a CRR equal to 4 percent of customers' deposits in cash with Bangladesh Bank overnight alongside an SLR equal to 5.5 percent of customers' deposits in the form of cash, gold or other securities.

The country's Shariah-based banks are facing a severe liquidity crisis apparently due to an increase in loan disbursements.

The total amount of outstanding loans in the banking system increased by Tk 12,020 crore or 2.70 percent to Tk 456,994 crore at the end of March 2024 compared to the end of December 2023.

It was also Tk 44,597 crore or 10.81 percent higher from that at the end of March 2023.

Islamic banks accounted for 28.24 percent of the total loans and advances of the whole banking sector at the end of March 2024.

Meanwhile, the total amount of deposits in the banking system stood at Tk 439,465 crore at the end of March 2024, down Tk 3,938 crore from that at the end of December last year.

It was Tk 27,834 crore or 6.76 percent higher at the end of March 2023.

The share of deposits of Islamic banks was 26.23 percent of the total deposits of the entire banking sector at the end of March 2024.

Islami Bank Bangladesh accounted for the highest 34.74 percent of deposits of Islamic banks.

Al-Arafah Islami Bank accounted for the second-highest, 10.42 percent, followed by First Security Islami Bank (10.20 percent) and EXIM Bank (9.62 percent).

Besides, Social Islami Bank held 7.38 percent of the deposits, ICB Islamic Bank 0.28 percent, Shahjalal Islami Bank 5.88 percent, Union Bank 5.05 percent, and Global Islami Bank 2.91 percent.

Industry insiders said a liquidity shortage at some Islamic banks has been adversely affecting the overall banking sector.

The liquidity crunch is worsening although some banks have been taking liquidity support from the central bank.

An official of the Bangladesh Bank told The Daily Star that Islamic banks in Bangladesh were sitting on huge amounts of excess liquidity two to three years ago.

But now the sector is facing challenges due to massive loan irregularities at five of the banks, he added.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments