Globe Edible Oil Ltd: S Alam’s backdoor takeover attempt

S Alam Group's takeover of the Islami Bank to drain the healthiest bank of the country had left investors and customers in shock. It did not stop there.

Now allegations have emerged that it used the bank in its bid to force the chairman of another group to sell their cooking oil business to the Chattogram-based conglomerate.

Globe Pharmaceuticals Group of Companies Ltd, the parent of Globe Edible Oil Ltd (GEOL) which markets its products under the brand name Royal Chef, has been able to stop the takeover since S Alam's influences ended with the fall of the Sheikh Hasina government last month.

"I was forced to sign an agreement on April 18 last year to sell the shares of GEOL to a company of S Alam under a serious threat," said Md Harunur Rashid, chairman of Globe Pharmaceuticals Group.

Speaking to The Daily Star on September 19, he said that GEOL was also forced to stop all operations due to illegal interference by S Alam.

"Not only this single company, S Alam Group, over the last decade, had been trying to do a hostile takeover of the entire Globe Group through careful planning," Harunur alleged and added it caused Globe Pharmaceuticals Group huge financial losses.

The edible oil firm recently filed a Tk 1,497 crore damages case with the 5th Joint District Judge's Court, Dhaka against S Alam Group, its subsidiary Globe Refined Sugar Industries Ltd, Islami Bank Bangladesh and the senior vice president (SVP) and head of the bank's Gulshan branch. Bangladesh Bank was also made a defendant in the case.

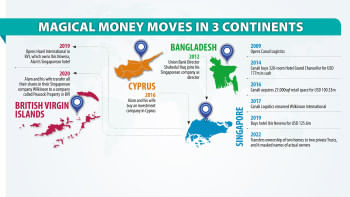

Founded in 1985 by Mohammed Saiful Alam, a relative of late Awami League politician Akhtaruzzanan Chowdhury Babu and his son former land minister Saifuzzaman Chowdhury Javed, S Alam Group has grown into one of the largest conglomerates in Bangladesh.

S Alam is one of the four edible oil importers and processors along with three other firms (TK Group, City Group and Meghna Group) who together control 80 percent of Bangladesh's cooking oil market, according to import data from the National Board of Revenue.

Globe was the third firm after City Group and Meghna Group of Industries to set up a plant to extract oil and oilcakes from seeds.

The firm, which had a presence in beverage, biscuit and dairy markets, wanted to invest Tk 450 crore to establish a seed crushing and solvent extraction complex to extract sunflower, soybean and canola oils, its Chief Finance Officer Shaker Shamim said in 2017.

Globe Group came into prominence when its subsidiary Globe Bio-Tech Ltd developed a Covid-19 vaccine candidate during the pandemic. It did not finish trials as the pandemic had already ebbed.

GEOL'S LOAN FIASCO

Harunur said the Globe Group of Companies applied to the Islami Bank in 2011 for a loan to import machinery and working capital to set up the edible oil company. The bank disbursed Tk 282 crore to the company in the first phase.

During the construction of the factory, there was a change in the ownership of the bank that stalled the funding.

Globe then invested Tk 1,200 crore from its subsidiaries to complete the project.

The company again applied to the Islami Bank for Tk 1,200 crore as working capital loans after S Alam took control of the board of directors of the Shariah-based bank.

But the bank did not provide the funds without any explanation, said Harunur. Instead, it collected Tk 76 crore from Globe as profit.

Harunur said they were able to meet with Saiful in 2019 after repeated attempts and he promised Tk 1,200 crore as working capital from the bank but it approved only Tk 550 crore.

After contacting the bank for the rest of the funds, Globe understood that the S Alam chairman forcefully halted the disbursement, said Harunur.

"This move was aimed at making the financial health of Globe Group worse and subsequently grab GEOL and other Globe subsidiaries through a forced auction or other illegal ways.

"We were forced to shut down the company [GEOL] due to a lack of proper financing by the Islami Bank," said the Globe boss.

The Daily Star tried to reach Islami Bank Chairman Obayed Ullah Al Masud and Managing Director Mohammed Monirul Moula but they did not respond to our phone calls.

S ALAM'S BID FOR GEOL

Saiful asked Globe officials to meet with him in Singapore in October 2022, Harunur said.

"We further requested him to approve the rest of the working capital loans. The S Alam Group chairman rejected our proposal and forced us to sell the shares of the company," said the Globe chairman.

S Alam had already formed a company named Globe Refined Sugar Industries Ltd without Globe Group's approval, alleged Harunur.

"I was forced to sign an agreement on April 18 last year to sell the shares of the company [GEOL] and the tenure of the agreement was until September 2023."

Saiful wanted to buy GEOL at Tk 2,200 crore -- Tk 1,900 crore in cash and the remaining Tk 300 crore was supposed to be provided in interest waiver by the Islami Bank, Harunur said.

S Alam paid Globe only Tk 228 crore and repeatedly extended the deadline of the agreement instead of paying the rest of the money, he said.

"When we requested them to pay the rest of the money, S Alam tried to force us to sell the shares of two more units of Globe Group, Globe Pharmaceuticals Ltd and AST Beverages Ltd, but we refused their proposal," the Globe boss said.

"S Alam had deliberately refrained from paying us the entire amount mentioned in the agreement. Their main objective was to take over Globe Group illegally."

S Alam men then threatened to start an auction process by declaring GEOL and Globe Pharmaceuticals defaulters through the Islami Bank, Harunur said.

The Globe Group chairman also alleged that Subrata Kumar Bhowmick, executive director (finance) of S Alam's Globe Refined Sugar Industries Ltd, was always putting pressure to sell the shares of the company.

The Daily Star tried to reach Saiful and Subrata but none of them responded to our phone calls.

FALSE CLAIMS: S ALAM DGM

Md Moniruzzaman, deputy general manager (DGM) of S Alam Group, was involved in the deal for the sale and purchase of shares of GEOL.

Contacted, he claimed that the allegations brought by the Globe Group boss were "false and fabricated".

He said they were still unaware of the money damages suit filed by Globe.

"We signed an agreement to purchase the company at Tk 1,900 crore, and Tk 375.25 crore has already been paid to them," Moniruzzaman told this newspaper this week.

"Since we made an advance for purchasing the company, there was an agreement that around five to six of our employees will be appointed to Globe Edible Oil until the sale was completed but we could not pay the remaining amount due to some reasons," he said.

But Globe threw the S Alam employees out of the company after the change of the government, said Moniruzzaman.

He said that Globe was trying to take advantage of the current political situation.

Asked why S Alam established a company by using Globe's brand name, the senior official of the conglomerate said, "We bought the company with brand value because we need it."

Moniruzzaman also said Globe Refined Sugar Industries Ltd was formed by using Globe's brand name for a "smooth transition of purchase" of the company.

He claimed they took Globe's approval for the brand name.

About Globe's loan fiasco at the Islami Bank, Moniruzzaman said that the Globe Group was a defaulter and that is why they did not get any new loans.

"Their business was not good and they failed to run the company, which is why S Alam proposed to buy it," he added.

Bangladesh Bank spokesperson Husne Ara Shikha told The Daily Star that they did not know about the damages suit as they were yet to get any documents on the case.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments