Losses of state enterprises may rise fivefold in FY25

The overall losses of state-owned enterprises in Bangladesh may rise by nearly five times in the current fiscal year compared to the previous year, according to a projection by the government.

A monitoring cell of the finance division under the finance ministry conducted a budgetary analysis of 50 entities under seven sectors.

Of them, six entities fall under the industrial sector, six under power, gas and water, eight transport and communication, three commercial, two agriculture and fisheries, six construction and 18 under the service sector.

The entities will end up making an overall loss of Tk 28,047.97 crore in fiscal year 2024-25, which started off this month.

This is 4.68 times higher than the total loss of Tk 5,989.87 crore incurred in FY24.

In FY25, the total earnings of the enterprises are estimated to be Tk 401,689.01 crore while the overall expense has been projected at Tk 429,736.98 crore.

The enterprises earned Tk 369,800.73 crore while they spent Tk 375,790.60 crore in the last fiscal year, according to the data from the Finance Division of the finance ministry.

The net loss of the state-owned enterprises was Tk 138.04 crore in fiscal year 2022-23.

Although most of the companies are making a profit their successes are being eclipsed by the performance of only 13 enterprises, including Bangladesh Power Development Board (BPDB) and the Trading Corporation of Bangladesh (TCB), according to the finance division's data.

The total loss of the 13 enterprises is projected to stand at Tk 36,144.93 crore in the current fiscal year.

Although the government has taken different austerity measures since the Covid-19 pandemic, the expenditures of the state-owned companies have been spiralling over the years.

The sharp rise in the losses of the state-owned companies has raised concerns among experts as a lingering macroeconomic crisis has gravely impacted people from all walks of life.

This is especially significant for the low and middle-income groups, who make up the major portion of the country's population of 170 million.

A better picture could be gleaned if the figures of profit and loss of the state-owned entities are audited by audit firms of an international standard, Golam Moazzem, research director of the Centre for Policy Dialogue, told The Daily Star.

Because in the past, it has been observed that there is a huge gap in the estimation and realisation of profit or loss of various organisations, he said.

"Besides, many of the entities are service providers who have no competitor in the market. They are making a profit due to their advantageous position as they are the single company in the market," he said.

"So, questions remain about how much profit they would have had under a competitive market mechanism," he said.

He said the loss of the service providing enterprises, such as the TCB, are understandable because they provide essential food commodities at subsidised prices specifically to low-income people.

However, losses of entities like the Power Development Board year after year are resulting from poor planning and policy decisions, Moazzem said.

Moreover, alternative modes of operations could be adopted for some of the manufacturing entities rather than keeping them afloat by bearing the losses, he added.

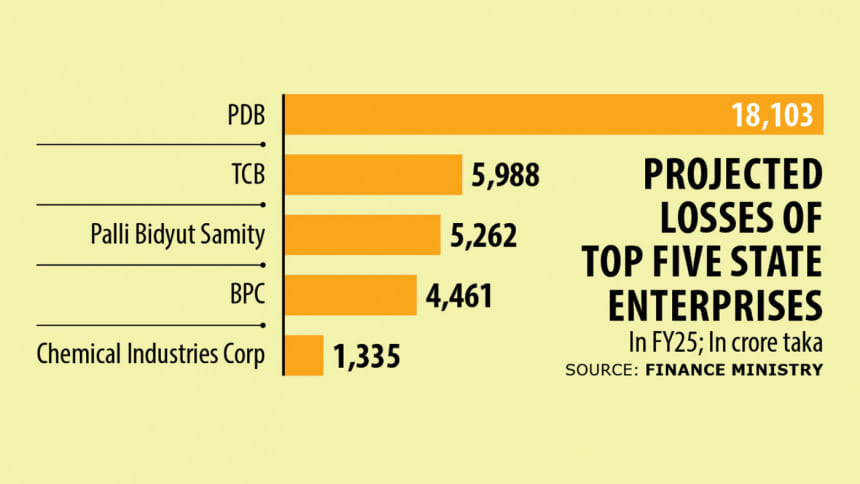

The BPDB is expected to incur the biggest loss. The board is likely to incur a loss of Tk 18,103.60 crore alone in FY25.

The board's loss will be almost three times higher in the current fiscal year than the loss it incurred last fiscal year.

In FY24, its loss amounted to Tk 6,117.19 crore, according to the finance ministry's budget documents.

The TCB is likely to incur the second biggest loss in FY25.

The loss is likely to amount to Tk 5,988.47 crore, which is 0.74 percent lower than its last year's loss of Tk 6,033.60 crore.

Palli Bidyut Samity under Bangladesh Rural Electrification Board is projected to take the third spot in terms of the amount of loss incurred in FY25 followed by Bangladesh Petroleum Corporation (BPC) and Bangladesh Chemical Industries Corporation (BCIC).

The loss of Palli Bidyut Samity is likely to be Tk 5,262.42 crore this fiscal year, which is 4.5 percent higher than its previous year's loss of Tk 5,035.48 crore.

The BPC's loss has been projected at Tk 4,461.68 crore, down from last year's loss of Tk 4,875.40 crore while the BCIC is likely to incur a loss of Tk 1,335.42 crore in FY25, which is lower than the previous year's loss of Tk 1,509.44 crore.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments