S Alam took more than half of Islami Bank’s loans

Chattogram-based business giant S Alam Group has taken more than half of the total loans disbursed by Islami Bank, said the Shariah-based lender's newly-appointed chairman.

At the end of June, Islami Bank's total outstanding credit stood at Tk 174,000 crore, according to the bank's records.

Another week is needed to gather the exact amount taken by S Alam Group, said Md Obayed Ullah Al Masud, chairman of Islami Bank, after a meeting with Bangladesh Bank Governor Ahsan H Mansur.

The group secured the loans by using overvalued assets; a reassessment of the group's assets is currently underway.

S Alam's collateral is insufficient to cover the amount borrowed, hence a letter has been sent to the law ministry to identify any assets outside the collateral, Masud said.

When the new board took charge, the bank faced a capital shortfall of Tk 2,300 crore.

The central bank reconstituted the Islami Bank board on August 22, with Masud, the former managing director of Rupali Bank, as its chairman. Four independent directors were also appointed.

"However, the shortfall is narrowing daily -- we expect the situation to improve by the end of this year."

As of Thursday, the shortfall stood at Tk 2,000 crore.

Customers would no longer face difficulties in withdrawing funds, he said, adding that deposits last week exceeded withdrawals, resulting in a net positive balance.

Asked about actions against Islami Bank officials who assisted S Alam Group, Masud said: "We do not plan to take immediate action against junior officials right as it could destabilise the bank."

However, senior officials who were involved are already being removed, and all responsible parties will be dealt with according to the law.

"No one will escape accountability, and no wrongful removals will occur either."

At the meeting with Mansur, Masud presented a roadmap to address the bank's crisis in three phases.

The first phase, which will end on December 31, will focus on recovery.

The second phase, which will be between 2026 and 2027, will mark a "turnaround", while the third phase, from 2027 to 2029, will focus on moving the bank forward.

S Alam Group, a Chhattogram-based business group blessed by former prime minister Sheikh Hasina, occupied the bank, the largest private lender by deposits in 2017, by force.

Once a profitable bank, its financial health took a nosedive after S Alam Group gained control in 2017.

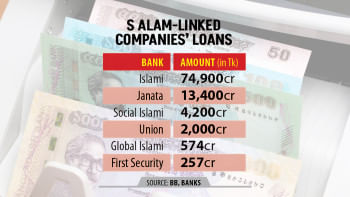

After taking control of the board, S Alam Group and its associated companies took Tk 74,900 crore loans from the bank, which is 47 percent of Islami Bank's total outstanding loans as of March this year, according to the bank's documents.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments