Steel sales slump by about 50% as govt projects come to a halt

The demand for steel in Bangladesh has almost halved over the past two months as most construction works have been halted following the recent political changeover, according to industry people.

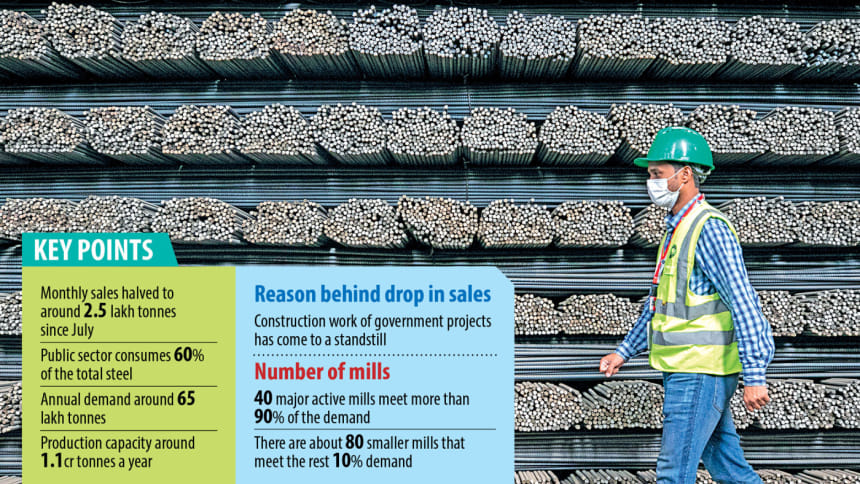

The combined sales of steel makers in the country have come down to less than 2.5 lakh tonnes per month since July while it was more than 5 lakh tonnes per month previously, they said.

Sumon Chowdhury, secretary general of the Bangladesh Steel Manufacturers Association, said many public projects are on hold as contractors fled after the Sheikh Hasina-led Awami League government was ousted by a mass uprising on August 5.

Project implementation under the Annual Development Programme (ADP) was slow at the start of this year, according to Implementation Monitoring and Evaluation Division data.

The ADP implementation rate was 1.05 percent in July compared to 1.27 percent during the same month last year.

Citing that the public sector accounts for 60 percent of the country's annual steel consumption, Chowdhury informed that sales have now halved.

Similarly, there is a lack of new housing projects in the private sector as sales have slowed due to higher interest rates on home loans, further impacting the demand for steel, Chowdhury said.

Besides, most people looking to build houses have put their plans on hold in the face of economic uncertainty.

Against this backdrop, Chowdhury suggested the interim government resume ongoing development projects to help the steel industry survive.

The steel industry in Bangladesh is highly competitive. Overall production capacity reached about 1.10 crore tonnes last year against an annual demand of 65 lakh tonnes, he said.

There are around 120 local steelmakers, with 40 large companies dominating more than 90 percent of the domestic market.

However, although these companies have expanded production in line with rapidly growing consumption over the past decade, Chowdhury believes the market will not return to normal any time soon.

Echoing the same, Shahriar Jahan Rahat, deputy managing director of KSRM, said the steel industry is facing severe uncertainty amid the regime change as many contractors who were implementing projects under the Annual Development Programme had fled.

Some contractors did not even pay their dues to steel suppliers before absconding while implementing agencies are not clearing the arrears either.

Rahat informed that KSRM is running at 50 percent of its 10-lakh tonne annual production capacity amid low demand, which is making it difficult for them to cover operational costs.

Mohammad Jahangir Alam, chairman of GPH Group, said the domestic steel industry is currently owed dues amounting to about Tk 8,000 crore to Tk 10,000 crore collectively.

Corporations involved in implementing government projects owe about 25 percent of this amount, but they will not be able to pay their bills, he added.

"So, there is a risk that at least 30 percent of our dues will not be collected," he said, adding that this could become a big problem for the industry.

Alam, also president of the Bangladesh Steel Manufacturing Association, said, in short, they want policy support to cover these losses.

He pointed out that steelmakers in the country are facing other challenges as well, such as higher finance costs due to increased bank interest rates.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments