A regime of crony capitalists

When the Awami League (AL) announced its manifesto with the slogan 'Charter for Change' ahead of the general elections in 2008, it drew applause from various sections of society.

Five key promises were articulated in the document -- lowering commodity prices and avoiding an economic depression, curbing corruption, increasing power and energy generation, eradicating poverty and inequity, and establishing good governance.

The party, led by Sheikh Hasina, won by a landslide and formed the cabinet in January 2009.

Six months later, it registered a big triumph, reducing annual inflation to 6.66 percent from 9.93 percent the year prior.

The AL alliance managed to keep prices to tolerable levels for the next two years, but annual inflation soared to its highest level since the turn of the millennium shortly thereafter, hitting 10.62 percent in fiscal year 2011-12.

However, it began to decline again thereafter, settling below 6 percent within three years.

We have seen infrastructure development during the 15-year rule of the past government. But there was overcapitalisation due to corruption.

That trend persisted for quite a while but finally lapsed in FY23, when consumers began to feel the pinch of rising inflation and the gradual erosion of real incomes.

The month prior to the ouster of the Sheikh Hasina-led AL government by a mass uprising on August 5, Bangladesh's consumers were grappling with exorbitant prices.

In July, inflation stood at 11.66 percent, the highest in 13 years, standing in stark contrast to what the party had promised before it came to power 15 years ago.

The unbridled spiral in prices also undid much of the strides made during the AL government's tenure in reducing the poverty rate, which dropped from 31.5 percent in 2010 to 18.7 percent in 2022. Extreme poverty also declined.

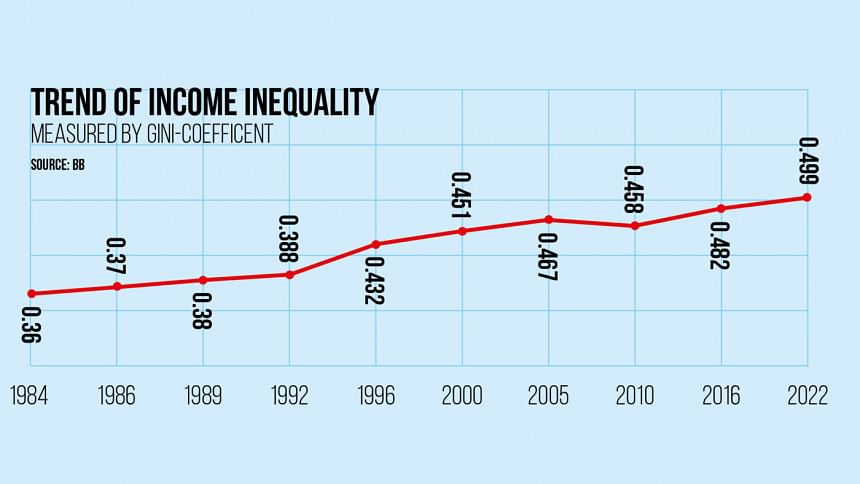

However, despite the economy growing at over 6 percent annually for one and half decades, inequality during the Hasina's tenure in terms of both income and consumption began to stand out.

"There was growth, but it was jobless growth. It was the growth of discrimination and injustice," stated MM Akash, a former professor of economics at the University of Dhaka.

There was growth, but it was jobless growth. It was the growth of discrimination and injustice.

Inequality, as measured by the Gini coefficient, rose to a historic high of 0.49 in 2022 from 0.45 in 2005 although the AL had promised inclusive growth.

According to the scale, 0 represents a perfectly equal distribution of income or wealth while 1 reflects the extreme opposite.

Economists said the nation saw the divide grow as cronies rushed onto the scene and began to rule the roost.

From securing and rescheduling loans from banks to grabbing public contracts for power, energy and public infrastructure projects, cronies and politically influential individuals seized control.

This overtime became the rule of the game over time.

"It was a regime of crony capitalists. All loans and licences were given based on cronyism, not efficiency," Akash said.

"Crony capitalism grew in South Korea too. But those cronies were nationalists. Here, we saw the opposite. Capital flight was rampant."

After being sworn into office in early January 2009, the AL-led grand alliance had a relatively smooth takeoff. The turbulence in the global economy was reducing. The commodity market, which became volatile during the global financial crisis in 2007-08, had also begun to recede.

Prices were also falling domestically, supporting the government's efforts to frame and implement policies.

Consequently, the party enjoyed stability on the economic front, which facilitated garment exports. Additionally, a number of people also found employment abroad.

"These favourable global economic conditions helped Bangladesh," said Selim Raihan, a professor of economics at the University of Dhaka.

One of the AL government's major initial steps was aimed at the power sector, which was contending with acute supply shortages. As such, complaints were rife that the energy deficit was one of the major impediments to investment.

When the AL took charge, Bangladesh's power generation capacity was roughly 5,000 megawatts.

Against this backdrop, the new government moved swiftly to frame the Quick Enhancement of Electricity and Energy Supply (Special Provisions) Act, 2010 in a bid to increase power generation and meet climbing demand.

However, the act included some curious clauses. For example, one stipulation stated that no question about any action, order or direction under this law could be raised before any court.

The decision created a rush among the private sector for the establishment of power plants as the government went on to purchase electricity through the direct purchase method, avoiding the competitive bidding process.

The number of power plants, which stood at just 27 in 2009, soared to over 150, largely owned by the private sector.

Today, private power plants account for at least 42 percent of the nation's total power generation capacity of 31,520 MW.

Zahid Hussain, a former lead economist of The World Bank, said the energy supply act had helped increase electricity generation capacity but it came at a great cost.

"It bankrupted the Bangladesh Power Development Board as noncompetitive procurement opened the floodgates for overpriced contracts."

Earlier this year, the AL government curtailed the power of the Bangladesh Energy Regulatory Commission to decide electricity prices.

This decision enabled the government to pass on the costs of unbridled corruption to electricity users, he added.

Anu Muhammad, a former professor of economics at Jahangirnagar University, said mega-corruption took place in the energy sector.

"The plan that was taken was environmentally disastrous, a financial waste and thoroughly corrupt," he said.

He cited the ill-advised focus on building a coal-based power plant in Rampal, near the Sundarbans, and the nuclear power plant at Rooppur.

"Much of the energy needs could be met through renewables," Muhammad said.

The AL government targeted to generate 10 percent of electricity through renewable sources by 2020. But it fell well short of the goal.

At present, renewable sources account for around five percent of total electricity generation capacity, according to government data.

Hussain said the public had high expectations that the AL government would adopt policy and institutional reforms, especially in terms of public financial management, transparency, infrastructure, energy, finance, trade, education, health, and social protection.

"That government fell on August 5, leaving behind demolished institutions and botched policies in each and every one of these areas."

Initially, the government vetted legislative reforms passed through presidential ordinances under the caretaker government.

These included the public money bill, the right to information act, separation of lower judiciary from administration, the energy regulatory commission act and so on, he said.

"Subsequently, it amended these and many pre-existing legislations such as the anti-corruption act in ways that neutralised the powers of these laws. The executive branch monopolised all the power, undoing the checks and balances that are essential for accountable management of public policies."

Hussain said the Value Added Tax law, framed in 2012, was state of the art for its time. But it was only framed to satisfy the International Monetary Fund (IMF) so the multilateral lender would disburse $1 billion in credit.

"Implementation of the law was delayed year after year. During this time, several amendments made the new law worse than the one it replaced in 2017."

"Some of the good initiatives were mismanaged by cronyism," he said, citing the rule which directed all expanded stipend programmes in education to be distributed among beneficiaries through one mobile financial service provider, namely Nagad, a company he believes "was born through licensing irregularities".

"The same goes for the kleptocratic management of social assistance and financial stimulus programmes in response to the Covid-19 pandemic."

He added that the Padma Bridge was a notable example of a nationally beneficial investment that took too long to complete and cost a lot more than necessary.

Approved in August 2007, the Padma Bridge, which connects 21 southwestern districts through roads and railways to the capital, was supposed to be implemented at a cost of Tk 10,162 crore within June 2015.

However, its opening was pushed by seven years to June of 2022, by which time costs had ballooned to Tk 30,770 crore.

"We have seen infrastructure development during the 15-year rule of the past government. But there was overcapitalisation due to corruption," remarked Mustafizur Rahman, a distinguished fellow at the Centre for Policy Dialogue (CPD).

"We have seen people with vested interests get contracts due to a lack of good governance and accountability."

However, he also said there had been some gains during the AL's tenure.

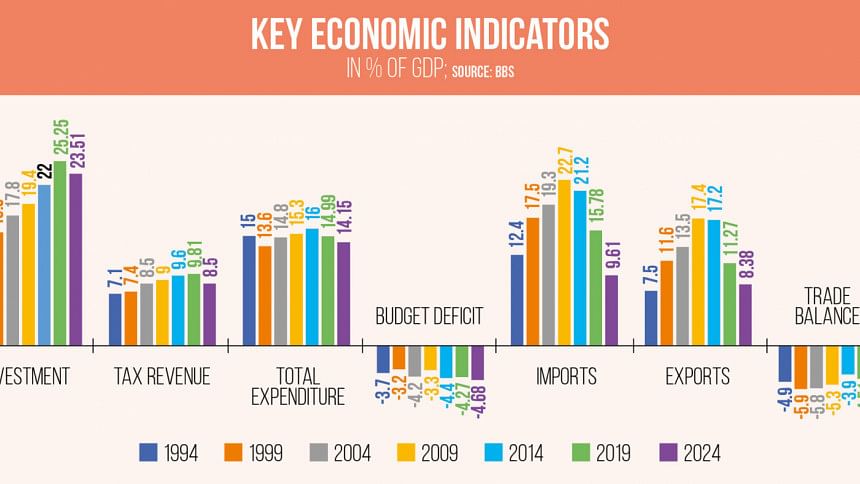

Naming a few positives, he said poverty levels had declined, infrastructure was developed, electricity generation and supply increased, agricultural production rose and exports experienced an uptick.

Data from the Power Division shows that nearly 100 percent of the population came under electricity coverage over the past one and half decades, up from less than half.

Production of rice, a staple food item, rose to nearly 4 crore tonnes from 3.13 crore tonnes in FY09, according to the Bangladesh Bureau of Statistics (BBS). Production of vegetables, such as potatoes, and fish also grew during the period.

"There has been some progress. However, the development could be termed extremely discriminatory. We have not seen the government take the path of inclusive economic growth and development," said Mustafa K Mujeri, executive director of the Institute for Inclusive Finance and Development (InM).

The development that took place in the last 15 years could also be termed costly, according to Mujeri.

"Because of corruption and money laundering, the costs of public projects were two-three times greater than what they should have been."

CPD's Rahman said infrastructure had been developed, but the flip side of that was reflected by an increased burden of debt.

"We are at risk of debt distress," he cautioned.

He also highlighted the troubles that plagued the banking sector during the AL's tenure.

"We have been raising concerns about capital flight and the weakening of the banking sector due rising default loans," he said.

"Crony capitalists grew and they used the banking sector as their wallets."

