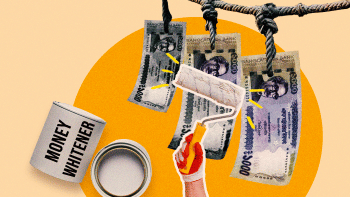

Amnesty for black money holders is a disgrace

We condemn the parliament's decision to once again approve a provision allowing black money holders to legalise undisclosed wealth without any scrutiny by paying a 15 percent tax, despite protests over the past few weeks. The provision is set to come into effect from July 1. While the country's highest income tax rate stands at 25 percent, allowing black money holders—many of them accumulating their wealth through corrupt means—to legalise it at a much reduced rate is truly befuddling. Experts, anti-graft watchdogs and even some lawmakers had strongly opposed the move which would send a wrong message to both individuals amassing black money and honest taxpayers.

The message is simple: the law is set in such a way that it favours black money holders over honest taxpayers. The former will no doubt be encouraged by it. And when those who earn their money legally are made to pay higher taxes compared to those who do so illegally, why should they, too, not try to game the system? Because the Awami League government has regularised this budget provision over the years, citing scenarios that defy logic, honest taxpayers (belonging to the higher tax slabs) may be forgiven for thinking they would be better off by not filing regular taxes, and making use of this provision later to pay a reduced tax. When laws are designed to create such discrepancies and encourage immoralities, it is not difficult to understand the moral standards of those arguing for these laws.

Given how widespread corruption has become in the country, the provision would come as a huge relief for the corrupt. They would be assured to know that despite massive public outcries, many in key positions are still willing to bend the rules in their favour. Not only that, they are even willing to undermine Article 20(2) of the constitution to do so. Except in 2020-21 (during Covid-19), the amount of black money whitened through this process has been a drop in the ocean compared to the estimated size of our black economy. The data clearly debunks the government's narrative that providing such a facility is going to bring significant amounts of black money into the mainstream. But even if it did, why would lawmakers accept money made from drug dealing, human trafficking, or other criminal activities being legalised under a special provision in the first place?

Having provided this facility repeatedly, has the government succeeded in reducing the size of the shadow economy? Has it improved its tax system or revenue collection as advertised? Has it managed to reduce corruption and strengthen rule of law? The answer to all these questions is a resounding "No". The government should, therefore, immediately withdraw the provision, and make sure black money holders—particularly those involved with criminal and corrupt activities—are held to account.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments