Tk 3,000cr export fund held up in four troubled banks

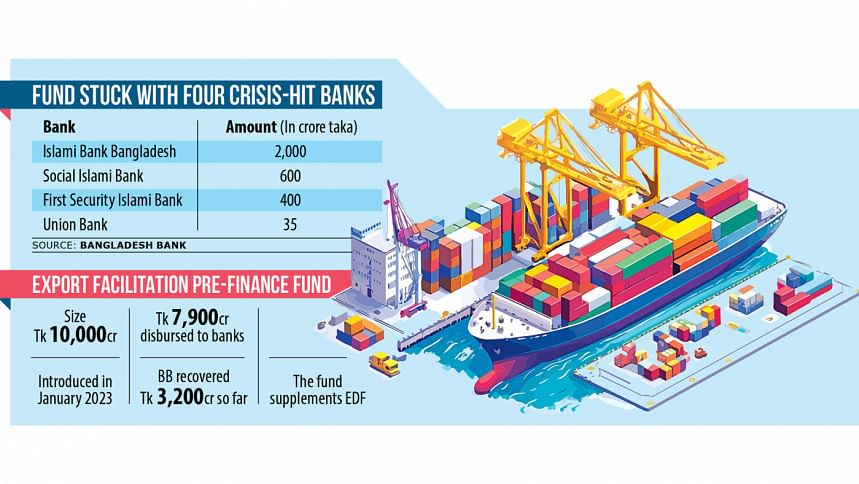

A large chunk of a Tk 10,000 crore central bank fund, meant for financing raw material imports for export orders, remains stuck with four crisis-hit banks, according to Bangladesh Bank officials.

This has made it difficult for sound banks to get adequate liquidity from the Export Facilitation Pre-Finance Fund (EFPF) to lend to local exporters for raw material purchases from foreign markets.

The four banks are Islami Bank Bangladesh, Social Islami Bank, First Security Islami Bank and Union Bank -- the boards of which were previously dominated by the Chattogram-based industrial conglomerate S Alam Group.

Following the political changeover on August 5, the banks saw their boards reconstituted, ousting S Alam's men from the boardroom.

Still, the banks have struggled to repay the Bangladesh Bank Tk 3,035 crore, due mainly to their severe liquidity crisis. Therefore, the central bank has been extending the repayment deadline.

Of the total amount, Tk 2,000 crore is owed by Islami Bank Bangladesh, Tk 600 crore by Social Islami Bank, Tk 400 crore by First Security Islami Bank and Tk 35 crore by Union Bank.

In January last year, the Bangladesh Bank formed the Tk 10,000 crore EFPF to support industries facing raw material import challenges due to a foreign currency crisis.

Since the fund's formation, the central bank disbursed Tk 7,900 crore to banks, and has so far recovered Tk 3,200 crore in principal, according to central bank officials.

The officials said several other banks such as NCC Bank, Janata Bank, Global Islami Bank, Premier Bank, Prime Bank, Mercantile Bank, Bangladesh Krishi Bank, Bank Asia and Eastern Bank continue to utilise the pre-finance fund.

Speaking on condition of anonymity, a senior central bank official told The Daily Star that the banking regulator usually deducts the fund from lenders' current accounts upon the expiration of the repayment term.

As per the rules, every lender has to maintain a current account with the central bank.

But the current accounts of the four banks with the central bank remained negative for a long time due to the liquidity crisis. As a result, the central bank was unable to deduct the fund, the official added.

"New fund disbursement to the lenders has been suspended as a large portion is already stuck with them," said the official.

Except for Islami Bank Bangladesh, the commercial lenders are now struggling even to repay their depositors.

Central bank officials expressed optimism that Islami Bank Bangladesh would be able to repay the fund by December of this year, as its negative current account balance continues to decrease.

The Daily Star attempted to contact Islami Bank Bangladesh Chairman Obayed Ullah Al Masud and Managing Director Mohammed Monirul Moula by phone, but neither responded to the calls as of yesterday noon.

The crisis-hit banks are currently repaying depositors on a limited scale by securing liquidity support from the inter-bank money market and through central bank-issued guarantees.

Mohammad Abdul Mannan, the new chairman of First Security Islami Bank, recently told the newspaper that normal banking activities were resuming and they were working to repay depositors with the liquidity support.

A senior Social Islami Bank official said they are now repaying depositors for emergency purposes by utilising the liquidity support.

Union Bank's new Chairman Md Farid Uddin Ahmad could not be reached for comment.

In January of 2023, the central bank introduced the EFPF for exporters, coinciding with the phasing out of the Export Development Fund (EDF) as per prescriptions of the International Monetary Fund (IMF).

As of now, the EDF stands at around $2 billion, trimmed down from $7 billion in December 2022.

Members of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), Bangladesh Textile Mills Association, BKMEA and B and C type industries in export processing zones (EPZs) are eligible for financing from the EFPF.

An exporter can get a maximum loan of Tk 200 crore from the fund, which must be used for raw material imports. Banks are required to pay back the fund within six months, although they may extend or reduce the repayment period for their clients.

According to the scheme guidelines, clients with overdue export bills are not eligible for new funds from the scheme.

Besides, clients already receiving loans from other central bank funds for raw material imports are not allowed to get loans from the EFPF. Central bank officials said loan defaulters are also barred from accessing the EFPF.

For all latest news, follow The Daily Star's Google News channel.

For all latest news, follow The Daily Star's Google News channel.

Comments