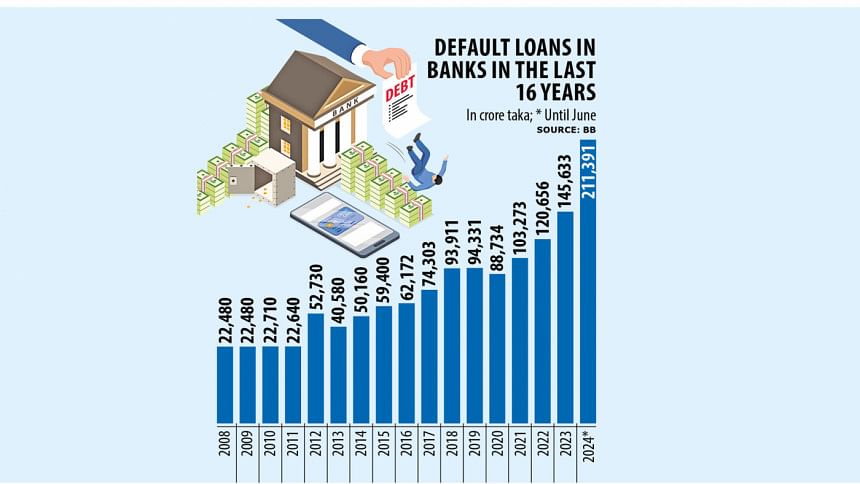

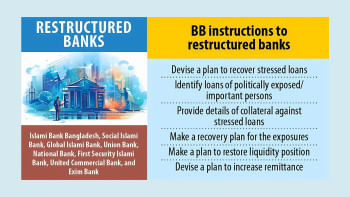

Default loans in the banking system surpassed Tk 200,000 crore for the first time at the end of June this year, underlining the fragile condition of the sector that fell prey to rampant scams and irregularities under the tenure of the Awami League government.

Bad loans in the banking sector stood at Tk 22,480 crore when the Awami League won the first of four consecutive general elections in 2008.

The amount accounts for 12.56 percent of the total disbursed loans.

But risky assets are far higher, totalling to around 400,000 crore if non-performing loans as well as rescheduled and written-off loans are considered.

"I can think of three black laws that damaged the ethical side of business, banking, and finance," said Birupaksha Paul, a professor of economics at the State University of New York in Cortland.

"The directorship law converted private banks into family-owned grocery shops. Second, relaxing the definition of defaulted loans induced moral hazards and cemented the eventual death of the banking industry by justifying willful looting. Finally, the provision to allow black money to be whitened by simply paying a 15 percent tax represented unethical validation for illicit financial outflows."

Elaborating on the first point, he cried that during the AL's tenure, Islami Bank, the largest bank in terms of deposits, was taken over by the Chattogram-based conglomerate S Alam Group's founder, Mohammed Saiful Alam.

S Alam and his family members have significant stakes in half a dozen banks and were allowed to hold a higher amount of shares than the permissible limit based on special approval from the central bank.

The Bank Company Act was amended to increase the tenure of a board member to 12 years from nine years at the last moment, showing the influence of major shareholders of banks on the government.

Patronised by politically influential individuals, loan scams and rescheduling of defaulted loans were ubiquitous.

"These are the biggest blunders that the Awami regime has committed, pampering oligarchs and financing their political interests," Paul said.

Raihan added that the economy was on the path of high growth supported by fabourable global economic conditions until 2019. This, combined with the low levels of inflation that prevailed for most of the AL's tenure, gave the government legitimacy.

"But it suffered from crises whenever unfavourable conditions emerged, such as during the Covid-19 pandemic. There was not enough resilience in the economy," he said.

"The economic growth failed to create enough jobs. On several occasions, we raised concerns that the jobless rate was growing. We could not diversify exports either."

Education and health desperately required increased investment, but budgetary allocations always fell short of the requirement.

"So, in one sense, it was a decade of lost opportunity for human capital formation," Raihan said.

Mujeri said discrimination had permeated all facets of life during the AL's tenure as its perspective of governance was neither development-oriented nor inclusive.

"Short-term gains are unsustainable. There is no credit if you cannot ensure long-term development," InM's executive director added.

"We strayed from establishing a democratic and participatory state and society. The main lesson is that unless there are checks and balances and democratic values, development activities will be unsustainable and will not yield any long-term benefits.

"State structure should be designed in line with that. That brings the issue of reforming the institutions."

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments